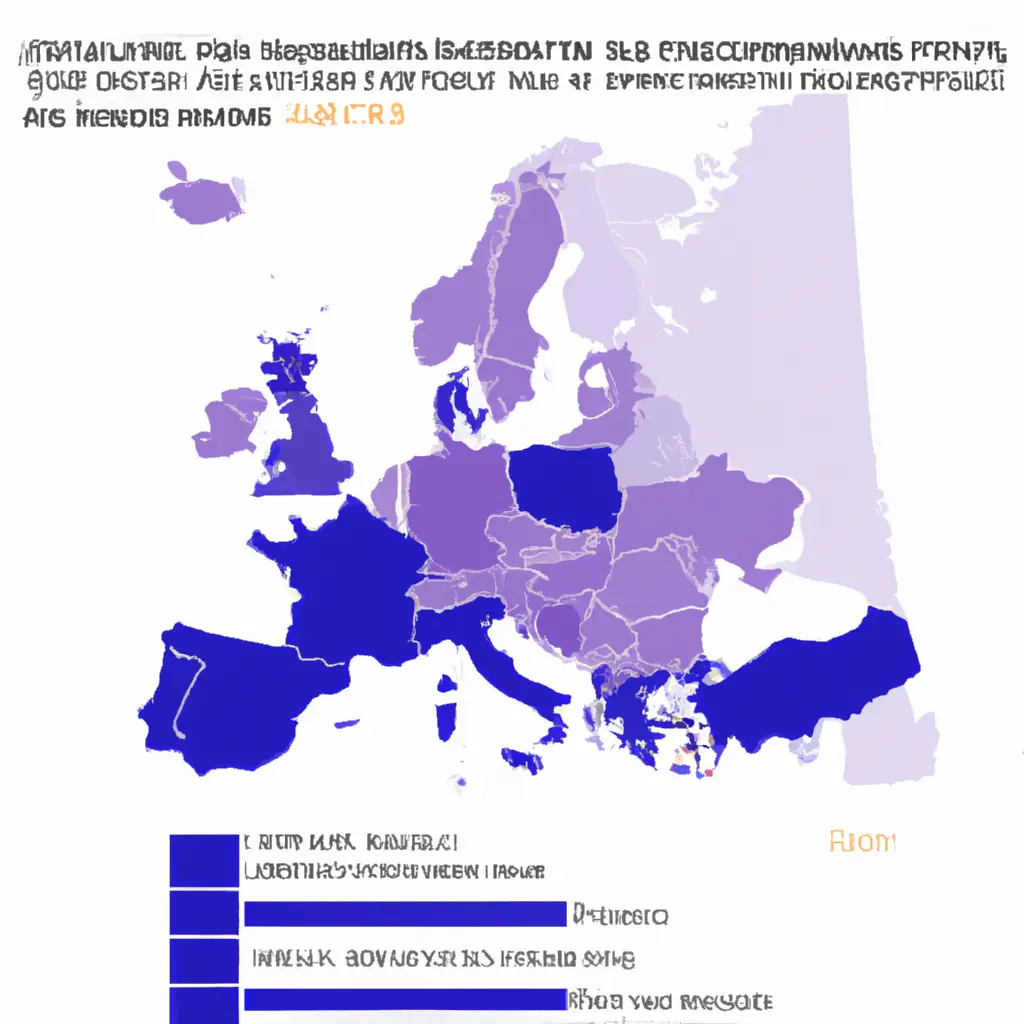

Property, inheritance, and gift taxes in Europe

The inheritance tax and gift tax were introduced back in the Roman Empire, when 5 percent of inherited property was collected to pay pensions to soldiers.

Currently, the practice of inheritance tax is widespread. Most of the European countries mentioned on the map currently levy inheritance tax, estate tax, or gift tax. These countries include Belgium, Bulgaria, Croatia, the Czech Republic, Denmark, Finland, France, Germany, Greece, Hungary, Iceland, Ireland, Italy, Lithuania, Luxembourg, the Netherlands, Poland, Portugal, Slovenia, Spain, Switzerland, Turkey, and the United Kingdom.

Inheritance tax is levied on the property of the deceased and is paid by the estate itself, while estate tax is charged only on the value of the transferred assets and is paid by the heirs. Gift tax is imposed when property is transferred by a living person. Typically, countries impose either inheritance tax or estate tax.

However, inheritances may be subject to double taxation if they fall under jurisdictions that impose different taxes.

14 May 2025

14 May 2025

13 May 2025

14 May 2025

Despite the fact that inheritance tax, estate tax, and gift tax may seem appealing, especially when the OECD refers to them as a way to reduce wealth inequality, their limited ability to generate revenue and their negative impact on entrepreneurship, savings, and employment should prompt policymakers to consider abolishing them rather than increasing them.

The tax rates applied to inheritances, legacies, and gifts often depend on the degree of kinship with the heir, as well as the amount to be inherited. For example, in France, different rates are applied for transfers to heirs and descendants, between siblings, relatives up to the fourth degree, and everyone else. Higher rates are applied to larger sums of money for transfers to heirs and descendants, as well as between siblings.

In some countries, such as Belgium or Switzerland, inheritance, gift, and estate tax rates also vary by region. In most European countries, transfers below a certain amount are not taxed.

Comment

Popular Offers

Subscribe to the newsletter from Hatamatata.com!

Subscribe to the newsletter from Hatamatata.com!

I agree to the processing of personal data and confidentiality rules of Hatamatata