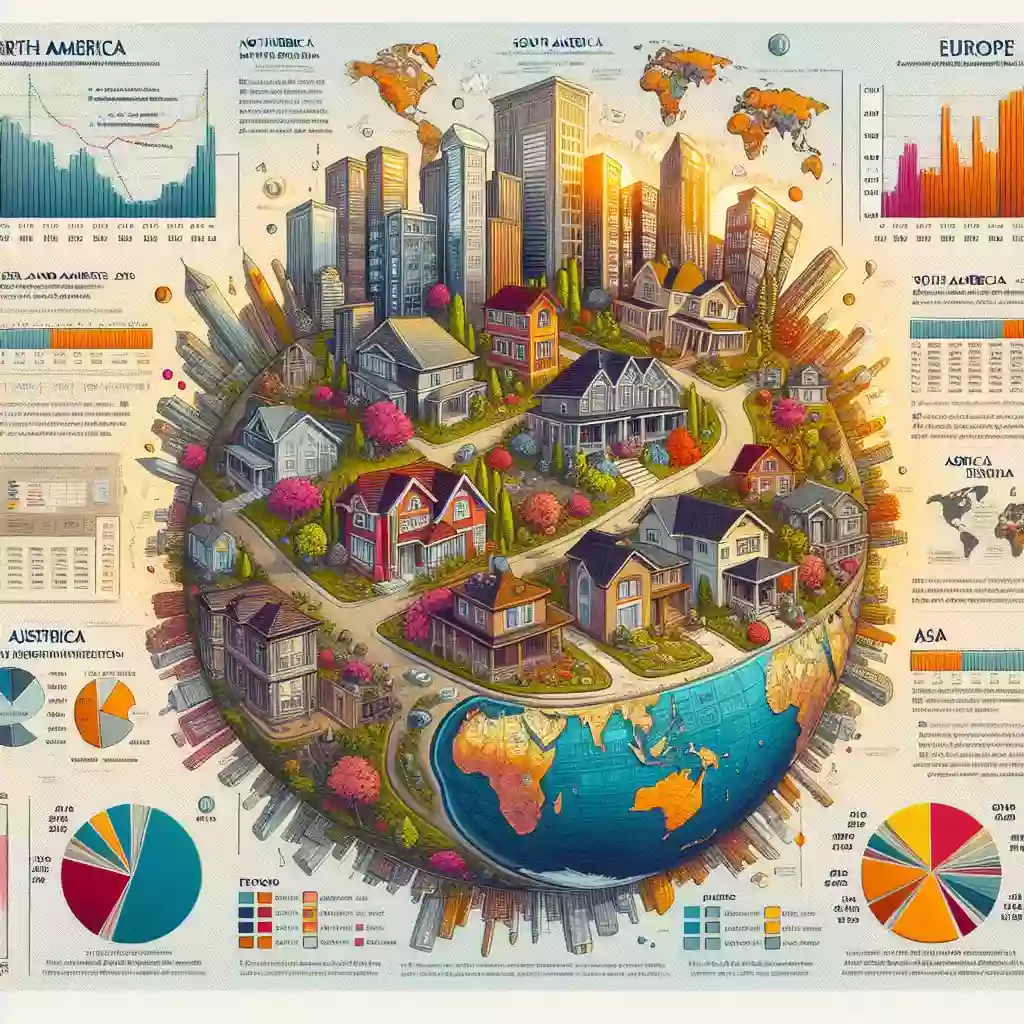

What are the prospects for global real estate markets in the context of inflation?

How the global real estate market will change: an overview of the GPG ranking in 2022

How are real estate market trends changing in different countries around the world?

Overview of the Global GPG Ranking

As part of the international GPG table, which covers 58 countries, information obtained from the analysis of data from the second quarter of 2022 is presented. This data is compared with the indicators from the first quarter and the same period last year.

The housing affordability index is published in two formats: with inflation taken into account and without it. The first option, as expected, looks more striking, as housing prices are rising in more than 90% of countries around the world.

The main findings and forecasts from GPG experts indicate that in 49 countries, housing prices have risen when adjusted for inflation, while without this adjustment, the figures pertain to only 34 countries. However, despite the overall increase in prices, the rate of growth is beginning to slow down: only in 12 markets is there an increase compared to last year.

Trends and slowing price growth

The slowdown is most pronounced in European and Asian countries, while the real estate markets in the Pacific region remain resilient, although they are not showing the same level of activity as before.

Despite this, the global housing market is depleting day by day due to a number of factors. Some of the reasons for this are:

Decrease in real estate availabilityrelated to its increase in price,

Overall inflation,

Conflicts,in particular, the war in Ukraine,

The ongoing COVID-19 pandemic.

Prospects on the international stage

The prospects on the international stage appear quite bleak. In an effort to combat inflationary processes, central banks are sharply raising key interest rates, which leads to an increase in lending rates as one of the consequences.

The increase in housing prices, as well as the rise in mortgage rates, uncertainty in the global economic situation, and the consequences of the conflict in Ukraine are likely to causedevastating crash in the real estate market.

Interesting countries from the GPG ranking

In our analysis, we highlighted ten countries from the specified ranking that are of interest to our readers, and additionally enriched the information with other statistical data from GPG. More details about each country are provided at the end of the article.

10. Italy

In this country, prices have increased by 1.44% excluding inflation, placing it 47th in the global ranking, while taking inflation into account shows a decrease of 6.04% (also 47th place). The overall situation in the Italian real estate market does not show significant fluctuations: even during the pandemic, price changes were minimal, amounting to only 1-2%.

Current post-pandemic trends show a growing interest in larger homes, especially in recreational areas. The word "stability" best describes the state of the Italian market today.

9. Spain

There is an observed increase in prices of 3.3% excluding inflation (41st place), but a decrease of 6.27% when accounting for inflation (48th place). After a rise in transactions in 2021, the trend of increasing prices continues in 2022. At the same time, the real estate market is starting to cool down.

Foreign buyers are becoming more active: one in every seven deals made in the country involves a buyer from abroad. Realtors note an increase in demand, including from clients in Eastern Europe. However, while major cities and coastal areas are seeing positive trends, the internal regions are contributing negatively to the overall figures.

At the same time, taking inflation into account, housing prices have significantly decreased over the past year.

The dynamics of the real estate market worldwide

In recent years, countries around the world have witnessed changing trends in the real estate market. In particular, in Thailand, housing prices have increased by 5.36% when inflation is not taken into account, placing the country 36th in the overall ranking. However, when inflation is considered, there is a decrease of 2.25%, which will allow Thailand to take the 40th position.

In anticipation of the arrival of tourists ahead of the season, local authorities have significantly simplified quarantine measures, which has increased interest in rental properties.

9 October 2024

9 October 2024

29 January

29 September

The situation in Finland

Finland is also showing positive results, with a price increase of 9.83% excluding inflation, which places it in 30th position. However, when accounting for inflation, the growth is only 2.24%, putting the country in 25th place.

This is surprising, as sellers are noticing a decrease in activity in the shadow market, which is linked to rising interest rates. It is expected that by the middle of this year, real estate sales will significantly decline, signaling a slowdown in market activity.

The situation in Germany

In Germany, the situation looks less optimistic. With a price increase of 9.98% not accounting for inflation, Germany ranks 29th, and when considering inflation, a mere 2.2% places the country in 26th position.

This is the lowest level of price growth in the last four years, when housing prices significantly exceeded 10%. Compared to the first quarter of this year, property prices have even decreased slightly.

The interest rate continues to rise, and the Central Bank has revised its forecast for GDP growth from 4.2% to 1.9%. Over the past eight years, housing prices in Germany have increased by an impressive 70%, and perhaps now is the time to correct the situation.

United Arab Emirates and Dubai

As for the United Arab Emirates, particularly Dubai, there has been a significant price increase of 10.12% excluding inflation, which ranks 28th, and 4.04% including inflation, placing it 23rd.

The reasons for such a sharp price increase are linked to the rise in external demand, especially considering that prices were almost at zero a year ago. Current activity in the UAE real estate market has reached its highest levels in the last ten years, which boosts confidence in the favorable future of the country's economy.

Montenegro

In Montenegro, according to statistics, real estate prices have increased by 11.52% without taking inflation into account, placing the country in 24th place. When considering inflation, the increase was 1.77%, which gives Montenegro 38th place in the overall ranking.

The main reasons for the growth are high inflation and significant interest from foreign buyers, including representatives from Russia and Ukraine. As the resort season approaches, there is a slight but noticeable increase in prices, and the investment program for obtaining citizenship has brought a substantial €30 million to the country's budget.

Latvia

Latvia is showing an impressive price growth of 14.45% without taking inflation into account, placing the country in 18th place. However, when considering inflation, prices decrease by 4.1%, which puts Latvia in 42nd place.

Among European countries, Latvia can compete in growth rates with other Baltic states as well as with the Czech Republic. In 2021, there was a sharp increase in prices, but by mid-2022, demand had significantly decreased due to rising interest rates.

Portugal

Portugal also stands out with its indicators: a price increase of 17.58% without taking inflation into account places the country in 13th place, while when considering inflation, the growth is 8.89%, which corresponds to 10th place.

Overall, the real estate market in Portugal is feeling confident, showing record results due to stable interest from both local and foreign investors, especially from the United States, Brazil, and other South American countries.

Conclusion

The analysis of the current situation in the real estate market across 58 countries, presented in the GPG ranking for the second quarter of 2022, allows for several important conclusions that prompt reflection on the future. A general trend of rising housing prices is observed almost everywhere; however, the pace of this increase is significantly slowing down. In a context where the purchasing power of the population is declining and central banks are forced to raise key interest rates to combat rising inflation, it is hard not to notice that the stability of this market is beginning to waver.

This is most evident in European and Asian countries, where there has been a significant decline in activity. While the Pacific region demonstrates relative resilience, circumstances, including the crisis in Ukraine and the aftermath of the COVID-19 pandemic, do not contribute to a full market recovery. The reduction in housing availability and high interest rates put many potential buyers in a position to choose between postponing their property purchase or considering less expensive options.

Highlighted countries

Among the highlighted countries, interesting points can be observed:

ItalyThe stable market, despite global fluctuations, continues to maintain a certain level of interest due to the influx of foreign buyers.

SpainMarket activity remains strong, especially among foreign investors.

Latvia and PortugalThese countries continue to attract investors despite a sharp decline in demand in 2022.

The future of the real estate market

In summary, it can be said that the future of the global real estate market looks uncertain, and all participants in this market will need to closely monitor economic indicators and changes in the political landscape. Current trends have the potential to influence price dynamics, which requires flexibility and caution from both buyers and sellers. I hope that the information provided will help readers gain a more comprehensive understanding of the current situation and make informed decisions in the future.

Comment

Popular Posts

9 October 2024

9934

9 October 2024

1485

29 September

343

Popular Offers

Subscribe to the newsletter from Hatamatata.com!

Subscribe to the newsletter from Hatamatata.com!

I agree to the processing of personal data and confidentiality rules of Hatamatata