Flat in USA

Choosing a property in USA for your request

- 🔸 Reliable new buildings and ready-made apartments

- 🔸 Without commissions and intermediaries

- 🔸 Online display and remote transaction

Our managers will help you choose a property

Liliya

International Real Estate Consultant

Need help choosing a property?

Leave a request and our manager will contact you.

Our managers will help you choose a property

Liliya

International Real Estate Consultant

Weather in USA

For Sale flat in USA

Flats in Florida

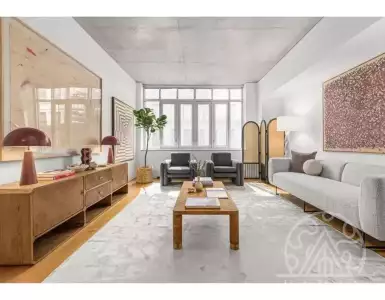

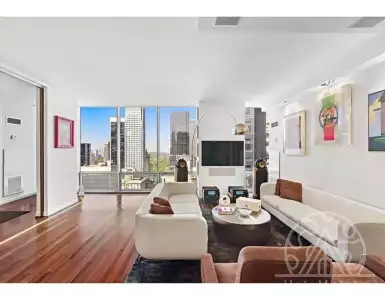

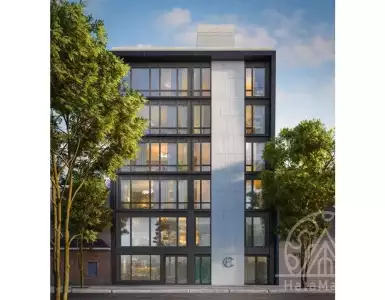

Flats in New York

Choosing a property in USA for your request

- 🔸 Reliable new buildings and ready-made apartments

- 🔸 Without commissions and intermediaries

- 🔸 Online display and remote transaction

Our managers will help you choose a property

Liliya

International Real Estate Consultant

Flats in Other regions of the United States

Flats in California

Flat in USA

Choosing a property in USA for your request

- 🔸 Reliable new buildings and ready-made apartments

- 🔸 Without commissions and intermediaries

- 🔸 Online display and remote transaction

Our managers will help you choose a property

Liliya

International Real Estate Consultant

Need help choosing a property?

Leave a request and our manager will contact you.

Our managers will help you choose a property

Liliya

International Real Estate Consultant

Individual selection flats in USA

Save time — for free we will select objects for your budget and goals

🇺🇸 U.S. Flats Market Overview: Regional price ranges, financing norms, and ownership types

Buying a Flat in USA is a decision that blends lifestyle, finance, and legal planning; buyers choose the USA for broad market depth, diverse climates from Miami’s beaches to Seattle’s temperate rainforests, and world-class infrastructure such as major airports, ports and rail corridors that sustain demand. Metropolitan clusters—New York City, Los Angeles, Miami, San Francisco, Boston, Chicago, Austin and Dallas—anchor both local purchases and global investment flows, with tourism hubs like Orlando and Las Vegas creating steady short-term rental potential. Urban planning, transit access, job markets and proximity to universities or hospitals shape neighborhood desirability, so selecting a borough, district or suburb influences price per square foot, rental yield and long-term capital appreciation.

🗺️ How location and infrastructure in USA shape Flat demand

Buyers gravitate to locations where transport nodes, employment centers and amenities converge; Manhattan and Downtown Brooklyn benefit from subway, PATH and commuter rail connectivity while San Francisco Bay Area demand centers around Silicon Valley, downtown San Jose and Emeryville driven by tech employment density. Climate influences seasonal markets: Miami and Palm Beach draw buyers seeking warm-weather living and short-term rental income, while mountain-adjacent markets like Denver or Salt Lake City attract outdoor lifestyle purchasers and second-home buyers. Infrastructure such as international airports—JFK, LAX, MIA, SFO, BOS—and medical centers like Massachusetts General Hospital or academic clusters such as Harvard and Stanford underpin long-term demand and liquidity. Buyers should evaluate local zoning, transit-oriented developments and planned infrastructure projects because they affect supply pipelines and neighborhood desirability; for example, Hudson Yards in Manhattan delivered new mixed‑use inventory and retail that shifted nearby pricing tiers. Developers often target transit corridors with mid- to high-rise flats to maximize rental demand and capital flow, especially near light rail lines in cities like Austin and Seattle. Urban amenities—parks, waterfronts, retail corridors and cultural institutions—consistently lift sale prices and occupancy rates across tiers of flats.

💶 How much Flat costs in USA and price segmentation

Pricing for a flat in the USA varies widely by city, neighborhood, building age and amenities; entry-level flats in secondary markets often start from $120,000–$300,000, while prime towers in Manhattan or San Francisco command $1,000,000–$5,000,000+. Typical size and price ranges:

- New developments and luxury towers: studios 400–650 sq ft ($400,000–$1,200,000), 1‑bed 600–900 sq ft ($500,000–$2,000,000), 2‑3 beds 900–2,500 sq ft ($900,000–$5,000,000+).

- Suburban condominiums and mid-market flats: 1 bed 700–1,200 sq ft ($200,000–$700,000), 2 bed 900–1,500 sq ft ($300,000–$1,000,000).

- City highlights with typical price per square foot: Manhattan $1,500–$2,500+/sq ft, San Francisco $1,000–$1,800+/sq ft, Miami $500–$1,200/sq ft, Austin $350–$700/sq ft. Market dynamics show steady demand for well-located inventory, with new developments absorbing quickly in core neighborhoods and resale markets offering yield opportunities through renovations and repositioning. Buyers assessing flat purchase costs in USA must budget for purchase price, closing costs (typically 2–5% of price), condo association fees, and property taxes which vary by state and county.

🧾 How the US economy and investment climate influence Flat market in USA

The US economy’s scale and diversified sectors—finance, technology, healthcare, education and tourism—create strong employment hubs that underpin rental demand and capital flows into flats. GDP size and consumer spending power drive long-term housing demand while tourism inflows to cities like Orlando, Las Vegas, Miami and New York support short-term rental markets. Tax structures and local incentives affect investor returns; some states offer favorable treatment for depreciation and cost-recovery while others have higher property taxes that reduce net yields. Investment considerations:

- Economic drivers: tech in San Francisco, Seattle, Austin, finance in New York, Charlotte, healthcare in Boston, Houston.

- Tax and regulatory variables: property taxes, local short-term rental rules, and state income taxes.

- Liquidity drivers: strong employment growth, new infrastructure and international buyer interest. These macro factors influence ROI on flat in USA and rental yield for flat in USA by affecting occupancy, rent growth and capital appreciation potential.

🎯 Which region of USA to choose for buying flat and target use cases

Selecting a region depends on buyer goals—long-term capital appreciation, rental income, relocation or seasonal residence. Urban cores such as Manhattan, Downtown LA, Brickell (Miami) favor premium buyers and institutional investors; suburban and Sunbelt markets like Austin, Dallas, Phoenix, Tampa suit families and yield-focused investors. Infrastructure and transport access are critical:

- Transit-rich cores: New York City (subway, commuter rails), Chicago (El/Metra), Boston (MBTA).

- Airport- and highway-accessible markets: Miami, Orlando, Dallas-Fort Worth, supporting high tourism or corporate travel.

- University/medical micro-markets: Cambridge-Boston, Palo Alto-SF, Houston Medical Center yield stable rental pools. Buyer profiles map to formats: compact flats and studios in CBDs for corporate renters; family-oriented multi-bedroom condos in suburbs and high-rise amenity buildings for premium purchasers.

🏗️ Leading developers and projects offering Flat in USA

Major developers and flagship projects set market benchmarks and influence resale values; recognized names produce record-setting towers and large mixed-use portfolios. Notable developers and projects:

- The Related Companies — Hudson Yards (New York).

- Tishman Speyer — The Spiral (Hudson Square), Rockefeller Center revitalizations.

- Extell Development — One57, Central Park Tower (New York).

- Hines — large-scale urban projects across Houston, Dallas, Miami.

- Swire Properties and Related in Miami — Brickell City Centre.

- Lennar and Toll Brothers — mass-market condominiums and build-to-rent inventory across Sunbelt metros. Buyers assess developer track record, warranty structures, amenities (concierge, fitness centers, parking, bike storage) and HOA governance because these elements affect maintenance costs and long-term resale prospects.

🧾 Mortgage USA for foreigners and financing options for flat in USA

Foreign buyers can finance purchases but face stricter terms than citizens; many banks and mortgage brokers provide programs tailored to non-residents. Typical conditions and figures:

- Down payments: 30–50% for non-residents, sometimes 20–30% for documented foreign buyers with US ties.

- Loan terms: 15–30 years, with fixed or adjustable-rate options.

- Interest rates and approval: rates depend on credit profile and lender; foreign borrowers may face higher margins and additional documentation requirements.

- Developer installment plans: some new developments offer reservation deposits and staged payment schedules or limited interest-bearing installments for pre‑construction purchases. Mortgage USA for foreigners often requires international credit reports, proof of income, tax documentation and a US bank account; using local mortgage brokers can improve access to competitive terms for a flat in USA with mortgage or flat in USA with installment plan.

🧭 Step-by-step Legal process to buy flat in USA

The Legal process to buy flat in USA follows defined milestones from offer to title transfer; understanding local regulations and timelines is essential for foreign buyers. Typical steps and roles:

- Pre-purchase: secure financing pre-approval or proof of funds, review HOA covenants and building financials.

- Offer and contract: submit an offer, negotiate contingencies (inspection, appraisal), and sign a purchase and sale agreement.

- Due diligence and closing: complete inspections, secure title search and insurance, wire closing funds, and record deed at county clerk’s office. Practical timelines range by state and transaction type; condominium purchases often involve HOA reviews and reserves checks, while new construction requires addenda covering construction timelines. Legal counsel and a reputable title company or closing attorney are central to verifying property encumbrances, liens and ensuring clear title.

⚖️ Legal framework, taxes and ownership rules for flat buyers in USA

Property ownership carries recurring obligations and regulatory constraints; taxes and rental rules differ by jurisdiction and can materially affect returns. Key legal and tax elements:

- Property taxes: set at county or municipal level and billed annually; rates vary widely and are a function of assessed value.

- Income and sales taxes: rental income is generally taxable in the US; non-resident owners may face withholding and must file US tax returns for rental income.

- Rental rules: short-term rental regulations vary—cities like New York restrict short-term rentals, while Miami Beach and many Florida counties permit them with licensing.

- Residence permits: purchasing a flat does not automatically grant residency; Residence permit through flat investment in USA or Golden visa through flat investment in USA are not available as purchase-for-visa routes in the same manner as some countries, although EB-5 investment programs exist for qualified commercial investments rather than standard residential purchases. Buyers should plan for insurance, HOA covenants, property management contracts and compliance with local short-term rental regulations when targeting rental income.

🏡 Which buyers should Buy flat in USA and typical property matchups

Different buyer objectives pair with specific markets and building types: living, relocation, seasonal residence, rental, investment or premium lifestyle ownership. Examples:

- Relocation and employment-led moves: San Francisco and Seattle 1–2 bed condos near tech campuses for professionals.

- Seasonal and second homes: Miami Beach, Palm Beach, Aspen luxury flats and penthouses.

- Rental-focused investors: workforce housing in Dallas, Charlotte, Phoenix and downtown flats near universities in Boston, Austin.

- Premium and trophy assets: Manhattan penthouses, San Francisco bay-front flats, Miami waterfront towers from developers like Related, Extell, Hines. Benefits for each use case differ: stability and services for family living, high occupancy cycles for rentals, and capital preservation in gateway cities.

The market outlook for a flat in USA points to continued demand for well-located inventory in major metros and Sunbelt growth corridors, supported by job concentration, international buyer interest and constrained new supply in certain downtown cores; investors should balance yield expectations—rental yield for flat in USA varies by market from 2–6% net—and capital appreciation potential to estimate ROI on flat in USA while accounting for Property taxes in USA for foreigners, financing constraints like Mortgage USA for foreigners and operational costs. Long-term prospects favor diversified portfolios across gateway cities and growing domestic metros where infrastructure, developer quality and regulatory clarity support liquidity and defensible returns.

Frequently Asked Questions

Prices for flats in the USA range widely: entry-level or small‑town condos $100,000–$300,000; many metro flats $300,000–$700,000; high-demand coastal or major-city flats $700,000–$2,000,000+; luxury properties exceed $2M. Use local comps and per‑square‑foot benchmarks to refine estimates for a specific market.

Long‑term stay options in the USA include work visas, family visas, student visas, and investor immigration paths that require qualifying business or job-creating investments. Owning a flat in the USA alone generally does not qualify you for residency; real estate ownership is typically not a substitute for required visa investments.

Many US lenders will finance non‑residents buying a flat in the USA, but terms are stricter: down payments commonly 20–30% (sometimes 30–50%), higher rates, proof of income, passport and ITIN, and larger cash reserves. Availability varies by lender, loan type, and state rules.

Closing costs in the USA usually total about 2–5% of the purchase price and include appraisal, title/escrow fees, lender charges, recording fees, and prepaid taxes/insurance. Exact items and who pays vary by state and local custom, so budget in USD and confirm line items in the closing statement.

You can generally rent a flat in the USA, but local zoning, city rules and HOA covenants may limit short‑term or long‑term rentals. Rental income is taxable federally and often at the state level; non‑resident owners must report income and may face withholding requirements. Check permits, licensing and local landlord regulations.

HOA or condo fees for flats in the USA vary widely: monthly amounts commonly range $100–$1,000+, with many urban condos falling in $200–$600. Fees cover common maintenance, building insurance, reserves and some utilities; special assessments can add unexpected costs. Review HOA budget and reserve studies before buying.

Standard due diligence for a flat in the USA includes a general home inspection ($300–$800), pest and HVAC checks, appraisal, title search and title insurance (~0.5–1% of price), HOA document review, and insurance and flood‑risk quotes. Use findings to negotiate repairs or credits.

Property tax rates for flats in the USA depend on state and locality; effective rates commonly range 0.3%–2.5% of assessed value, with many areas around 0.5%–1.5%. Assessment methods, exemptions (senior, homestead), and billing cycles vary, so check local mill rates and appeal procedures for the area you target.

Foreign buyers can own flats in the USA; common ownership structures are individual, joint tenancy, LLC or trust. Title insurance and escrow are standard to protect against past defects. No general federal ban on foreign ownership exists, but state laws, tax reporting, and choice of ownership structure affect liability and taxes.

Suitability depends on location: quality of life, healthcare access, schools, transport and cost of living vary across the USA. Major cities offer strong internet and coworking for remote workers; rural areas can be cheaper but have limited infrastructure. Typical monthly living costs range roughly $1,000–3,500+ depending on city and lifestyle.

Properties by Region

Properties by Country

- Real estate in Bulgaria (11408)

- Real estate in Montenegro (5186)

- Real estate in Indonesia (2423)

- Real estate in Spain (2289)

- Real estate in Portugal (1975)

- Real estate in Italy (1922)

- Real estate in Turkey (1699)

- Real estate in Cyprus (1571)

- Real estate in Thailand (1565)

- Real estate in Croatia (1431)

- Real estate in Greece (1082)

- Real estate in USA (1013)

- Real estate in France (1006)

- Real estate in Georgia (519)

- Real estate in Serbia (329)

- Real estate in Slovenia (123)

- Real estate in Egypt (23)

Don't know where to start buying a property in USA?

Leave a request and receive free advice on prices, taxes, residence permits and the real estate market. in USA.

Maria Guven

Head of Direct Sales Department

+90-507-705-8082