Real Estate in Denver

Real estate in Denver for living, investment and residence permit

- ✓ Verified properties directly from developers

- ✓ No overpayments or commissions

- ✓ Guarantee of transaction purity and post-purchase support

Our managers will help you choose a property

Liliya

International Real Estate Consultant

Need help choosing a property?

Leave a request and our manager will contact you.

Our managers will help you choose a property

Liliya

International Real Estate Consultant

Hot Deals

For Sale Real Estate in Denver

Recommended to see

Welcome to the Banning Lewis Ranch community! This home offers 3 bedrooms, 3 baths and an office/bonus area. On the...

Submit Request

This beautiful ranch style home in Woodman Hills is located near bike/walking trails and open space. The home features 4...

Submit Request

Studio for sale in Santa Margarida, located in Roses, Girona is a great opportunity for those looking for a property...

Submit Request

This home sits on 5 acres of land and offers breathtaking mountain views. Recent renovations include vinyl flooring in the...

Submit Request

This cozy studio with sea views represents the perfect place to stay in Roses, Girona. Located in the picturesque area...

Submit Request

Maison Commonwealth is a boutique complex of 5 apartments, consisting of two combined brownstones and a brand new building overlooking...

Submit Request

Welcome to the embodiment of luxurious living in the heart of Brentwood. This luxurious building, The Dorothy-Granville, is a rare...

Submit Request

Located on Monument Square in a beautiful brick townhouse, this elegant three-story condominium offers two bedrooms and three bathrooms, as...

Submit Request

Located in the prestigious One Paraiso Edgewater complex in the heart of Miami, these exquisite 3-bedroom apartments embody luxury and...

Submit Request

Welcome to the home of your dreams in the heart of Gallery and Tanglewood district. This bright and open 3...

Submit Request

Beautiful oasis with 4 bedrooms and 3.5 baths in desirable Woodlake Forest IV. This bright and spacious home features gorgeous...

Submit Request

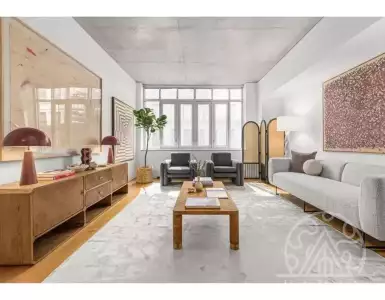

THE CONDOMINIUM, 246 WEST 17th STREET Superbly located in the endlessly thriving, always bustling, and perpetually coveted neighborhood of Chelsea,...

Submit Request

Didnt find the right facility?

Leave a request - we will handle the selection and send the best offers in a short period of time

Irina Nikolaeva

Sales Director, HataMatata

Real Estate in Denver

Real estate in Denver for living, investment and residence permit

- ✓ Verified properties directly from developers

- ✓ No overpayments or commissions

- ✓ Guarantee of transaction purity and post-purchase support

Our managers will help you choose a property

Liliya

International Real Estate Consultant

Need help choosing a property?

Leave a request and our manager will contact you.

Our managers will help you choose a property

Liliya

International Real Estate Consultant

Need help choosing real estate in Denver?

Leave a request and we will select the 3 best options for your budget

!

!

Other Properties for sale in Boston, USA 7 690 233 $

Maison Commonwealth is a boutique complex of 5 apartments, consisting of two combined brownstones and a brand new building overlooking...

!

!

For sale Flat in LA, USA 1 334 016 $

Welcome to the embodiment of luxurious living in the heart of Brentwood. This luxurious building, The Dorothy-Granville, is a rare...

🇺🇸 Denver, CO Real Estate: Median Prices, Neighborhoods, Commuter Transit & Mountain Views

Denver sits at the foot of the Rocky Mountains and offers a blend of urban energy and outdoor lifestyle that attracts buyers from across the United States and overseas. Located roughly 25 miles (40 km) east of Rocky Mountain foothills and served by Denver International Airport, the city combines a strong job market, cultural neighborhoods, and recreational access — skiing within a couple of hours, world-class mountain trails nearby, and an average of 300 days of sunshine supporting year-round outdoor life. For private buyers and investors alike, Denver delivers predictable demand, diversified neighborhoods, and a market with both steady rental income and long-term capital appreciation.

🏙️ City overview and lifestyle for buying property in Denver

Denver’s municipal boundary contains a mix of dense downtown towers and low-rise neighborhoods, with the Central Business District concentrated around the 16th Street Mall and Union Station. The city’s climate is semi-arid with four distinct seasons, low humidity, and frequent sun — conditions that influence energy costs, landscaping choices, and lifestyle amenities for homeowners. Cultural anchors include the Denver Art Museum, performing arts venues in the Golden Triangle, and neighborhood festivals that sustain tourism and local hospitality demand. Denver is a regional hub for outdoor recreation and corporate headquarters, which supports stable employment and consistent rental demand. The airport’s connectivity and rail link to Union Station make short business trips and tourism growth reliable drivers for short- and mid-term rental strategies. Local life tends to be active: cycling lanes, microbreweries, and parks such as City Park and Washington Park give residents walkable options within many neighborhoods. Denver’s urban planning favors transit-oriented development and infill, with new developments concentrated along light-rail corridors and former industrial zones like River North (RiNo). Buyers looking at property in Denver should weigh lifestyle trade-offs — proximity to nightlife and restaurants in LoDo and RiNo versus family-friendly yards and schools in Washington Park and Central Park.

💶 Property prices in Denver and market overview

Prices vary substantially by neighborhood and property format. Across metro Denver, median single-family home prices commonly sit in the mid-to-high hundreds of thousands to low millions in premium areas, while condos and townhouses are more accessible.

- Price ranges by district (typical market examples):

- Cherry Creek / Cherry Creek North: single-family $900,000–$2,500,000+, condos $500,000–$1,200,000

- LoDo (Lower Downtown) / CBD: condos/lofts $450,000–$1,600,000, price per sq ft $450–$800

- RiNo / River North: new lofts and condos $400,000–$1,000,000

- Washington Park / Congress Park: single-family $700,000–$1,800,000

- Central Park (Stapleton): townhouses/condos $350,000–$700,000, single-family $450,000–$900,000

- Prices by property type:

- Apartments/Condos: $300–$700 per sq ft depending on centrality and finishes

- Single-family homes: $300–$600 per sq ft with high-end neighborhoods above that band

- Townhouses: $350,000–$900,000 typical ranges based on lot and finishes

- Market segmentation and dynamics:

- Luxury segment centered in Cherry Creek, Washington Park, and LoHi commands the highest per-square-foot rates.

- Infill new developments and off-plan property in Denver frequently show premium pricing near transit corridors.

- Recent dynamics reflect steady appreciation and cyclical inventory tightening in desirable neighborhoods, with rental yields stronger in high-demand corridors and student housing near Auraria.

🚦 Transport and connectivity for property in Denver

Denver’s transport network combines highways, rail, and comprehensive bus/light-rail service under the RTD system. The A Line commuter rail links Denver International Airport to Union Station with an average trip time around 37 minutes. Major highways include I‑25 (north–south) and I‑70 (east–west), with E‑470 and C‑470 serving ring-road and suburban connections.

- Typical travel times:

- Downtown to Cherry Creek: 10–15 minutes by car

- Downtown to Denver Tech Center (DTC): 20–30 minutes

- Downtown to Denver International Airport: 30–45 minutes depending on traffic

- Public transport and alternatives:

- RTD light rail lines radiate from downtown and serve Central Park, DTC corridors, and outlying suburbs.

- Bike-share and e-scooters provide first/last mile connectivity in neighborhoods like LoDo, RiNo, and Cherry Creek.

- Ride-hailing and commuter shuttles are common for corporate employees in business hubs. These transport assets are central to valuation and rental demand: properties within a short walk of light-rail stations or Union Station typically command a premium.

🏫 Urban infrastructure and amenities shaping real estate in Denver

Denver’s infrastructure mix supports families, students, and professionals. Education options include the University of Denver (DU), the Auraria Campus (University of Colorado Denver, Metropolitan State University, Community College of Denver), and numerous charter and public school choices. Healthcare and research anchors include UCHealth University of Colorado Hospital and Children’s Hospital Colorado on the Anschutz Medical Campus in neighboring Aurora.

- Signature amenities and facilities:

- Cherry Creek Shopping Center and Cherry Creek North for retail and luxury shopping

- Denver Union Station as a transit and hospitality hub

- Cultural centers: Denver Art Museum, Red Rocks Amphitheatre nearby for major events

- Parks: Washington Park, City Park, Sloan’s Lake, and mountain access within a short drive

- Business hubs and coworking:

- Downtown CBD, Denver Tech Center (DTC), and emerging hubs in RiNo and Uptown host finance, tech, and professional services employers. These amenities drive both lifestyle buyers and investor demand for short- and long-term rentals.

📈 Economic environment and city development influencing real estate in Denver

Denver’s economy is diversified across technology, aerospace and defense, healthcare, energy, and tourism, giving the city resilience and steady migration inflows. Major employers and alumni networks feed rental demand and corporate relocation needs. Tourism, mountain access, and conventions sustain seasonal occupancy for short-term rentals, while new office conversions and adaptive reuse in RiNo create mixed-use investment opportunities.

- Economic indicators relevant to buyers:

- Strong job growth in tech and healthcare supports rental occupancy and wage-driven housing demand.

- Continued inbound migration from high-cost coastal metros supports long-term capital appreciation.

- Public and private investment in transit and mixed-use projects concentrates value along light-rail corridors.

🏘️ Which district of Denver to choose for buying property and neighborhood profiles

Choosing a Denver neighborhood depends on goals: family life, investment yield, nightlife, or commute. Each neighborhood has distinct development intensity and buyer profiles.

- Representative neighborhood breakdown:

- LoDo / CBD: dense, high-rise condos, walkable nightlife; suited for investors targeting short-term visitors and professionals.

- RiNo: creative-industrial conversions, growing mixed-use inventory; appealing for boutique new developments and lifestyle buyers.

- Cherry Creek: upscale retail and single-family homes; target for premium lifestyle buyers and long-term capital preservation.

- Washington Park / Congress Park: tree-lined streets, top schools, family-oriented; strong for long-term rentals and owner-occupiers.

- Central Park (Stapleton): master-planned, newer inventory, family-friendly amenity set; good for value-conscious buyers seeking yards.

- Safety, infrastructure and density:

- Central neighborhoods have higher policing and business services but more nightlife-related noise.

- Suburban-style districts like Central Park provide larger lots and lower density with community parks and schools.

- Developing areas such as RiNo combine industrial heritage with rapid redevelopment and rising price momentum.

🏗️ Property formats and housing types in Denver real estate

Denver offers a full spectrum: new developments in infill sites, off-plan condominiums, resale single-family homes, townhouses, loft conversions, and mixed-use commercial-residential buildings. New build property in Denver often emphasizes energy efficiency, rooftop amenities, and integrated retail.

- Typical formats and characteristics:

- Condos and lofts: smaller footprints, high amenity packages, close to downtown

- Townhouses: multi-level family units in infill and master-planned communities

- Single-family homes: detached lots, larger interior space, common in Washington Park and Cherry Creek

- Off-plan property and new developments: often sold with 10–20% deposit and scheduled closings Buyers should compare warranties, HOA governance, and construction quality when weighing resale property in Denver versus new developments.

🏢 Developers and key residential projects shaping real estate in Denver

Denver’s urban transformation has real projects and recognized developers driving supply. Notable names include Continuum Partners and East West Partners, both involved in large-scale Union Station and Central Park area development, and McWhinney, a local Denver developer with infill residential and mixed-use projects. National firms such as Hines and Brookfield have also invested in regional assets.

- Key projects and examples:

- Union Station redevelopment — major transit-oriented regeneration that reactivated downtown hospitality and residential demand

- Central Park (Stapleton) master-planned community — large-scale suburban-to-urban conversion offering diverse housing formats

- RiNo conversions and mixed-use infill including creative-office and boutique residential projects

- Construction quality and developer reliability:

- Established developers provide bankable warranties, detailed HOA documents, and known delivery timelines.

- In Denver, buyer protections include standard state disclosures, building codes with seismic and energy standards, and third-party inspections.

💳 Mortgage, financing, and installment options for property in Denver

Financing for foreign buyers is available but structured more conservatively than for residents. Lenders typically require larger down payments, and developer installment plans vary.

- Typical mortgage and financing terms for non-resident buyers:

- Down payment / deposit: commonly 30%–50% for foreign national borrowers

- Loan terms: fixed-rate and adjustable-rate mortgages up to 30 years, with non-resident loans often priced 0.5–1.0% higher than comparable resident loans

- Interest rates depend on market conditions and borrower profile; FHA loans are generally not available to non-residents

- Installment plans and off-plan financing:

- Developers occasionally offer staged payments for new build property in Denver with structured deposits during construction and final payment at closing

- Cash buyers benefit from negotiation leverage; mortgage approvals require proof of funds, credit history, and often an ITIN or US credit footprint

🧾 Property purchase process for buying property in Denver

The transaction sequence is standardized but includes contingencies important for international buyers. Steps and local practices matter for timelines and costs.

- Typical purchase steps:

- Offer and earnest money deposit (1%–3% typical), inspection and appraisal contingencies, lender underwriting if financing

- Title search, homeowner association reviews for condos/townhouses, and closing with settlement agent

- Typical closing costs: about 2%–5% of purchase price inclusive of title insurance, recording fees, lender charges and transfer fees

- Common payment methods:

- Wire transfers through US or international banks, escrow accounts for deposits, certified funds at closing

- Foreign buyers frequently open a US bank account and obtain an Individual Taxpayer Identification Number (ITIN) to facilitate transactions and tax reporting

⚖️ Legal aspects and residence options for property in Denver

Foreign nationals can own real estate in the United States without restrictions on title; ownership does not automatically grant residency. Tax and legal planning are essential.

- Ownership and tax notes:

- Foreign buyers can hold title as individuals, LLCs, or trusts — structure affects liability and estate planning

- Property tax effective rates in Colorado tend to be relatively low, often around 0.5%–0.8% of assessed value; closing costs and ongoing property tax and HOA fees are additional ownership expenses

- FIRPTA withholding rules apply to foreign sellers on disposition; rental income is taxable and generally reported on federal and state returns

- Residence permit and immigration:

- Buying property in Denver does not create a path to a residence permit; visa and immigration options are separate processes (such as employment-based visas or investor programs requiring substantial capital)

- Investor visas have specific thresholds and documentation outside the scope of a standard property purchase

💼 Property use cases and investment strategies for real estate in Denver

Denver supports many use cases: owner-occupier homes, long-term rentals, student housing, short-term rentals subject to municipal regulation, and buy-to-hold for capital growth. Each strategy aligns with specific neighborhoods and property types.

- Practical matchups by use case:

- Permanent residence and family living: Washington Park, Central Park, Cherry Creek — single-family homes and townhouses

- Long-term rental and steady cashflow: University corridors, Capitol Hill, Uptown — condos and multi-family units

- Short-term rental and hospitality investment: LoDo, RiNo, near Union Station — subject to Denver short-term rental licensing and neighborhood restrictions

- Value-add and development plays: RiNo, industrial conversion zones — off-plan redevelopment and loft conversions

- ROI and rental yield considerations:

- Urban core condos near transit yield stable occupancy from professionals and corporate travelers

- Family homes in established neighborhoods benefit from lower vacancy and premium school districts, supporting long-term appreciation

Buying property in Denver gives buyers the choice of high-amenity urban living, family-oriented suburbs, or investment-focused infill opportunities. Whether you are evaluating new developments in Denver with installment plan options, considering a mortgage as a foreign buyer, or comparing resale property in Denver for rental yield and capital growth, the city’s diverse neighborhoods and robust infrastructure create multiple paths to meet personal and investment objectives.

Frequently Asked Questions

Denver market ranges by property type: detached single‑family homes commonly sell roughly $550,000–$650,000 USD; townhomes $400,000–$600,000; condos $250,000–$450,000. Typical monthly rents: 1‑bed $1,500–$2,300, 2‑bed $2,000–$3,200. Prices vary by neighborhood, size, and condition—expect premium neighborhoods to sit above these ranges.

Yes — non‑US citizens can buy and hold real estate in Denver with no ownership restriction. Expect higher down payments for borrowers (often 25–40% for foreign/investor mortgages) and higher interest rates. Nonresident sellers may face federal withholding (FIRPTA) on sale proceeds; consult a US tax advisor. Buying property does not grant visas or residency.

Denver shows strong rental demand from young professionals, students, and tech/energy workers. Typical gross rental yields range ~3.5–6% depending on product and area; vacancy commonly around 4–7%. Liquidity is better than resort markets but can vary by neighborhood. Seasonality: demand peaks in summer (move season) and is boosted by winter visitors for nearby mountain access.

Resale transactions with financing usually close in 30–45 days; cash deals can close in 7–21 days. New builds or off‑plan purchases often take 6–18 months depending on stage. Expect buyer closing costs of roughly 2–5% of purchase price (title, appraisal, escrow, lender fees) and potential HOA/inspection timelines that can extend contingencies.

Property tax effective rates in Denver County commonly run about 0.5–0.8% of market value annually. Buyers should budget closing costs ~2–5% of price; sellers commonly pay 6–8% (commissions). Colorado has a state income tax; capital gains taxed federally (0–20% plus possible NIIT). Also plan for HOA fees ($200–$600+/month), local sales/occupancy taxes for short‑term rentals, and ongoing insurance.

Yes — Denver offers widespread broadband and growing fiber coverage, with average household speeds often 100+ Mbps in many neighborhoods. Plenty of cafes and coworking options, outdoor lifestyle, transit and an international airport. Leases are typically 12 months for long stays; furnished short‑term and month‑to‑month options exist but can be pricier. Note: US visa rules (e.g., ESTA) limit many visitors to ~90 days.

Top rental areas depend on goal: downtown/LoDo and RiNo suit short commutes and young professionals; Capitol Hill, Baker and Highlands are strong for one‑bed demand; Washington Park and Cherry Creek attract families and higher rents; Central Park (Stapleton) and Aurora areas offer affordability and family tenants. Expect downtown condos to yield ~3–4% and emerging neighborhoods 4–6% gross.

Denver permits short‑term rentals but with strict rules: primary‑residence requirements in many zones, permit/licensing, caps and enforcement fines for noncompliance. Hosts must collect occupancy taxes. Seasonality drives revenue—summer and winter ski periods are busiest. Revenue for a 1‑BR can range widely (roughly $1,800–$3,500 monthly gross seasonally), depending on location and permit status.

Off‑plan risks: construction delays, cost overruns, financing gaps and builder liens. Protections: insist on escrowed deposits, clear completion dates with penalties, review construction warranties (often 1–10 year coverage tiers), obtain title insurance, verify permits, and check HOA draft budgets. Use independent inspections and retain a real estate attorney for contract safeguards.

Financing: primary residences can have lower rates and smaller down payments (e.g., FHA options), while investment loans usually require 20–25%+ down and higher rates (+0.5–2%). Taxes: investors use depreciation and may do 1031 exchanges; homeowners use mortgage interest and capital‑gain exclusions if qualified. Operations: budget 8–15% of rent for maintenance/management and expect tighter tenant screening and HOA rental rules.

Properties by Region

Services in Denver

Properties by Country

- Real estate in Bulgaria (11408)

- Real estate in Montenegro (5186)

- Real estate in Indonesia (2423)

- Real estate in Spain (2289)

- Real estate in Portugal (1975)

- Real estate in Italy (1922)

- Real estate in Turkey (1699)

- Real estate in Cyprus (1566)

- Real estate in Thailand (1565)

- Real estate in Croatia (1431)

- Real estate in Greece (1082)

- Real estate in USA (1013)

- Real estate in France (1006)

- Real estate in Georgia (519)

- Real estate in Serbia (329)

- Real estate in Slovenia (123)

- Real estate in Egypt (23)

Get the advice of a real estate expert in Denver — within 1 hour

Looking for a property in Denver? Leave a request — we will help you take into account all the nuances, and we will offer objects according to your personal request.

Maria Guven

Head of Direct Sales Department

+90-507-705-8082