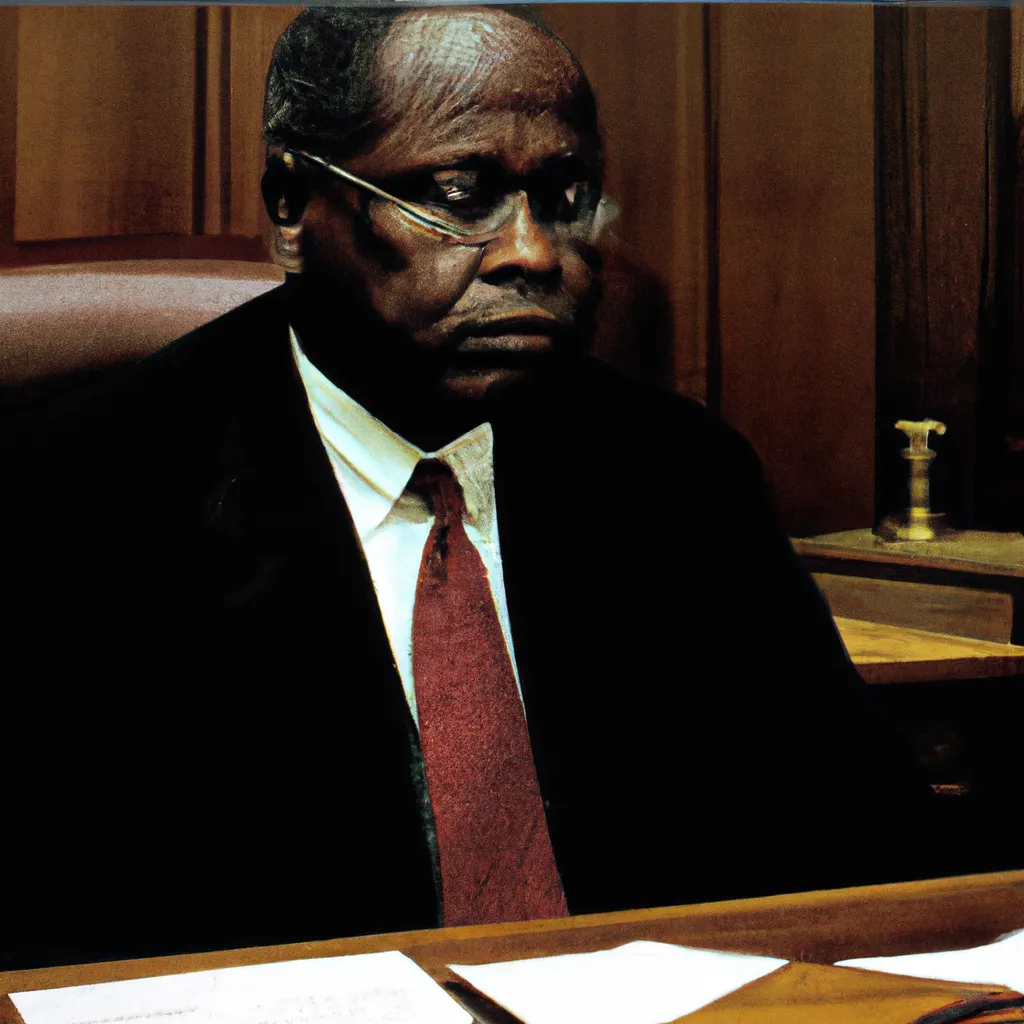

For many years, Clarence Thomas received income from a dissolved real estate sales company.

In the past two decades, Supreme Court Justice Clarence Thomas has reported in mandatory financial disclosures that his family received rental income of hundreds of thousands of dollars from a firm called Ginger, Ltd., Partnership.

However, this company, founded in Nebraska in the 1980s by his wife and her relatives, has not existed since 2006. According to state registration records, a related real estate company was closed that year, and a separate firm, Ginger Holdings, LLC, was established. It took over the management of the rental activities of the company that had ceased operations, as indicated by real estate documents.

However, despite this, Thomas continued to report income from the liquidated company - between $50,000 and $100,000 annually in recent years, and did not mention the new company, Ginger Holdings, LLC, on the forms. The previously unreported error could be attributed to a mistake in the paperwork. But this is just one of a series of errors and omissions made by Thomas in his mandatory annual financial disclosures over the past few decades, according to a review of these documents. This raises questions about how seriously Thomas takes his obligation to accurately report details about his finances to the public.

The story of Thomas's declaration

The issue has become relevant again after ProPublica reported this month that a Texas billionaire organized luxury vacations for him and also purchased a house in Georgia from Thomas and his relatives, where his mother lives, and this transaction was not disclosed in the documents. In a statement, Thomas said that colleagues told him, without naming names, that he did not need to report his vacations, and that he always tries to follow the reporting instructions. He has not yet discussed this transaction publicly. In 2011, he updated his financial disclosures for several years after an independent group, Common Cause, drew attention to the issue to include information about the employment of his wife, Virginia Thomas, a conservative activist. At that time, the judge stated that he did not understand the instructions for filling out the forms. In 2020, he had to amend his income reports after another oversight group found that he had not disclosed reimbursements for travel expenses for speaking engagements at two law schools.

An ethics expert in the judicial system said that this sequence of errors is alarming. "Any assumption of Thomas's honesty and commitment to upholding the law has vanished. His assurances and promises cannot be trusted. Is there more? What is the full story? The public has a right to know," said Stephen Gillers, an ethics expert in law at New York University. Gillers stated that all three branches of government should investigate Thomas's compliance with federal ethics laws or his failure to do so.

"Since 1790, the Supreme Court has been the connecting link that united the republic, with the exception of the Civil War. We need the public to continue to respect it even in cases of disagreement and to understand why this is important. Overall, the public does this." “However, this respect is now in serious danger, and others must take action to stop the decline,” he said.

Thomas did not respond to the questions directed through the court's press secretary. His wife also did not respond to requests for comments.

Thomas's income from the firm "Ginger, Ltd., Partnership," which he describes in his financial disclosures, has significantly increased over the past decade, although the exact amounts are unknown since only ranges are provided on the forms.

14 May 2025

14 May 2025

The company's roots go back to several neighborhoods developed decades ago by the late parents of Ginny Thomas in the Douglas County community, just outside of Omaha. According to state registration records, Ginger Limited Partnership was established in 1982 for the sale and rental of real estate, with Ginny Thomas, her parents, and her three siblings as partners. The firm owned and rented residential lots in two areas, Ginger Woods and Ginger Cove, collecting annual rent for each occupied parcel of land, according to copies of lease agreements archived in the county.

When he was appointed to the federal appeals court, Thomas included this firm in his financial report as one of his wife's assets, valued at $15,000 at that time. The firm was dissolved in March 2006.

At the same time, Ginger Holdings, LLC was established in Nebraska, according to state records that indicate the address of the same business as the closed company, naming Joann K. Elliott, sister of Ginny Thomas, as the manager. In the same month, leases for more than 200 residential lots in Ginger Woods and Ginger Cove were transferred from Ginger Limited Partnership to Ginger Holdings, LLC, as shown by property documents in Douglas County. Joann K. Elliott asked over the phone to direct any questions to Ginny Thomas. "You can call her, and she will be able to answer anything she wants you to know," she said before hanging up. Ginny Thomas is not listed in the state registration records concerning Ginger Holdings, LLC.

In his latest statement in 2021, Thomas estimated his family's interest in Ginger Limited Partnership, a dissolved firm, to be between $250,000 and $500,000. He reported that he earned income from it ranging from $50,000 to $100,000 this year.

On Friday, Democratic congress members responsible for overseeing federal courts referred to Thomas's "clear failure to comply with disclosure requirements" and his "pattern of noncompliance with disclosure requirements" - and called on the Judicial Conference, the body that sets the policy for federal courts, to refer him to the Attorney General for an investigation into potential violations of federal ethics laws.

In addition to the recent revelation about Thomas's financial ties to Texas billionaire Harlan Crow, they referred to a period in the 2000s when Thomas did not disclose his wife's employment as required by law, until the omission was identified by the independent group Common Cause. Ginni Thomas earned over $686,000 from the conservative Heritage Foundation from 2003 to 2007, according to the nonprofit's tax returns. For the years 2003 to 2007, the judge listed "none" as his wife's income. He did the same in 2008 and 2009 when she worked at the conservative Hillsdale College. Thomas acknowledged the mistake when he made corrections to these statements in 2011. He wrote that the information was "mistakenly omitted due to a misunderstanding of the filing instructions." However, in the years preceding these omissions, Thomas had correctly reported his wife's employment.

Thomas also did not report the sale of three properties in Georgia Crow in 2014, and he continued to indicate that he owned a stake in these properties as late as 2015, according to his income declarations. Additionally, starting in 2010, he did not declare expenses for his transportation, meals, and accommodation while teaching at the universities of Kansas and Georgia in 2018. After the incompleteness was revealed by the nonprofit organization Fix the Court, Thomas made amendments to his declaration for that year. He also made corrections to his 2017 declaration, in which he did not report similar reimbursements related to teaching at Creighton Law School, from which his wife graduated.

The information for this report was compiled by Jonathan O'Connell and Alice Krits.

Comment

Popular Offers

Subscribe to the newsletter from Hatamatata.com!

Subscribe to the newsletter from Hatamatata.com!

I agree to the processing of personal data and confidentiality rules of Hatamatata