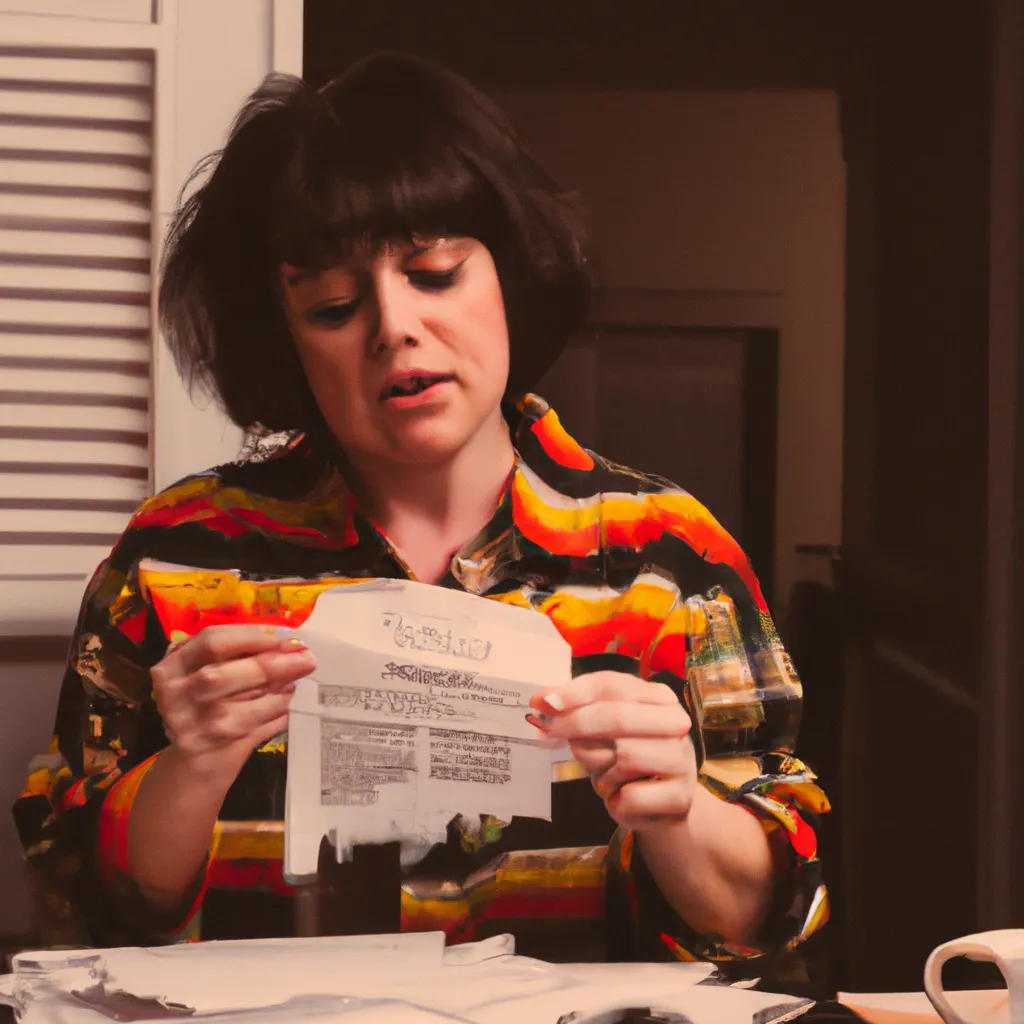

The influence of interest rates on household debts debts

Recently, the increased interest rates have become a topic of public discussion after a homebuyer posted on social media their monthly payment for an apartment amounting to 10,900 baht, of which the principal was only five baht, while the interest expenses were 10,894.5 baht.

The post received a lot of attention after interest rates were raised over the past two years, as adjustable-rate mortgages require higher interest payments, which can lead to a more fragile economy.

Household debt in the country has significantly increased, and the Bank of Thailand plans to introduce new measures regarding consumer debt starting January 1, 2024.

According to data from the central bank, Thailand's household debt reached 16 trillion baht in the first quarter of this year, or 90.7% of the country's GDP, which is worse than the 87% recorded in the fourth quarter of 2022.

18 April 2025

1 May 2025

30 April 2025

18 April 2025

Comment

Popular Posts

18 April 2025

162

18 April 2025

106

Popular Offers

Subscribe to the newsletter from Hatamatata.com!

Subscribe to the newsletter from Hatamatata.com!

I agree to the processing of personal data and confidentiality rules of Hatamatata