How to choose a profitable investment property in Phuket?

- What are the prospects for real estate investment in Phuket?

- How to choose real estate in Phuket: the best investment options

- Real estate in Phuket: How to find the perfect investment option?

- How to avoid risks when investing in real estate in Phuket?

- How can developers minimize risks through a rental pool?

- How to choose between a rental pool and guaranteed income for investors?

- How to choose profitable real estate investments in Phuket?

Introduction

In Phuket, the real estate market that meets all modern criteria offers owners the chance to earn regular rental income, which can range from 5% to 9% annually. However, for novice investors with little experience in this segment, understanding the specifics of rental income distribution as outlined by developers and management companies on the island can be quite challenging.

Key terms

The first step is to familiarize yourself with some important terms. Rental yield, in a broad sense, indicates the percentage obtained from the value of real estate in the form of annual rental income. This term has various interpretations. For example, in developed countries in Europe, yield refers to gross yield, which is calculated as the ratio of rental income to the initial value of the property, meaning the purchase price.

Here, the actual expenses for maintenance, management, and taxes on the property are not taken into account. In turn, in Phuket, yield is often understood as yield before tax deductions, but excluding management and maintenance costs. This indicator is usually referred to asnet incomeInterestingly, the net yield in Phuket often exceeds similar figures in well-known tourist regions of Europe (for example, the net yield from short-term rentals in Athens is only 1.8% per year), which has become one of the reasons for the declining interest from investors, including Europeans, in resort real estate in Phuket.

Real estate market offers

In addition, there are many residential complexes in the Phuket market with a variety of conditions. Approximately available are620 sentences, the starting price of which begins at1,146,000 US dollarsOne of the current projects is a new high-end villa complex located in Thep Kasattri, Thalang, Phuket, with a completion date scheduled for 2025.

Real estate options

It is also worth paying attention to the possibility of purchasing:

- A two-story villa with a spacious pool, terrace, and garden in the Pasak area, near golf clubs and the beach, priced at789,000 US dollarsThis villa has an area of488 m²and includes4 bedrooms.

- A three-story premium-class villa, also located in the Pasak area, close to golf clubs and international educational institutions, for683,000 US dollarswith a total area228 m²in which are locatedthree bedrooms.

- A new elite residential space with developed infrastructure, located just a few minutes' walk from Bang Tao Beach, awaiting completion in2026.The starting price for real estate in this complex is111,000 US dollars.

Conclusion

So, resort property in Phuket is a wonderful opportunity for investors looking to secure a steady rental income in such an attractive tourist destination.

Real estate in Phuket

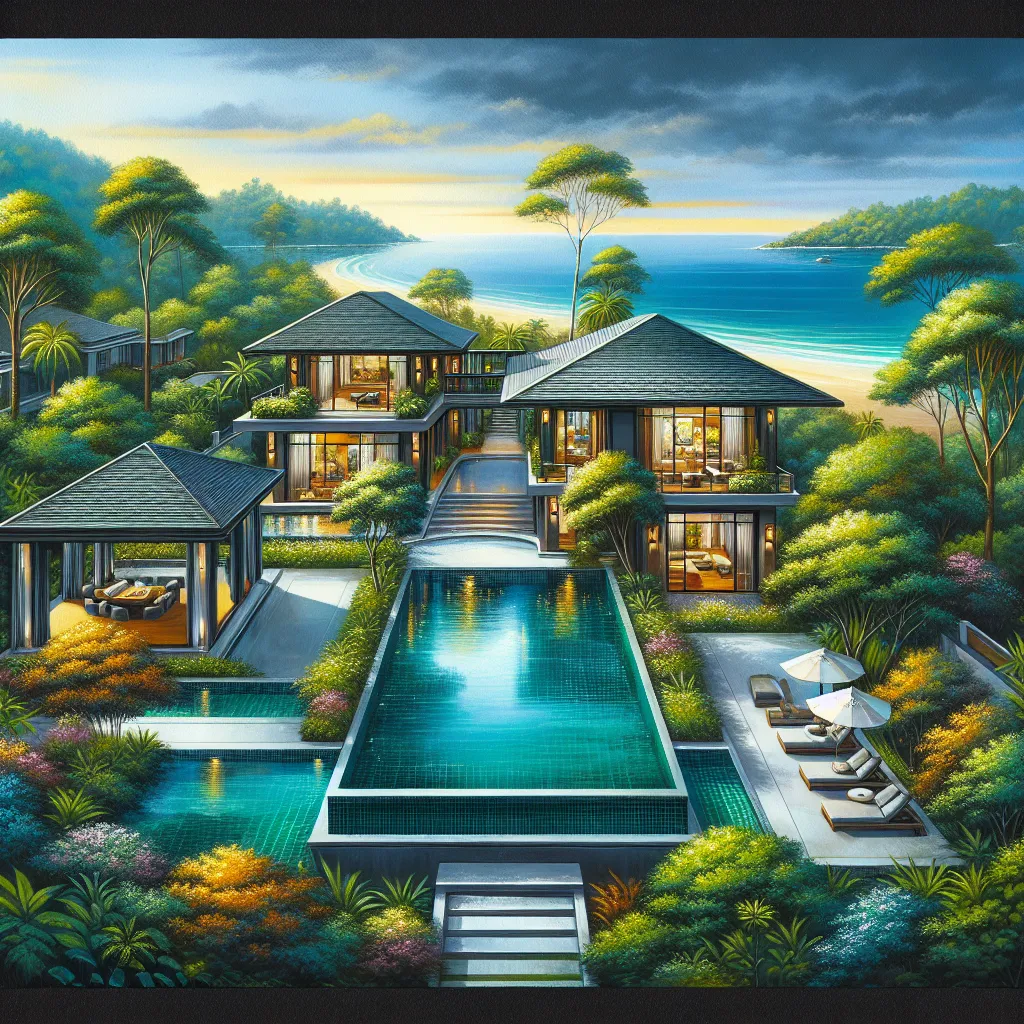

On the island of Phuket, located in Thailand, there is an amazing variety of housing options available. Potential buyers can choose from 789 apartments, starting at a price range of $723,000. These apartments feature modern villas with private pools and relaxation areas.

New residential complexes

In the picturesque area of Talang, a new residential complex is being built, featuring 54 magnificent villas with pools. Prices start at $1,594,000, and construction is scheduled to be completed in 2023, providing investors with attractive options for living or renting.

Housing by Bang Tao Beach

For those looking for housing in close proximity to Bang Tao Beach, it's worth considering a new residential complex offering 51 apartments priced at $182,000. The completion of these properties is scheduled for 2025, making them appealing to future owners.

Resort condominiums on Naiton Beach

In addition, a number of investors may be interested in a large resort condominium on Naiton Beach, which offers 400 apartments starting at a price of $173,000. These offerings open up wide opportunities for profitable investments.

Investment opportunities

In Phuket, you can also find 251 apartments in various residential complexes with centralized management. The owners of these apartments can expect a stable rental income. One example of investment property located in beautiful Phuket is condominiums aimed at renting to vacationers.

- Developed resort infrastructure.

- Rental strategies developed during the design phase.

- Ensuring a reliable income for owners.

Short-term rentals and residences

There are many condominiums designed for long-term owner occupancy. These apartments are most often referred to as residences. Owners can rent out their apartments, and in many cases, these complexes also have centralized rental management. However, the level of rental income in these cases may be lower than in condominiums that are intended for short-term rentals to tourists.

Apartments for rent

Apartments offered for rent in Phuket are often referred to as condos. All deals are made with the condition that owners cannot use their condos at any time. However, the loyalty programs available in Phuket allow investors to stay in their condominium (not necessarily in their own apartments) without additional payment for 14-30 days a year.

For this, it is necessary to agree on the dates in advance with the management company.The data on these apartments can provide owners with a high rental yield.This makes such investments particularly attractive against the backdrop of the growing tourist flow and interest in the region in question.

Phuket offers a wide range of condominiums with various housing options. Currently, there are 76 listings available, with starting prices from $117,000. In this price segment, you can find spacious one-bedroom apartments near Surin Beach, with a total area of 39 square meters.

If you are interested in more luxurious options, for $546,000 you can purchase a magnificent apartment with a stunning view of the bay. This offer is located in a modern residential complex that includes a swimming pool, gym, and parking, all situated in the Patong area. The property covers an area of 222 square meters and also features one bedroom.

Other housing options

Among the various housing options, there are also apartments located between Surin and Bang Tao beaches, priced at $191,000. These apartments cover an area of 36 square meters and include one bedroom.

For those looking to live in a prestigious area near Bangtao Beach, there are 88 square meter apartments with two bedrooms available for $356,000. There are also options with one bedroom priced at $315,000, located just five minutes' drive from Patong Beach and covering an area of 74 square meters.

Fully furnished options

- For $152,000, there are one-bedroom apartments available, located 200 meters from Rawai Beach, with an area of 42 square meters.

- You can also consider spacious one-bedroom apartments for $202,000, located between Surin and Bang Tao beaches, with an area of 57 square meters.

- In addition to this, you can check out a one-bedroom apartment offer in an exclusive residential complex that features developed infrastructure and high-quality service, located near Nai Yang Beach, priced at $128,000 and covering an area of 40 square meters.

Guaranteed return

Speaking ofguaranteed incomeIt should be noted that many developers and management companies in Phuket offer their clients a stable income of 5-7% per year when entering into long-term contracts that can last from 2 to 5 years. The management company takes on all expenses and costs associated with maintaining the properties, allowing the investor to receive a fixed income over several years.

For example, if the property was purchased for $110,000 and a three-year contract was signed with a 5% return, the investor receives three payments of $5,500, totaling $16,500.

Frequency of income payments

Management companies usually pay out income to their clients once a year, most often at the beginning of the calendar year. Real estate expert Natalia Emelyanenko notes that for ease of understanding, all the prices and incomes presented are converted into dollars, even though all financial transactions in Thailand occur in baht, including payments to investors. For decades, Thailand's national currency, the baht, has been able to consistently maintain a range of 30-35 baht per dollar with slight fluctuations, which allows investors to feel relatively confident about the returns calculated in baht.

Contract extension

At the end of the contract term, you have the option to extend it under the same conditions or make changes. The choice of the scheme withguaranteed incomeallows to protect the investor from various risks, such as downtime or potential losses caused by temporary factors, including lockdowns or ineffective actions by the management company.

Thus, the main task of an investor is to make the right choice of reliable real estate and conditions that will ensure comfortable ownership and income generation.

Risks of investing in real estate

Investing in real estate always comes with certain risks, which can be partially borne by both the developer and the management company. These risks depend on the conditions included in the contract. Sometimes the developer is simultaneously the owner of the land and acts as an intermediary, which allows them to manage their own assets through their company. Typically, the guaranteed rental income is structured in such a way that even in conditions of low occupancy, financial obligations to investors can be met without delays.

The situation in Phuket

For example, let's take the situation when a coronavirus pandemic broke out, causing the tourist flow to Phuket to virtually come to a halt. Many management companies found an optimal solution by offering long-term rentals of residential properties, targeting expats living on the island. This strategy allowed them to maintain financial stability and meet their obligations to investors even during difficult times.

Analysis of proposals based on profitability

If you are offered a guaranteed return above7%When it comes to annual returns in Phuket, it's crucial to approach such information critically. It's important to conduct a detailed analysis to avoid potential fraudulent schemes from developers who may use such offers to attract clients in a highly competitive environment. In situations where the guaranteed returns seem too high compared to the market average, two undesirable scenarios are likely:

- Risky predictions:The client can expect high profits in the future; however, the chances of this happening are quite low, which could lead to difficulties with payments.

- Inflated prices:It is possible that the cost of housing already includes compensation payments for investors, and if a sale is necessary, the price may turn out to be significantly lower than expected.

Collaboration with reliable developers

We prefer to collaborate only with verified and reliable developers in Phuket. These are companies that have already proven themselves in the market by successfully completing several projects and having positive experiences in renting them out.

29 January

9 October 2024

9 October 2024

29 September

Realistic returns

Angelina Belyaeva, a partner relations specialist, emphasizes that sometimes agreeing to a more modest but realistic guaranteed return can lead to more significant benefits in the future. When considering the guaranteed return from the developer's perspective, it becomes clear that there is no point in setting it below the market level, as this may deter potential investors who will ultimately turn their attention to more attractive offers from competitors.

If the developer offers a guaranteed return at the level of5% (which is currently the norm for Phuket), especially for properties that are just starting their rental period through 1-3 yearsAfter the completion of construction, this may indicate a high level of professionalism of such companies and their accurate assessment of financial prospects.

Choosing a developer

Thus, when choosing a developer and a specific real estate property, it is essential to carefully analyze the provided conditions, assess their feasibility and potential consequences, taking into account the current market situation.

Developer risk analysis

In the modern world, development activities are associated with the need for thorough analysis of potential risks. This approach allows the developer to be confident in their ability to pay the promised returns to investors, regardless of any changes in the situation. Once the condominium starts generating profit and becomes popular among tourists, there is an opportunity to revise the terms of the contracts. One solution in such a situation may be to switch to a revenue distribution system based on actual rentals, known as a rental pool.

What is a rental pool?

The rental pool is a model that allows for the sharing of actual rental profits among all investors and the management company. Annual rental income from all units in the condominium is collected in one account managed by the organization, and then distributed during a pre-established reporting period according to one of two schemes.

Income distribution schemes

- First schemeThe profit is divided as follows: the management company receives 30% of the total amount, while 70% is allocated to investors in proportion to their ownership shares. An important aspect is that only net income is included, as all expenses, including cleaning, laundry, and utility services, are deducted first. Investors have the right to complete financial reporting, which clearly outlines all costs.

- The second schemeThe profit is divided based on the principle of 40% for the management company and 60% for the investors. In this option, the gross revenue is distributed, and all expenses are covered by the management company. At the same time, investors may not receive information about specific expense items included in the final report.

Notes on income distribution

It should be emphasized that when distributing income, the frequency with which specific apartments were rented out is not taken into account; the main criterion is only the share of these apartments in the total area of the entire complex. For a long time, a 30/70 income distribution scheme was used in Phuket, but recently management companies have started to switch to more favorable terms of 40/60.

Issues of investor distrust

One of the reasons for this change is the existing issue of distrust among investors. When they receive detailed reporting documents with numerous expense items, they question the necessity of these costs. Analyzing each line takes a lot of time and can complicate interactions between the parties. Therefore, some management companies prefer to take on all the expenses themselves, thereby increasing their share in the distribution.

Hybrid distribution model

Real estate expert Natalia Emelyanenko believes that one of the most client-oriented approaches to distributing rental income is the use of a hybrid model. In this model, a guaranteed income is established, for example, at a level of 5% per annum for investors, and part of this profit goes to reward the management company. The remaining income, after deducting all expenses, is distributed between the management company and investors through a rental pool system.

The drawback of the hybrid approach

Nevertheless, in Phuket, only a few management companies still offer this hybrid option. This creates difficulties for investors who are interested in better conditions for their investments, highlighting the importance of transparency and trust in the relationships between all participants in the process.

Of course, this approach may complicate financial calculations; however, it significantly strengthens investors' trust in the project. In this case, they eliminate the need to choose between two income options—fixed profit or a rental pool—thereby gaining additional protection and confidence in their potential profitability.

Natalia Emelyanenko, an expert in the real estate sector, emphasizes the critical importance of choosing a scheme, especially in cases where the management company does not offer hybrid solutions. The fundamental truth of investing is that an increase in risks often leads to a rise in potential profitability. The basic difference between a rental pool and guaranteed income essentially lies in the level of risk.

Risks and returns of the rental pool

When conducting business through a rental pool, investors take on all the risks associated with property downtime and loss of income caused by various external factors, as was the case during the pandemic. However, the risks taken can present significant opportunities for income generation, as demonstrated by the certain demand for tourist services in Phuket.

In 2022, there was an increase in rental prices, which helped maintain interest in real estate even during the traditionally inactive season. Investors who invested in new rental projects could expect a return of around 9% per year, and this fact cannot be overlooked. Those who purchased property a few years ago at lower prices and are renting it out at today's high rates had every reason to anticipate even more impressive profits, as the return is calculated based on the initial cost of the acquired property.

Guaranteed income and its benefits

Guaranteed income is typically chosen by investors in the early stages when the complex is just starting its operations and has not yet established its reputation. The speed at which the management company can achieve high occupancy rates for the condominium, as well as its level of profitability, largely depends on its experience and the quality of services provided.

Typically, the process of achieving a stable income can take two to three years, however, in 2022, some newly opened complexes were able to reach a level of significant profit in their very first operating season.

Factors influencing the choice of investment object

When choosing an investment object with high returns, it is important to consider a number of factors:

- Location:This is one of the main criteria that determines how attractive the complex will be for tourists.

- Convenience of access:Proximity to the sea and the presence of developed infrastructure (stores, cafes, restaurants) play a key role.

- Analysis of developers:At the stage of selecting a land plot, they should consider the attractiveness of the location for buyers and tenants.

The right choice of location can have a significant impact on your investment plan.

In condominiums managed by a single management company, there is a higher yield. Investors cannot choose the management company themselves, which leads to centralized renting and reduces competition among management firms.

This, in turn, contributes to price stabilization and prevents price dumping. These conditions positively affect the rating of the tourist attractiveness of such properties, as the level of services provided to tenants is higher and more professionally organized.

Buying an apartment in a new building

If you are planning to purchase property in new construction, it is important to pay attention to the information provided by the developer regarding future rentals. Some developers have their own management companies or conduct open tenders for large management networks to service their properties.

If the developer offers a choice from multiple companies operating in Phuket, it may indicate that there will be several management companies in the complex, which could negatively impact the overall profitability.

Orientation of management companies

Management companies are primarily focused on the tourist market, rather than just managing rental flows. It is more profitable for them to rent out properties on a short-term basis, as their income depends on the volume of tourist services and high occupancy rates of the properties.

Typically, the more short-term rentals there are, the higher the returns, while long-term rentals generally involve lower income.

Real estate market analysis

It is also worth taking a closer look at the real estate market. Although this indicator is considered relative, it is important to understand that apartment prices and rental rates are constantly rising. This suggests that buying an apartment early could provide a higher future return if rental prices continue to increase.

Moreover, when you buy property in new developments, the price per square meter at the start of sales is usually lower than after the construction is completed.

Current offers in Phuket

There are many attractive offers available in Phuket. For example:

- The starting price of one of the new elite residences, located just a few minutes from Bang Tao Beach, is$111,000...and the completion of construction is scheduled for...2026In total, this complex offers 789 apartments.

- Another exclusive project is starting from$182,000and is also located near the beach, with plans to complete construction byin the year 2025.

Profitable options for investors

If you're looking for a great deal, you should consider the large resort condominium on the first line of Naiton Beach, which was completed inin the year 2023The prices for apartments start from$173,000A total of 251 apartments are being offered.

For those looking for more compact options, a new "turnkey" studio apartment 700 meters from Bang Tao is now available for$157,000with an area30 square meters...which makes it an interesting choice for investors.

Additional options for residential complexes

Among the current offerings, there is also a residential complex featuring swimming pools, a fitness center, and a tropical garden, located 850 meters from Bang Tao Beach, with construction completion scheduled for2025 yearand prices starting from$132,000.

Another residence with pools, gardens, and coworking spaces, also located in Phuket, is equally attractive, with construction set to be completed inin the year 2025and starting prices from everything$72,000This variety allows investors to choose the most suitable options according to their requirements and financial capabilities.

Conclusion

In concluding our review of investment real estate in Phuket, I would like to emphasize how important it is to choose the right strategy for generating stable rental income. As shown in the article, rental yields in Phuket can vary, but on average they reach5-9% per yearwhich is a very attractive indicator compared to other resort destinations, especially in Europe.

I understand that for beginner investors, navigating the local nuances of rental income distribution can be challenging. However, knowing the basic terms and schemes, such asgrossandnet incomeIt will help to more successfully assess potential investments. The findings show that by choosing condominiums, especially those geared towards short-term rentals, one can achieve the highest profitability.

Advantages of investing in real estate in Phuket:

- A wide selection of real estate: from luxurious villas to modern condominiums.

- Developed infrastructure and proximity to the beaches.

- The net return is higher compared to European resorts.

Phuket offers a wide range of real estate options that make resort properties particularly attractive to international investors. My advice is to thoroughly analyze the various management and rental schemes before making a purchase, so you can choose the one that best aligns with your goals and expectations.

Final recommendations:

- Study various schemes for distributing rental income.

- Pay attention to the specifics of socially-oriented condominiums.

- Don't forget about the opportunities for short-term rentals to maximize income.

In conclusion, resort properties in Phuket offer excellent opportunities for investors to generate income. However, it is important to remember that successful investments require careful preparation and market analysis. I hope this article has served as a useful guide for you in the world of rental real estate and helps you make the right choice based on your personal desires and financial goals.

Tags

Comment

Popular Posts

9 October 2024

9939

9 October 2024

1485

29 September

374

Popular Offers

Subscribe to the newsletter from Hatamatata.com!

Subscribe to the newsletter from Hatamatata.com!

I agree to the processing of personal data and confidentiality rules of Hatamatata