Is price conspiracy common in the U.S. economy?

28 September The Justice Department continued its efforts to reduce the cartelization of wages and prices in the U.S. economy. This time, DOJ filed an antitrust lawsuit against Agri Stats Inc. for engaging in anticompetitive information sharing among broiler meat, pork and turkey producers. Agri Stats allegedly collects, integrates and disseminates price, cost and production volume information to competing meat producers, allowing them to align production and prices to maximize profits. As a result, stores and consumers are paying much more.

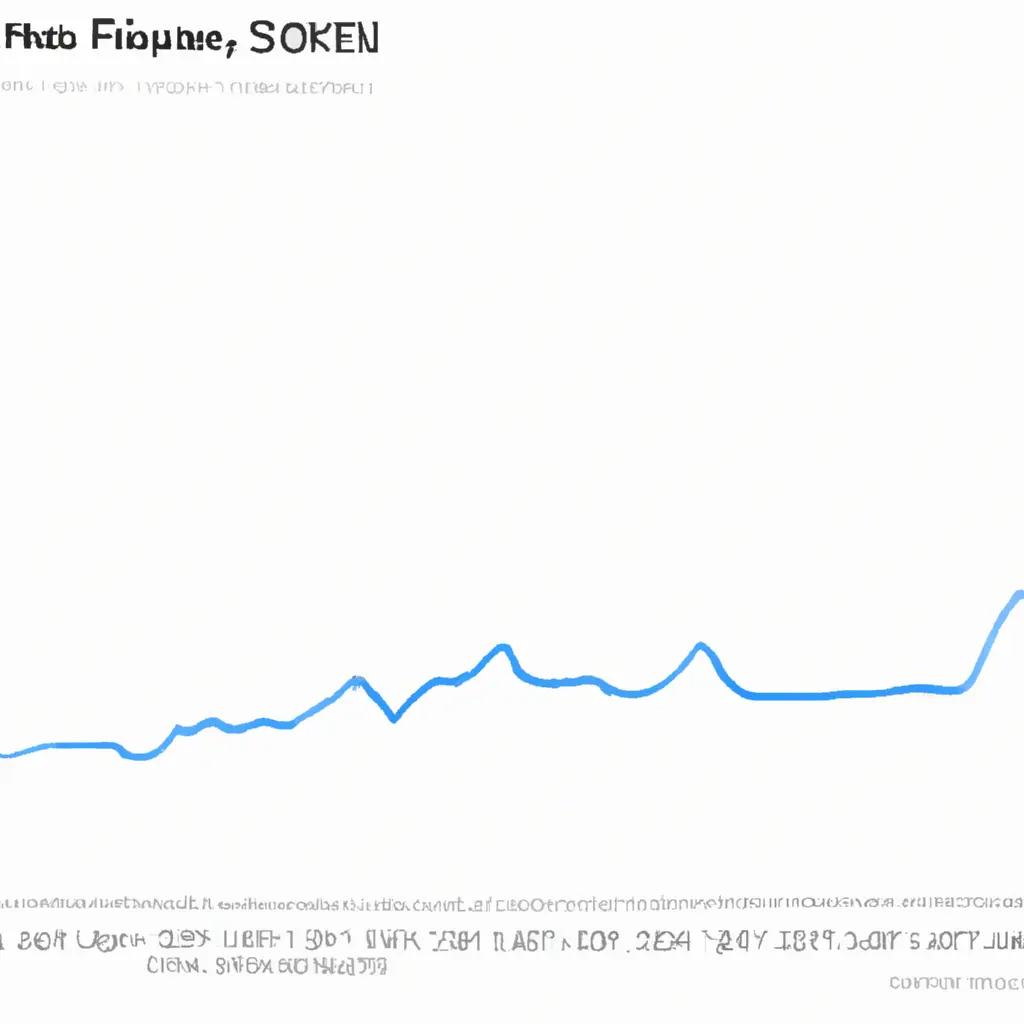

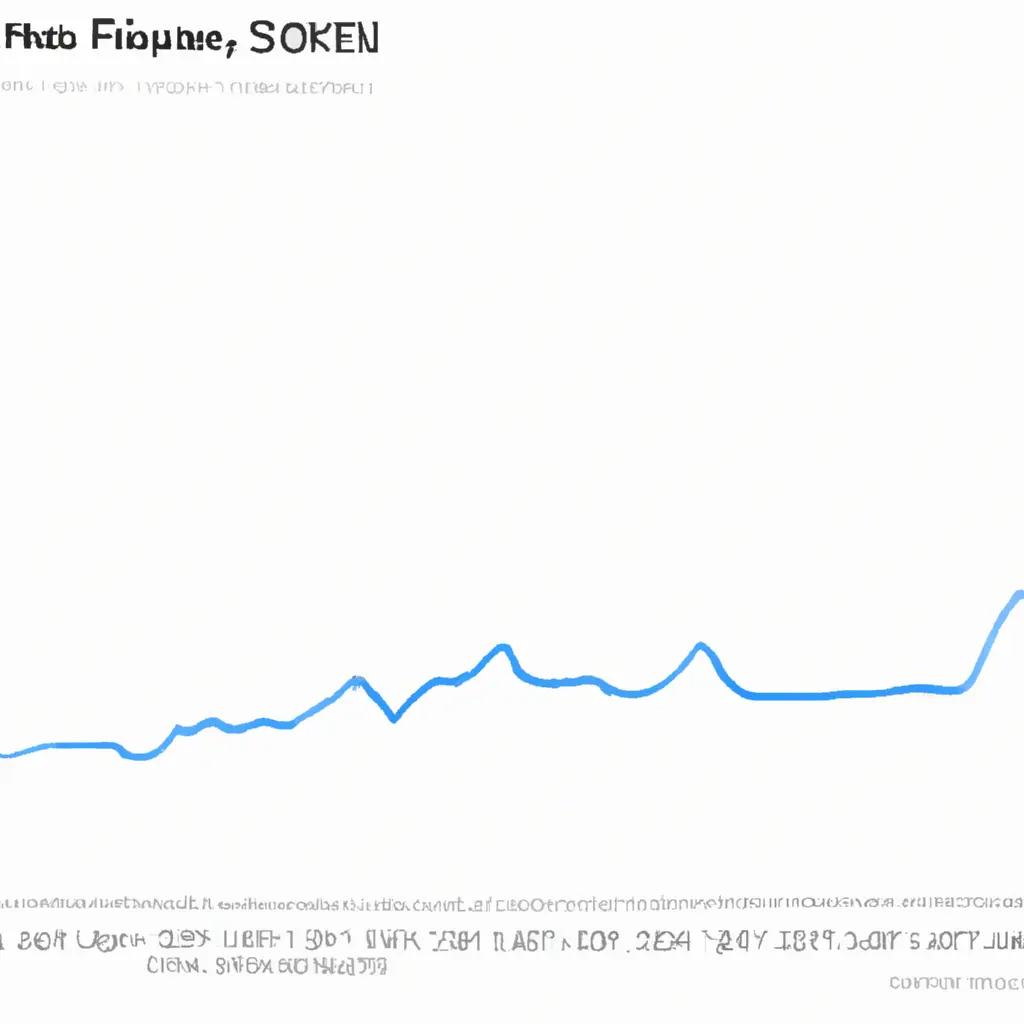

This is the impact the information sharing has had on pork prices:

The DOJ apparently delayed taking action on this case because Agri Stats has been the subject of several private antitrust lawsuits in recent years. According to Investigate Midwest, Agri Stats, a widely used private data and analytics firm for the meatpacking industry, has been named in more than 90 lawsuits since 2016, making it the second-most sued company in the industry during that period (Tyson Foods holds the top spot). All of the lawsuits accuse the company of promoting anticompetitive behavior because, thanks to near-instantaneous data, meat producers can see what their peers are planning...

Most of the allegations are similar, even across industries. Meat producers "conspired and combined to fix, raise, maintain and stabilize the price" of a commodity, states the first lawsuit filed in 2016 on behalf of Maplevale Farms, a food service company in New York.

Wholesale and retail price data from the USDA shows prices have been rising and stabilizing for consumers since early 2008, when the conspiracy allegedly began affecting the market, especially for pork.

Agri Stats suspended its turkey and pork reporting in the wake of these private antitrust lawsuits, but, according to DOJ, "expressed its intention to resume such reporting once these lawsuits are resolved," and the Agri Stats scheme continues to this day in the chicken processing industry.

It would be nice to see DOJ pursue price and wage-fixing schemes that were not discovered by the private lawsuits. To get an idea of Agri Stats, all they would have to do is walk half a mile in Washington, D.C. to the USDA. After all, the USDA's Office of Animal and Plant Health Inspection has long purchased data from Agri Stats. According to Investigate Midwest:

Although the terms of the contract aren't entirely clear, the USDA's Animal and Plant Health Inspection Service, or APHIS, has been purchasing data from Agri Stats for the past decade - a fact that surprised [former USDA Office of Economic Research division chief James] McDonald, who worked in a different area of USDA.

"Wow," he said when asked about the government's purchase orders. Because of the concentration of meat production, "Agri Stats is a source of statistics for this industry in a way you don't see anywhere else in other industries," he said.

A spokesman for APHIS said the agency purchases the data to calculate insurance payments for poultry, in case animals need to be put to sleep because of a disease outbreak.

"Agri Stats was selected as the data source for APHIS to calculate the fair market value of various poultry species because some of these animals are not sold or purchased on the market, so pricing data is not publicly available," the spokesperson wrote in an email.

The problem is that this data is not publicly available. By DOJ:

"By disseminating vast amounts of competitively sensitive information to participating producers, Agri Stats withholds its reports from meat buyers, workers, and U.S. consumers, which exacerbates the competitive harm caused by Agri Stats' information sharing. "

McDonald's assertion that "Agri Stats is the source of this industry's statistics in a way you don't see anywhere else in other industries" may have been true in the past, but that's no longer the case now. It is becoming clearer by the day just how widespread "information sharing" is among the major players in the American economy.

13 May 2025

14 May 2025

14 May 2025

One of the biggest cases is Texas-based RealPage, which has been accused of acting as a middleman in sharing information for real estate rental giants. The company faces several lawsuits alleging that management companies coordinated price-setting through RealPage software, which also allowed companies to share rate and pricing data in markets in the most expensive U.S. cities.

Many rental markets dominated by large landlords have seen astronomical rent price increases (even pre-pandemic) in recent years, as well as rising evictions and increased homelessness. The lawsuits against RealPage and rental management companies allege that its software covers at least 16 million units across the U.S., and property management companies owned by private investment funds are the most enthusiastic users of RealPage's technology.

Agri Stats, much like RealPage in the rental market, has encouraged meat producers to raise prices and reduce supply.

Matt Stoller calls it "the economics of price fixing" and believes it is systematic across all industries in the country.

It would be surprising if it weren't. In fact, it's hard to blame companies and middlemen for this, given that the Clinton administration effectively legalized such schemes back in the '90s, and subsequent administrations have failed to close the loophole.

This finally changed in February, but first a quick review of the Clinton "information sharing" rule.

In 1993, First Lady Hillary Rodham Clinton and other officials announced measures to make health care more "affordable" and "accessible" to all Americans. The policy statements provided "safety zones" for antitrust suits that created conditions under which DOJ and FTC would not prevent the following:

These rules provided an opportunity to evade the Sherman Antitrust Act, which "establishes a basic antitrust prohibition against contracts, associations, and conspiracies in restraint of trade or commerce. "

And it wasn't just in health care. The rules were interpreted as applicable to all industries. To say it was a disaster is to say nothing. Judging by the lawsuits against Agri Stats and RealPage, it's clear that companies have increasingly turned to data firms offering software to "share information" with competitors in order to keep wages low and prices high - effectively creating national cartels.

In the same year that Hillary Clinton introduced the price-fixing loophole, Archer Daniels Midland was prosecuted for manipulating the international lysine market. Three of its executives were even sent to prison and the company was fined $100 million, which was the largest fine for antitrust violations at the time.

If there's one positive thing that happened under the Biden administration, it's that the DOJ finally recognized that these Clinton-era loopholes were a mistake and closed them in February. Here is the DOJ's Feb. 3 statement:

"After careful review and careful consideration, the department has concluded that withdrawing the three applications is the best option to promote competition and transparency. The health care landscape has changed dramatically over the past three decades, since these guidelines were first published. As a result, statements have become overly permissive on some issues, such as information sharing, and no longer serve their purpose of providing comprehensive guidance to the public on current competing health care issues in today's environment. Withdrawal best serves the interests of transparency regarding the policy of applying the antitrust division to the health care industry. Recent antitrust actions and competition advocacy in the healthcare industry provide guidance to the public, and a case-by-case approach will allow the division to better evaluate mergers and activities in the healthcare market that may harm competition. "

In a Feb. 2 speech at an antitrust conference in Miami, Deputy Chief Prosecutor Doha Mecca explained that advances in technological tools such as data aggregation, machine learning and pricing algorithms have increased the competitive value of historical information. In other words, it's too easy now (and has been for several years) for companies to use

Comment

Popular Offers

Subscribe to the newsletter from Hatamatata.com!

Subscribe to the newsletter from Hatamatata.com!

I agree to the processing of personal data and confidentiality rules of Hatamatata