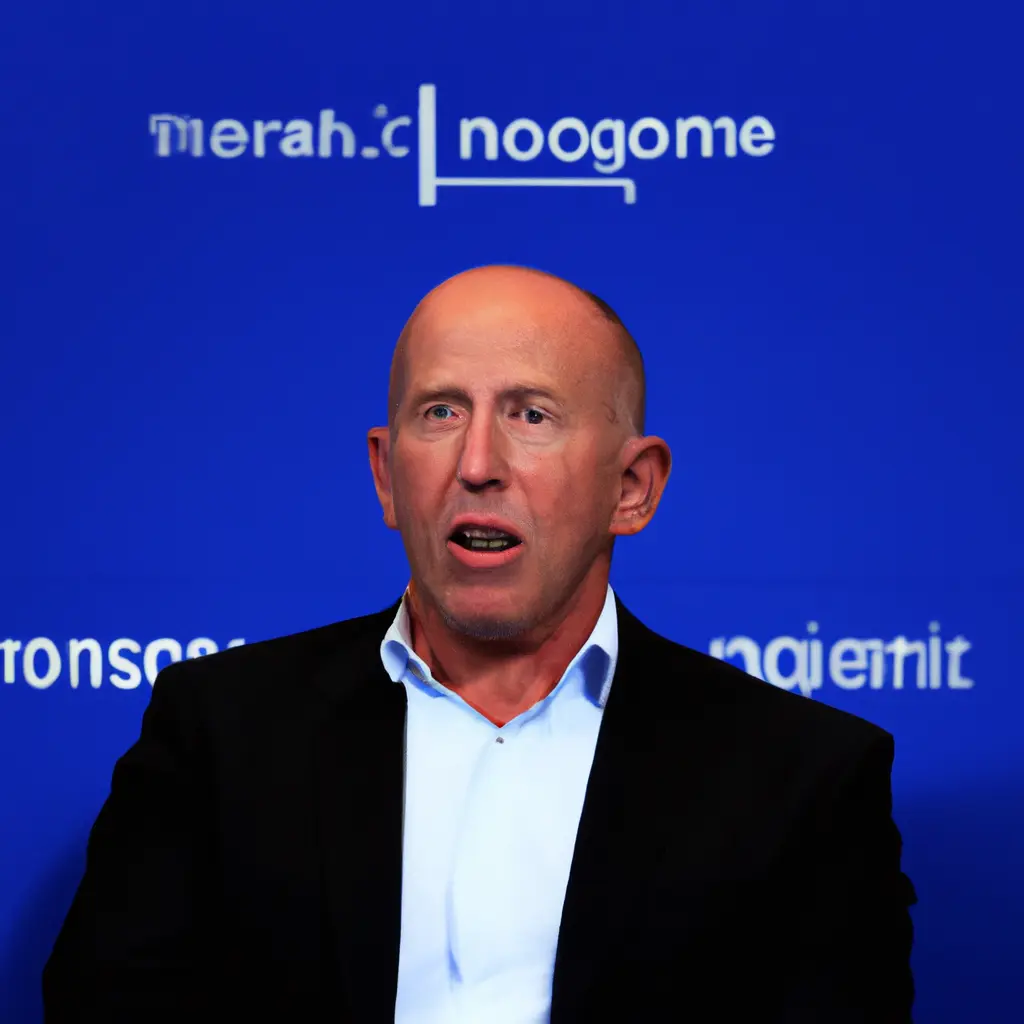

Commercial real estate: Billionaire Barry Sternlicht's firm has defaulted on $212.5 million for an office building in Atlanta.

The Starwood Capital Group led by Barry Sternlicht has defaulted on a $212.5 million mortgage secured by an office building in Atlanta, marking yet another sign of increasing troubles in the U.S. commercial real estate sector.

The mortgage on Tower Place 100 in the Buckhead area of Georgia's capital expired on July 9, and Starwood was unable to refinance or pay off the debt, according to a document prepared by Computershare. "The borrower confirmed that they cannot repay the loan upon its expiration," the document states, adding that creditors have hired lawyers and are negotiating an agreement.

A representative of Starwood, which manages assets worth over $115 billion, declined to comment on the situation. Corporate landlords, including Blackstone Inc. and Brookfield Asset Management Ltd., have stopped payments on office buildings that they consider unprofitable as vacancies rise due to the growing popularity of remote work.

Additionally, borrowers' financing costs have increased following the Federal Reserve's interest rate hikes to curb inflation, while property values have decreased.

The Tower Place 100 building was 62% leased by the end of 2022, down from 87% in 2018 when the loan was secured. One of the largest tenants of the 29-story building is WeWork Inc., which has been facing financial difficulties. The share of vacant office space in the Atlanta area reached 22.4% in the second quarter, compared to the national average of 20.6%, according to a report by Jones Lang LaSalle Inc.

We will find property in Georgia for you

- 🔸 Reliable new buildings and ready-made apartments

- 🔸 Without commissions and intermediaries

- 🔸 Online display and remote transaction

Our managers will help you choose a property

Liliya

International Real Estate Consultant

Subscribe to the newsletter from Hatamatata.com!

Subscribe to the newsletter from Hatamatata.com!

Popular Posts

We will find property in Georgia for you

- 🔸 Reliable new buildings and ready-made apartments

- 🔸 Without commissions and intermediaries

- 🔸 Online display and remote transaction

Our managers will help you choose a property

Liliya

International Real Estate Consultant

Subscribe to the newsletter from Hatamatata.com!

Subscribe to the newsletter from Hatamatata.com!

I agree to the processing of personal data and confidentiality rules of Hatamatata

Popular Offers

Need advice on your situation?

Get a free consultation on purchasing real estate overseas. We’ll discuss your goals, suggest the best strategies and countries, and explain how to complete the purchase step by step. You’ll get clear answers to all your questions about buying, investing, and relocating abroad.

Irina Nikolaeva

Sales Director, HataMatata