US home prices in 2023: Where will they fall? And where will they rise next?

Home prices hit an all-time high in 2022, with the median price up 50% since January 2020. High mortgage interest rates have significantly slowed the housing market, and Redfin predicts that the median U.S. home price could fall by nearly 4% in 2023, marking the first year-over-year decline in a decade. Home sales will also fall and reach their lowest level since 2011, down 30% from 2021. While many neighborhoods are already experiencing price declines, some are expected to see prices go even higher this year.

The places where prices will drop the most

Cities that have experienced the most growth in the housing market since the COVID-19 pandemic, such as the coast and cities on'

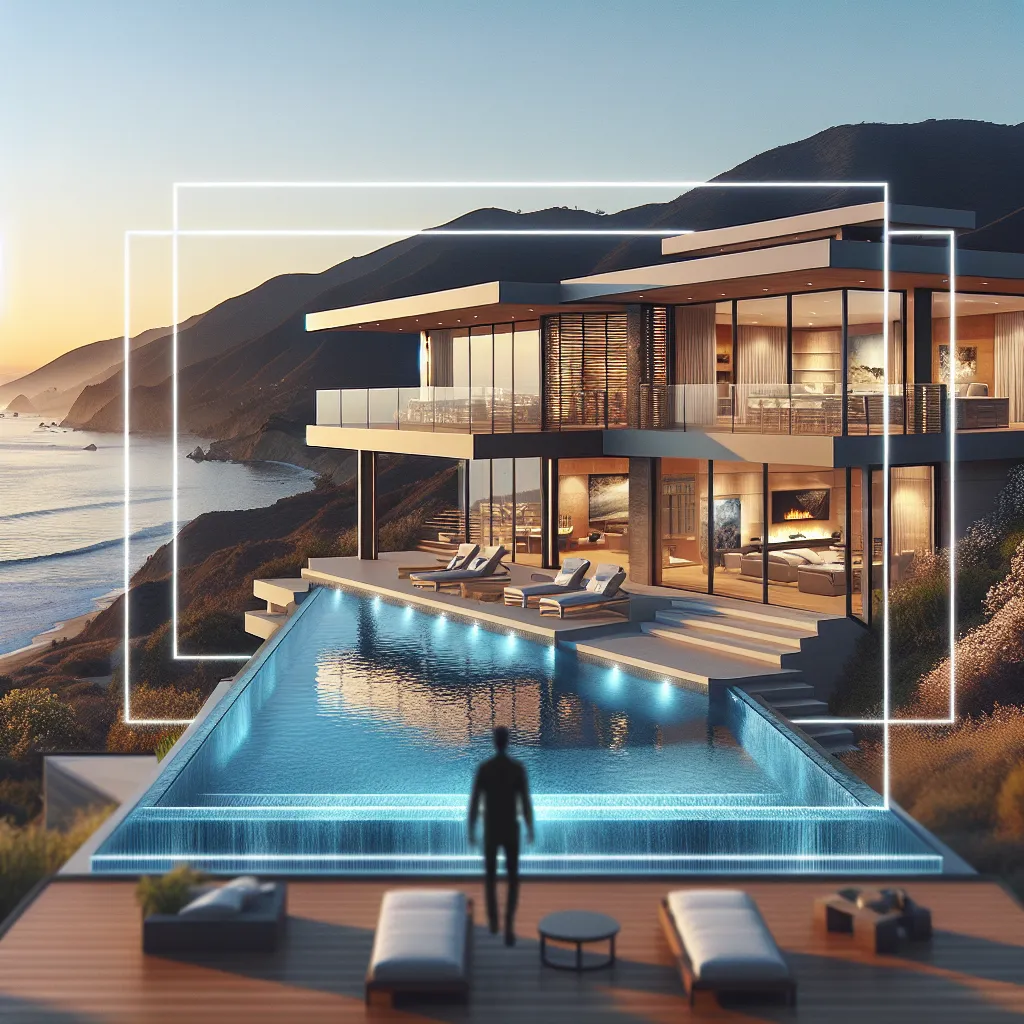

's most volatile prices, as there is more room for price declines compared to neighborhoods that have not experienced such increases. Areas at high risk of climate catastrophe, such as the hills of California and coastal real estate in Florida, will continue to rise in price, largely due to high insurance costs. According to Redfin, catastrophe insurance premium rates will continue to rise, offsetting any price declines in these areas. Insurance premium rates in Florida rose 33% last year and are expected to increase even more due to Hurricane Ian, the deadliest hurricane to hit Florida since 1935. The hurricane also became the most expensive'

'in the state's history, causing $113 billion in damage. Many insurance companies have stopped issuing policies for homes at higher risk of fire in California.

Areas where prices will continue to rise.

14 May 2025

14 May 2025

13 May 2025

Buying a home is the most expensive purchase in most people's lives. When considering the total costs of owning real estate, don't forget to consider' 'insurance, property taxes and maintenance before deciding to buy a home. The dramatic increase in insurance premiums will offset any decline in home prices seen in some areas. Buying a home should be based on your personal financial situation, and it is important to plan for all upcoming expenses.

We firmly believe in the Golden Rule, so editorial opinions are ours alone and have not been previously reviewed, approved or endorsed by advertisers. The Ascent does not cover every offering in the marketplace. Editorial content from The Ascent is separate from The Motley Fool's editorial content and is created by a different team of analysts.

The Motley Fool has a disclosure policy.

The Motley Fool is a USA TODAY partner offering financial' 'News, analysis and commentary aimed at helping people take control of their financial lives. Content is created independently from USA TODAY.

Comment

Popular Offers

Subscribe to the newsletter from Hatamatata.com!

Subscribe to the newsletter from Hatamatata.com!

I agree to the processing of personal data and confidentiality rules of Hatamatata