The housing crisis in Europe is just beginning.

In the upscale district of Düsseldorf, Milena and Manuel David had planned to start building their new home this summer, which would have marked a milestone for them, moving them out of their cramped apartment where they share a bedroom with two children. However, after a 16-month wait for a building permit, mortgage rates tripled, and construction costs increased by 85,000 euros ($90,000). After the family recalculated their finances, they had to admit that their dream of building their own home had collapsed amid the worst construction crisis in Europe in decades. Similar problems are occurring across the continent. Residential construction is declining, costs are rising, while slow bureaucracy and increasingly strict energy efficiency requirements are exacerbating the situation. Given the already tight housing market, this scenario threatens to slow economic growth and further ignite political tensions, as the housing shortage jeopardizes more and more voters.

“I’ve spent many nights lying awake,” said Milena, a 37-year-old teacher, looking at the thicket of bushes and weeds where her children were supposed to play. “It frustrates me that we were so close.”

David's family was the perfect candidate for building their own home. They had two sources of income, stable jobs in the public sector, and most importantly, they didn't have to pay for the land for construction, which was gifted to them by Manuel's parents. Their problems highlight how imperfect the housing market in Europe is.

“If we are given such a huge advantage and we still face difficulties, how will others manage to cope at all?” said Manuel, a 35-year-old project manager at a nonprofit organization.

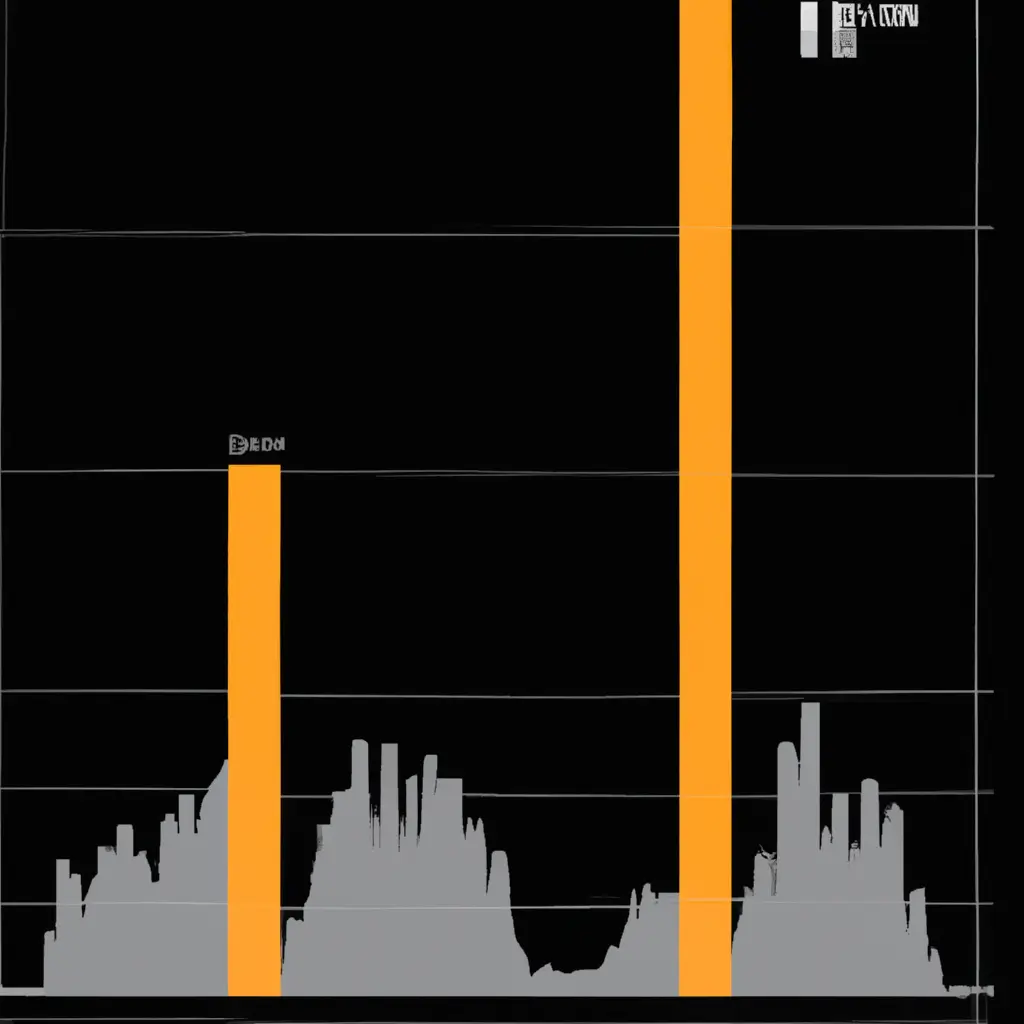

The most affected countries are some of the wealthiest. In Germany, the number of new building permits fell by more than 27% in the first half of the year. In France, permits dropped by 28% by July, while housing construction in the UK is expected to decline by more than 25% this year. Sweden is experiencing its worst downturn since the 1990s crisis, with construction rates at less than a third of what is needed to meet demand.

This situation means that governments are not fulfilling their promises to voters. Sweden is committed to providing affordable housing according to its Constitution, but the supply of rental apartments has not met demand for decades, leading to rising housing prices and forcing people to live in illegal sublets. In the UK, housing construction has consistently fallen short of the target set by the ruling Conservative Party in 2019, which was to build 300,000 homes per year.

In Germany, affordable housing was one of the key commitments made by Chancellor Olaf Scholz's ruling coalition when he came to power in 2021, but economists estimate that the government will need until 2026 to achieve its goal of adding 400,000 new homes each year.

“Providing citizens with housing is one of the most important responsibilities of the state,” said Kolya Müller, co-chair of Scholz's Social Democratic Party in Frankfurt. “Clearly, this is not being achieved.”

The shortage of housing deepens social divides, forcing people to spend more of their income on housing. Attitudes towards migrants may also worsen, as they are increasingly seen as competitors for limited living space. In the city of Lörrach, in southern Germany, several dozen residents were forced to move to other apartments earlier this year to make room for refugees.

“If we cannot solve the housing crisis, it will pose a real threat to our democracy,” said Müller, who explains the rise of the Alternative for Germany party – the second strongest party in polls – partly due to tensions arising from housing issues.

The trends are not as dire everywhere. In Portugal and Spain, housing construction significantly exceeds the levels of 2015, when construction in these markets nearly came to a halt after the debt crisis. However, there is still a severe housing shortage, highlighting how difficult it is to solve this problem, and initiatives to attract investors, such as the "golden visa" in Portugal, have led to rising housing prices.

The problems with building a sufficient amount of affordable housing are ultimately linked to inadequate government policy.

14 May 2025

14 May 2025

14 May 2025

In the past, governments played a more active role in housing construction. A significant portion of the existing housing in Sweden was built as part of a government initiative to add a million housing units between 1965 and 1974. In Germany, cities like Berlin constructed large residential complexes for workers migrating to urban centers after the end of World War I.

But all of this has changed. In Germany, the shift to complete dependence on the private sector was intensified after reunification, which reduced city budgets and forced many cities to sell real estate. In the late 1980s, there were about 4 million social housing units in Germany, but by 2020, that number had dropped to just over 1 million. The situation in the UK is similar: public housing was sold to tenants in the 1980s.

“The state tends to favor the individual over the collective, primarily leaving the provision of adequate housing to private owners,” said Kerstin Brückwe, a historian at the European University Viadrina in Frankfurt (Oder).

In East Germany, where the far-right party Alternative for Germany has the most support, concerns about housing are particularly acute. After reunification, many lost the right to live in the homes that were previously provided by the communist regime. Currently, East Germans are less likely to own property compared to their West German counterparts.

In Skellefteå, in northern Sweden, this paradigm threatens to slow down Northvolt AB's plans to ramp up production at its first battery factory. The company is hiring more than 100 people a month, but the decline in construction makes it nearly impossible for this city of 36,000 residents to keep pace.

“We may face serious problems,” said Patrick Larsen, head of land and development in the municipal administration. “This is a huge challenge.”

The collapse of construction has led to calls for incentives and support for the industry, but governments have limited willingness for additional spending after the Covid pandemic and amid efforts to curb inflation. As a result, there has been a wave of company bankruptcies and layoffs that could diminish long-term opportunities in construction.

In the UK, around 45,000 residential property developers have closed down in the last five years.

In Sweden, 1,145 companies in the construction sector filed for bankruptcy in the first 10 months of this year, which is 35% more than in 2022, according to data from Creditsafe.

The fate of the old police building in Frankfurt symbolically reflects the problems of a system where housing supply is in private hands. The 15-hectare site in the heart of the financial center had been abandoned for over 15 years until Gerchgroup acquired it and promised to restore the majestic structure from 1914 and build more than 440 partially subsidized apartments.

However, in August, the developer filed for bankruptcy in court, leaving a gap in the city center where housing is needed. In the five years that Gerchgroup has owned the historic site, not a single excavator has started work.

Politicians are cautiously intervening. The Labour Party in the UK promises a package of reforms to speed up the slow planning and construction system for 1.5 million homes in the next parliamentary session. The Portuguese government aims to increase the amount of property available for residential use and simplify licensing procedures. Germany has promised to simplify building regulations and increase public investment, but these actions are not expected to bring significant relief.

“These gradual changes create complete uncertainty among builders,” said Wolfgang Schubert-Rab, president of the construction sector lobbying group ZDB. Instead of starting projects right away, they will wait for even more favorable subsidies next year, “when the situation will look even gloomier,” he said.

For the Davidov family

Comment

Popular Offers

Subscribe to the newsletter from Hatamatata.com!

Subscribe to the newsletter from Hatamatata.com!

I agree to the processing of personal data and confidentiality rules of Hatamatata