Tokyo's high housing prices discourage young professionals.

Mie Kawamata dreamed of a home of her own, where she could tend a small garden and her one-year-old daughter could play outside, but still stay close enough to commute to central Tokyo.

But after much searching, Kawamata and her husband, who both work in the accounting industry, gave up on the idea of their own home and bought an apartment about a third of the size they wanted. "I'm not sure ordinary people can afford to buy a house now," said Kawamata, 31. "Housing and rent prices have gone up a lot compared to the past, but at the end of the day wages haven't increased that much. "

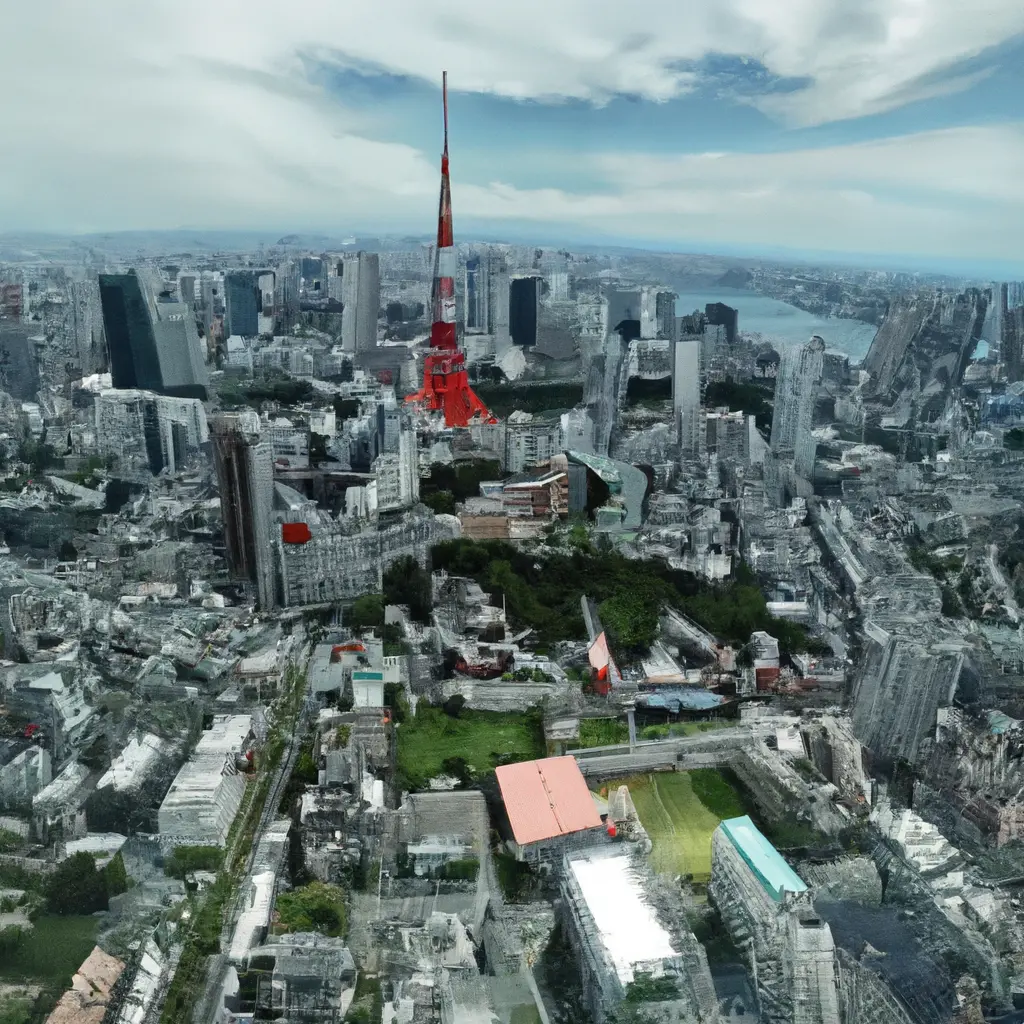

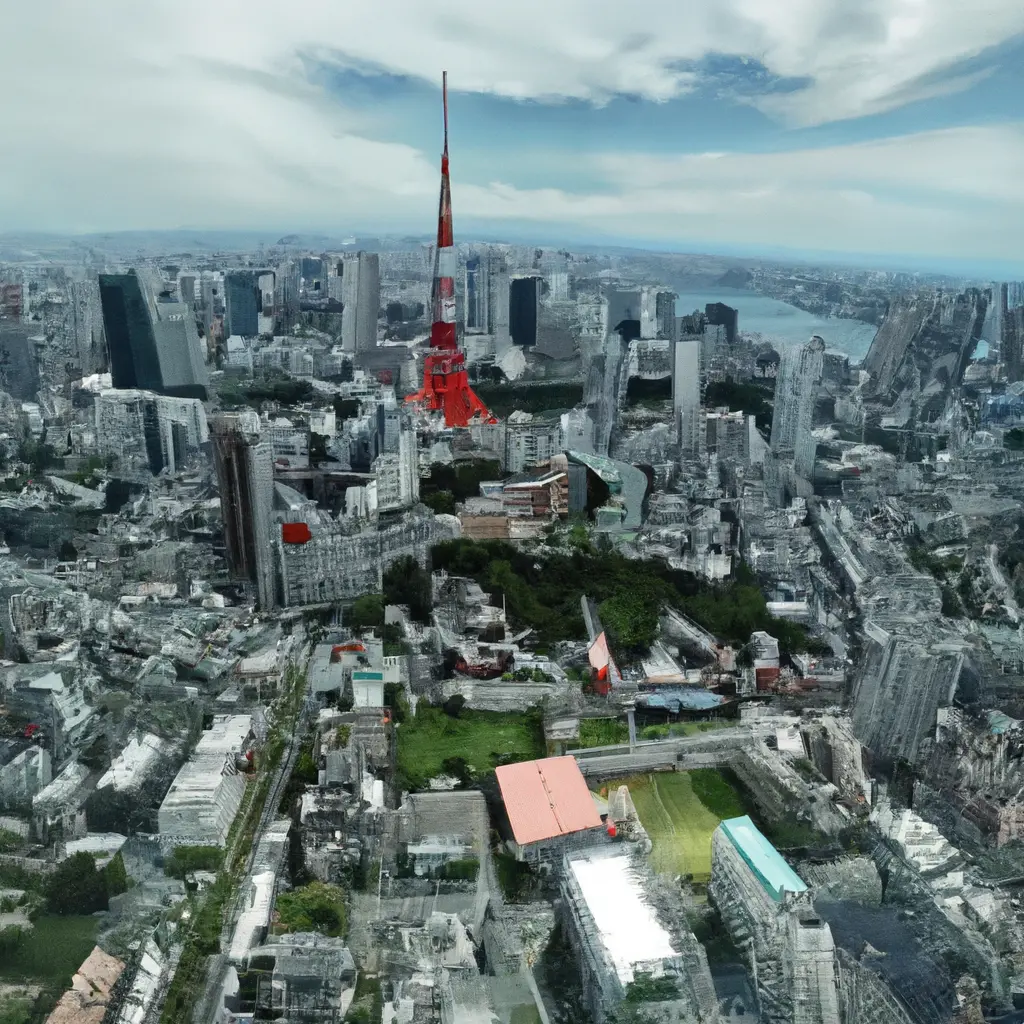

After decades of deflation and a stagnant economy, Japan is experiencing an investment boom that has made''Central Tokyo apartments out of reach for young Japanese professionals. A flood of investment has lifted the average price of a new apartment in central Tokyo by 60 percent to a record 129.6 million yen ($865,000) in the first half of this year, according to the Real Estate Economic Institute. Tokyo has become the second most unaffordable city in the world, behind only Hong Kong, according to the UBS Global Real Estate Report.

A 60-square-meter apartment in Tokyo now costs 15 times the salary of a skilled worker, surpassing London, Singapore and New York, the UBS report showed. While this is partly due to low interest rates, the price rise is being driven by foreign buyers taking advantage of a weak yen at its closest low in 33 years, a''also by those looking to withdraw funds from China, where the real estate crisis and geopolitical issues are having a negative impact on investment, according to real estate experts.

Since 2019, foreigners have invested more than 1.8 trillion yen in Japanese real estate, outpacing institutional investors, real estate funds and corporations, according to consulting firm Cushman & Wakefield. And more isn't stopping yet. Funds from real estate speculators piled up during the pandemic, and Japan looks like an attractive destination for them in Asia, said Cushman & Wakefield principal Mari Kumagai. "If they want to keep money in the Asia-Pacific region, they tend to choose Australia, Singapore or Japan," said''Kumagai, adding that Japan is the most attractive of the three options in terms of price stability and the size of the economy.

Average apartment prices in central Tokyo have risen in the past year due to the large amount of high-end housing entering the market.

14 May 2025

14 May 2025

13 May 2025

For Mari Mochizuki, a single mother and salesperson at a music company, it's an unsatisfying situation. She's unsuccessfully looking for an apartment large enough for her piano and possibly a cat. The 39-year-old woman is eager to find a place that will retain its value for a later job relocation. But the options she's seen downtown are either''too expensive, or worn out, so she is looking on the northern fringes of the capital. "It seems that prices for every decent-sized apartment are going up blindly, even those in remote areas or with surprisingly low-quality finishes," she said.

Comment

Popular Offers

Subscribe to the newsletter from Hatamatata.com!

Subscribe to the newsletter from Hatamatata.com!

I agree to the processing of personal data and confidentiality rules of Hatamatata