Stabilizing the hotel market in India: Marriott Menon on rates and recovery

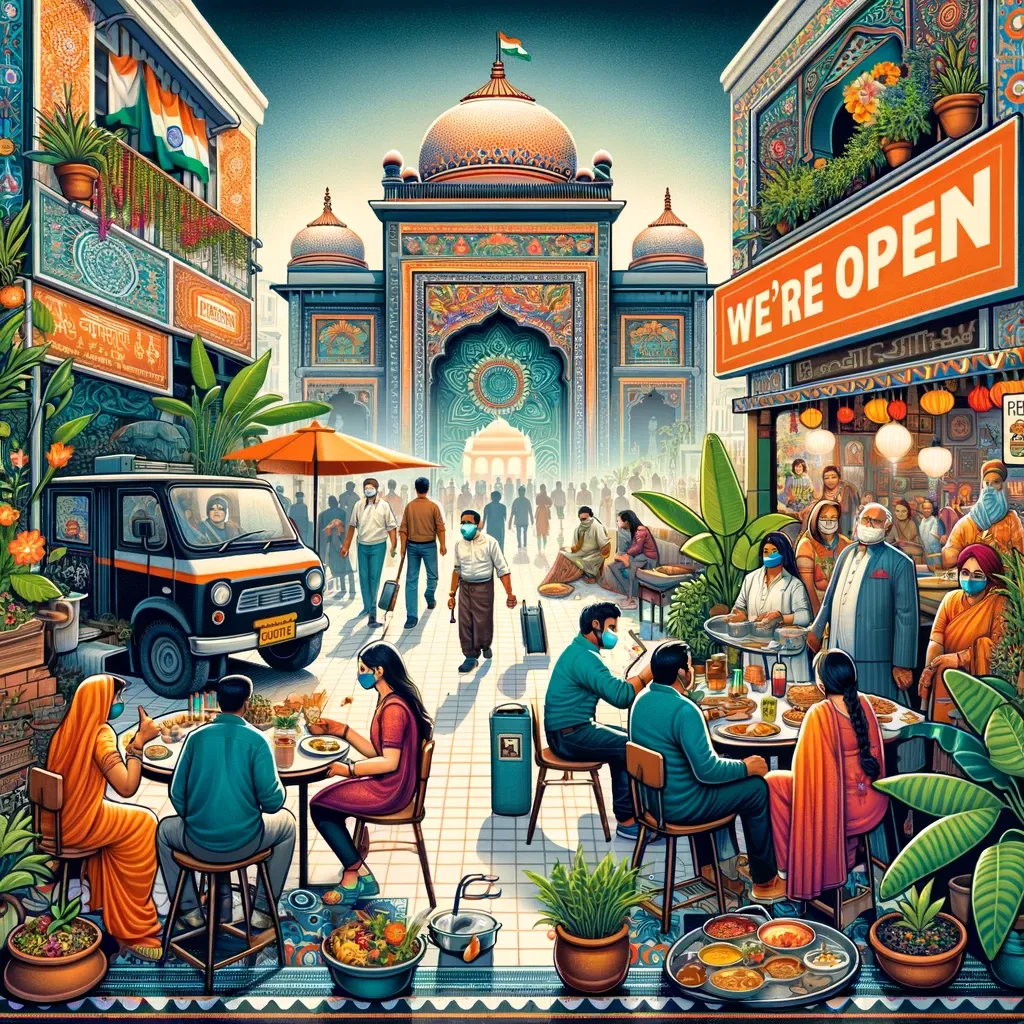

In a recent interview with BusinessLine, APEC (excluding China) president of Marriott International, Rajiv Menon, describes the resilient Indian hospitality sector. He highlights not only his company's growth plans, but also the recovery and stabilization of the industry as a whole after the pandemic, mentioning "8-11 percent annual average rate growth in various markets." He also shares about Marriott's strategies and the challenges faced by the Indian hotel industry such as visa difficulties.

Reflecting a revenue growth of 32% and a total turnover of Rs. 9000 crore in FY 2024, what is the outlook for 2025, given the double-digit growth in bookings seen in the first quarter? Operating on a calendar basis, our first quarter bookings show promising double-digit growth, pointing to another successful year. It is projected that 2025 will maintain a trajectory similar to the brilliant results of fiscal year 2024. In terms of employment, with the opening of 13-14 new hotels, we foresee the addition of approximately 1,500-2,000 employees to our existing 29,000 colleagues, driving organizational growth and economic development.

Which of your 17 brands in India will drive growth this year and how many additions do you foresee in the next five years? Our focus on après-level and upper mid-priced brands such as Fairfield by Marriott, Moxy, Courtyard by Marriott, Four Points by Sheraton and Aloft is driving rapid expansion. Luxury brands JW Marriott, St. Regis and Ritz Carlton are also showing strong growth with many new projects. Exact numbers are difficult to predict, but our growth trajectory signals steady development for each brand.

With nearly 200 million global members and over 6 million in India, how does Marriott Bonvoy stand out? We transcend conventional loyalty programs by focusing on unique experiences and creating a sense of belonging in an exceptional ecosystem. Sponsorship programs like the Australian Open and partnerships with artists like Ed Sheeran offer our members unique moments that money can't buy. These efforts not only add value to our program, but also reinforce Marriott's special position in India's dynamic hotel scene.

Can you share your views on the current state of the Indian hotel industry and do you foresee stabilization in the average room rate (ARR)? As far as ARR is concerned, we expect stabilization to continue during this year, although this does not rule out possible increases, especially given the current inflation. The dynamics of our industry depend on supply and demand, and markets experience stronger rate increases when demand exceeds supply.

What is the impact of rising real estate costs on the hotel industry and on investors and hotel chains, regardless of the specific brands being pursued? In developed regions, rising construction costs have led to a slowdown in new openings due to rising interest rates. However, in India, despite rising costs, the hotel industry remains robust. Investors see an opportunity to get a favorable ROI, even with higher construction costs. Unlike other sectors, the hotel industry in India is witnessing a surge in construction activity, especially in the luxury and premium segments. It must be noted that stable or slightly higher interest rates, much lower than a few years ago, are contributing to the optimistic situation, triggering a flurry of hotel construction activity in response to changing real estate market dynamics.

Despite improvements in the visa issuance process, what problems still arise for travelers arriving in India due to unfulfilled recovery of foreign tourist visits? Competition between countries depends on easy access and hassle-free travel for travelers. While India offers diverse attractions, the visa process remains a critical factor. Compared to countries offering visa-free access, the 'visa on arrival' process is still bound by bureaucratic hurdles. To boost tourism, discussions are ongoing with the government to further simplify the visa process for a more affordable and streamlined entry into India.

Is the upcoming election expected to have an impact on demand? This question depends on the context, as seen in the recent presidential election in Indonesia. Initial fears due to possible heightened tensions ahead of the June elections have not materialized, demonstrating the unpredictability of electoral outcomes. The impact of the elections in India will play out, and while some effects are expected, the maturity of the market tends to mitigate the dramatic impact, promoting stability as seen in Indonesia.

Comment

Subscribe to the newsletter from Hatamatata.com!

Subscribe to the newsletter from Hatamatata.com!

I agree to the processing of personal data and confidentiality rules of Hatamatata