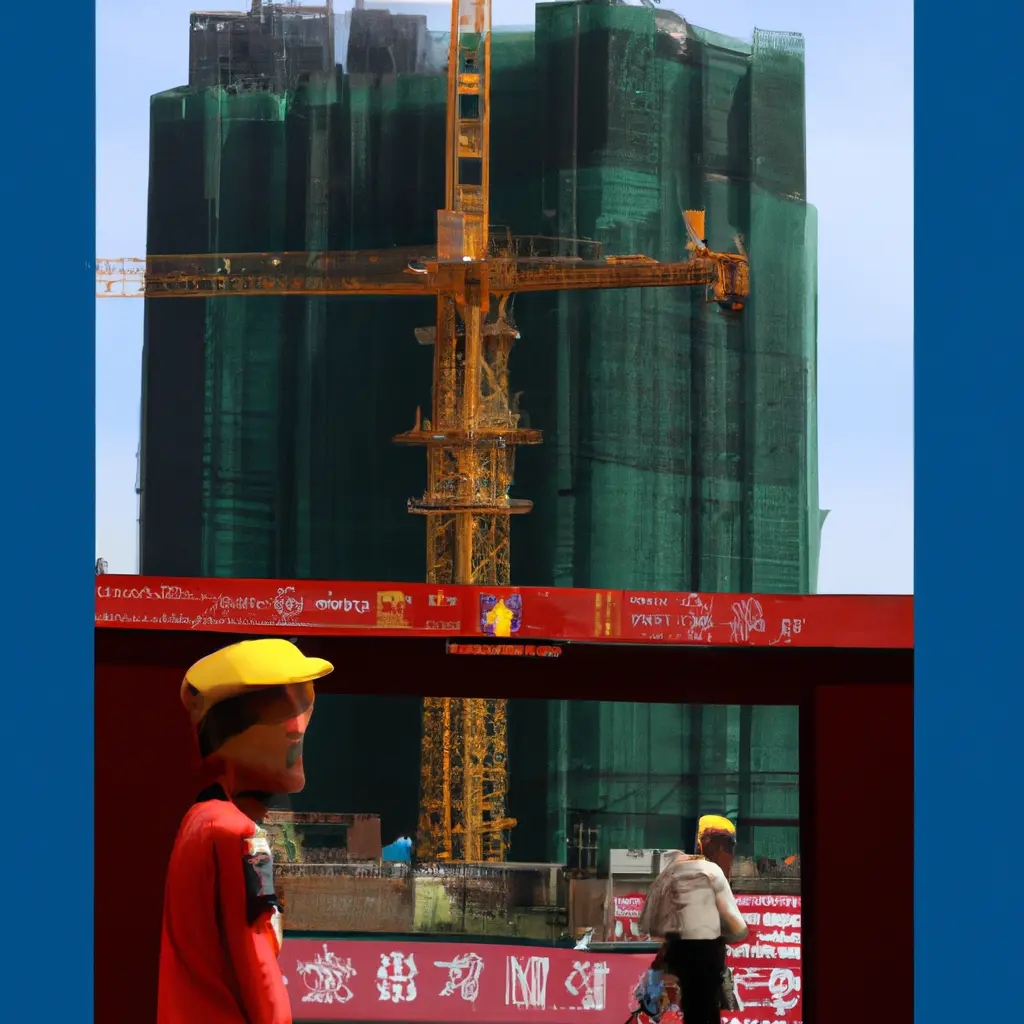

Garden of the Country: How is the crisis in China's real estate market?

HONG KONG, Aug 17 (Reuters) - The debt crisis at Country Garden (2007.HK), China's largest property developer until this year and previously considered a financially healthy company, has sparked fresh fears of a spreading crisis just two years after the default of China Evergrande Group (3333.HK).

What could happen next?

Since the sector's debt crisis unfolded in mid-2021, companies responsible for 40% of China's housing sales have defaulted, mostly private real estate developers. This has led to many unfinished homes, unpaid suppliers and creditors who are not only financial institutions, but also ordinary people who have purchased property management products related to trust finance.

Many offshore bonds are now trading at low double-digit or even single-digit cents on the dollar, and their value has fallen by 90%. There is very little liquidity left in the equity and debt markets as investors and lenders avoid the sector.

With home sales already very weak, the debt crisis could delay the prospect of a recovery in both the real estate market and the broader Chinese economy, in which real estate is a major pillar.

S&P Global Rating said Wednesday it may change its real estate sales forecast from a "falling ladder" to an "L"-shaped recovery if Country Garden officially defaults.

Home buyers could become even more wary of private developers, and home prices in many neighborhoods could come under more pressure if Country Garden resorts to forced sales to raise money.

Local authorities may tighten the terms of trust accounts that hold provisional funds to ensure homes are completed and delivered, a priority set by Beijing. This, in turn, will further shrink the sector and lead to additional defaults even among government-backed developers.

What's different this time?

Country Garden's rapid descent into financial difficulties didn't cause as much of a shock in the market as Evergrande's because most private developers had already defaulted.

While Country Garden's total debt of 1.4 trillion yuan ($191.7 billion) is only 59% of that of the world's most indebted real estate developer Evergrande, Country Garden has 3,121 projects in all provinces of China, while Evergrande has about 800.

Evergrande was already insolvent at the time of default, but Country Garden now has more assets than liabilities. Analysts warn that Country Garden could become insolvent if it has to write down large amounts of inventory and if the value of its assets declines over time.

Is there a systemic risk?

This week's news of defaults on investment products of leading trust management firm Zhongrong International Trust Co highlighted the over-reliance of China's $3 trillion shadow banking sector on the real estate sector.

The rising number of defaults by real estate developers has already raised the share of Chinese banks' bad loans to 4.4 percent by the end of last year from 1.9 percent in 2020, Moody's says.

Market experts generally do not believe China is on the verge of a "Lehman moment," where the failure of a single company will lead to a widespread financial meltdown, however, as financial institutions' exposure to the real estate sector has declined over the past few years.

China's real estate sector accounts for more than half of global new home sales and construction, and it is the largest active class in the world with an estimated market value of about $62 trillion.

The next thing to look at is how regional governments, many of which rely on real estate revenues, manage their debts. The International Monetary Fund estimates that local financial institutions (LGFVs) have a total debt of 66 trillion yuan.

Will the government intervene?

The Chinese Communist Party's political bureau is fueling speculation about possible stimulus when in late July it dropped the usually repeated phrase that "houses are for living, not speculation" in a statement announcing its intention to adjust real estate policy in a timely manner.

No decisive incentives have been announced yet, however, and industry experts are divided on whether they will be implemented.

Many analysts are hopeful that Beijing, which has so far refrained from state-sponsored aid, will take decisive action in the coming weeks to halt the downtrend.

Some analysts, however, question what tools Beijing can use while maintaining a balance between supporting the housing market and controlling debt.

Tags

We will find property for you

- 🔸 Reliable new buildings and ready-made apartments

- 🔸 Without commissions and intermediaries

- 🔸 Online display and remote transaction

Our managers will help you choose a property

Liliya

International Real Estate Consultant

Subscribe to the newsletter from Hatamatata.com!

Subscribe to the newsletter from Hatamatata.com!

Popular Posts

We will find property for you

- 🔸 Reliable new buildings and ready-made apartments

- 🔸 Without commissions and intermediaries

- 🔸 Online display and remote transaction

Our managers will help you choose a property

Liliya

International Real Estate Consultant

Subscribe to the newsletter from Hatamatata.com!

Subscribe to the newsletter from Hatamatata.com!

I agree to the processing of personal data and confidentiality rules of Hatamatata

Need advice on your situation?

Get a free consultation on purchasing real estate overseas. We’ll discuss your goals, suggest the best strategies and countries, and explain how to complete the purchase step by step. You’ll get clear answers to all your questions about buying, investing, and relocating abroad.

Irina Nikolaeva

Sales Director, HataMatata