Real Estate in Manhattan

Real estate in Manhattan for living, investment and residence permit

- ✓ Verified properties directly from developers

- ✓ No overpayments or commissions

- ✓ Guarantee of transaction purity and post-purchase support

Our managers will help you choose a property

Liliya

International Real Estate Consultant

Need help choosing a property?

Leave a request and our manager will contact you.

Our managers will help you choose a property

Liliya

International Real Estate Consultant

Hot Deals

For Sale Real Estate in Manhattan

Recommended to see

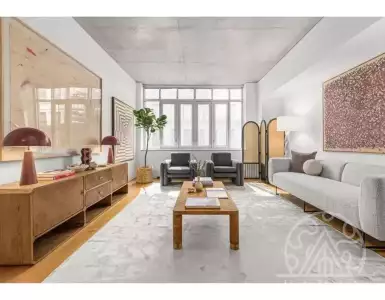

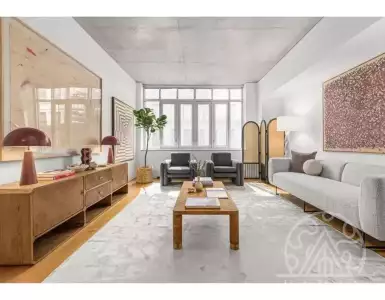

THE CONDOMINIUM, 246 WEST 17th STREET Superbly located in the endlessly thriving, always bustling, and perpetually coveted neighborhood of Chelsea,...

Submit Request

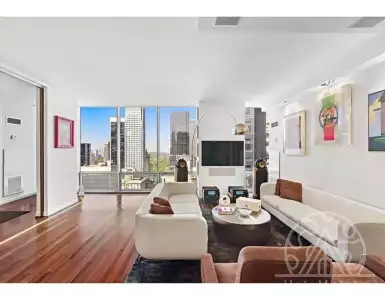

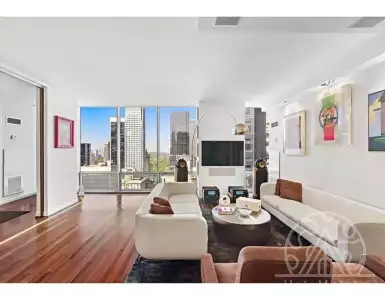

The iconic Olympic Tower building at 641 5th Ave, residence 31C, is one of the most sought after by celebrities,...

Submit Request

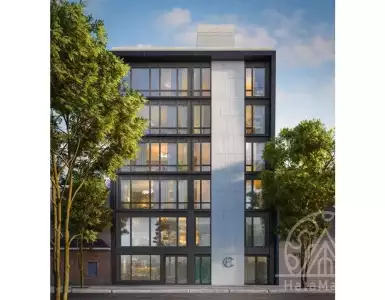

Introducing a new full-floor condominium that combines stunning interiors and a private outdoor space with the trendy lifestyle of Williamsburg....

Submit Request

This sunny and spacious duplex loft at Magnolia Mansion Lofts offers 14-foot high ceilings, large north-facing windows, in-unit washer-dryer, hardwood...

Submit Request

PRIVATE TERRACE == SEPARATE ROYAL BEDROOMS == WARDROBES == 1600 SF! LIVE IN THIS IMPRESSIVE RENOVATION IN THE HEART OF...

Submit Request

Classic luxury of Upper East Side. Created for the modern era. Elegant and bright, with a private backyard and thoughtful...

Submit Request

The first four photos are a virtual render and previous renovation that do not reflect the current layout and finishes....

Submit Request

City living is easy! Located on the 32nd floor, this renovated 2-bedroom, 2.5-bathroom corner apartment offers over 1,300 +-- sf...

Submit Request

Ciao, East Village! Modern Italian Luxury Welcome to this stunning 3 bedroom 3 bathroom penthouse at 75 First Ave with...

Submit Request

At the crest of the hill leading to the Firefighters Memorial in the historic Riverside West End neighborhood sits a...

Submit Request

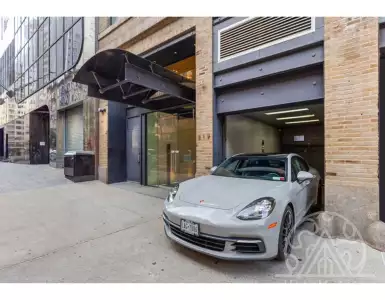

Recognized as the building of the year in 2022! On-site model apartment buildings are now available for inspection by appointment:...

Submit Request

Didnt find the right facility?

Leave a request - we will handle the selection and send the best offers in a short period of time

Irina Nikolaeva

Sales Director, HataMatata

Real Estate in Manhattan

Real estate in Manhattan for living, investment and residence permit

- ✓ Verified properties directly from developers

- ✓ No overpayments or commissions

- ✓ Guarantee of transaction purity and post-purchase support

Our managers will help you choose a property

Liliya

International Real Estate Consultant

Need help choosing a property?

Leave a request and our manager will contact you.

Our managers will help you choose a property

Liliya

International Real Estate Consultant

Need help choosing real estate in Manhattan?

Leave a request and we will select the 3 best options for your budget

!

!

Flat for sale in New York, USA 2 883 852 $

THE CONDOMINIUM, 246 WEST 17th STREET Superbly located in the endlessly thriving, always bustling, and perpetually coveted neighborhood of Chelsea,...

!

!

Buy flat in New York, USA 3 471 320 $

The iconic Olympic Tower building at 641 5th Ave, residence 31C, is one of the most sought after by celebrities,...

🇺🇸 Buy Manhattan real estate: neighborhood price trends, inventory, co-op vs condo data

Manhattan is the economic and cultural heart of New York City, a compact island where skyline density, world-class institutions, and 24/7 urban life intersect. Buyers choose Manhattan for access to global finance, leading universities, theater and dining, high-quality healthcare and a uniquely liquid property market. Lifestyle here ranges from quiet brownstone streets on the Upper West Side to glass-and-steel luxury towers along Billionaires’ Row and Hudson Yards.

🏙️ City overview and lifestyle in Manhattan

Manhattan sits between the Hudson and East Rivers and includes neighborhoods from Inwood in the north to Battery Park City in the south, creating intense urban variety in a three-to-four-mile-wide corridor. Residents experience a temperate climate with four seasons, easy waterfront access along the Hudson and East River esplanades, and nearby beaches such as Rockaway reachable by ferry and subway connections. Daily life centers on walking, cycling, subway use and short car rides; mixed zoning produces high-rise corridors alongside historic low-rise blocks.

Manhattan’s character is shaped by scale: Wall Street and Midtown are finance and corporate cores, while Chelsea, SoHo and Greenwich Village drive culture and lifestyle. Public spaces such as Central Park, Hudson River Park and the High Line provide green relief that strongly affects livability and resale value. For buyers the trade-off is density: convenience and capital appreciation potential versus higher cost per square foot and limited private outdoor space in many central neighborhoods.

Investors and private buyers alike value Manhattan for liquidity and international demand: the city consistently ranks among the top global markets for cross-border real estate investment, with demand coming from institutional buyers, family offices and owner-occupiers seeking long-term appreciation and rental income. Neighborhood selection, property type and purchase structure determine whether you prioritize rental yield, capital growth or lifestyle.

💠 Which district of Manhattan to choose for buying property in Manhattan

Manhattan’s districts differ sharply in price, density and buyer profile, so matching goals to neighborhoods is critical. Tribeca, SoHo, and Greenwich Village attract buyers seeking character and luxury loft living with high resale value. Midtown and Hudson Yards appeal to corporate professionals and investors targeting new developments and large-scale amenities. Upper East Side and Upper West Side are favored by families for schools and quieter streets, while Financial District and Battery Park City suit buyers wanting proximity to work and waterfront views.

Safety and livability vary: neighborhoods like Battery Park City, Upper West Side, and Murray Hill score highly on family-oriented metrics, while nightlife-heavy areas such as East Village and Lower East Side may suit younger renters. Development intensity is highest in Midtown and Hudson Yards, with new towers and mixed-use complexes, whereas brownstone neighborhoods maintain lower building heights and cooperative housing concentration. Typical buyer profiles:

- Families: Upper East Side, Upper West Side, Harlem

- Luxury buyers and internationals: Tribeca, SoHo, Midtown South, Billionaires’ Row

- Young professionals and renters: Chelsea, Hell’s Kitchen, Lower Manhattan

Neighborhood bullet list with typical strengths:

- Tribeca: historic lofts, luxury resale, strong appreciation

- Hudson Yards: new developments, podium retail, transit hub (related projects)

- Upper East Side: top private and public schools, museums (Metropolitan Museum)

- Financial District: proximity to corporate offices, rapid growth in residential conversions

- Harlem and Inwood: more affordable entry points, opportunity for future appreciation

💶 Property prices and market overview in Manhattan

Manhattan pricing is highly segmented by micro-market. Average price per square foot across Manhattan commonly sits in a mid-to-high range, with prime floors exceeding $3,000–$6,000 per sq ft in super-prime towers and more mainstream central neighborhoods in the $1,200–$2,500 per sq ft band. Entry-level resale property in outer Manhattan pockets can be available nearer $800–$1,200 per sq ft. Typical unit sizes:

- Studios: 350–600 sq ft

- One-bedrooms: 600–900 sq ft

- Two-bedrooms: 900–1,400 sq ft

- Penthouses and townhouses: 1,500–6,000+ sq ft

Price ranges by district (indicative):

- Tribeca / SoHo / Greenwich Village: $1.5M–$20M+

- Midtown / Hudson Yards: $800K–$15M

- Upper East Side / Upper West Side: $700K–$6M

- Financial District / Battery Park City: $600K–$10M

- Harlem / Inwood: $300K–$1.5M

Market dynamics show that new developments in Manhattan and trophy assets command a premium, while resale property in established co-op buildings often trades at discounts to luxury condos due to board restrictions. For investors, rental yields in prime Manhattan are modest (often 2–4% gross) but total returns can be driven by long-term capital appreciation. Search terms buyers use include property in Manhattan, real estate in Manhattan, and property for sale in Manhattan.

🚇 Transport and connectivity in Manhattan

Manhattan’s transport network is centered on the subway, with major hubs at Grand Central Terminal, Penn Station and Fulton Street providing commuter access across the region. Commuting times are short: Midtown to Wall Street typically 15–20 minutes by subway, Midtown to Hudson Yards or Chelsea 10–20 minutes, while transit to JFK or LaGuardia takes 40–70 minutes depending on route. PATH trains connect Lower Manhattan to New Jersey, and expansive bus routes cover cross-town and crosstown gaps.

Road access includes FDR Drive and West Side Highway, with access to I-95 and New Jersey via George Washington Bridge to the north. Taxis and rideshares are widely used; many residents prefer walking or cycling — Citi Bike stations are dense and growing. For investors, proximity to transit hubs increases long-term liquidity and rental demand.

Transport bullet points:

- Subway coverage: extensive, lines serve all major neighborhoods

- Commuter rail: LIRR at Penn Station, Midtown access to Long Island and regional airports

- Ferries: NYC Ferry routes and private ferry services to Brooklyn, Bronx, Staten Island and NJ

- Airports: JFK and LaGuardia within 45–70 minutes by car, Newark accessible via PATH and NJ Transit

🏥 Urban infrastructure and amenities in Manhattan

Manhattan hosts top-tier healthcare, education and cultural assets that support long-term value. Major hospitals include NewYork-Presbyterian, NYU Langone, Mount Sinai and specialty centers across the borough. Universities such as Columbia University and NYU create steady student housing demand and research-driven employment. Parks and recreation — Central Park, Hudson River Park, High Line — significantly enhance neighborhood desirability.

Retail and business hubs are concentrated around Fifth Avenue, Madison Avenue, Hudson Yards and Brookfield Place, offering luxury shopping and corporate services. Museums (Metropolitan, MoMA, Guggenheim) and Broadway theaters underpin tourism and short-term rental demand in central neighborhoods. Quality infrastructure supports both lifestyle purchases and investment property in Manhattan.

Amenities bullet list:

- Major hospitals: NewYork-Presbyterian, NYU Langone, Mount Sinai

- Universities: Columbia, NYU, The New School

- Parks: Central Park, Hudson River Park, The High Line

- Shopping/business centers: Fifth Avenue, Hudson Yards, Brookfield Place

📈 Economic environment and city development in Manhattan

Manhattan’s economy is diversified across finance, media, tech, tourism and healthcare. The Financial District remains a global capital market hub while Midtown supports corporate headquarters and creative industries. Tech sector growth is concentrated in Hudson Yards and Midtown South, with major firms and co-working spaces attracting talent. Tourism is a consistent demand driver, supporting short-term rentals and hospitality-adjacent real estate.

Public and private investment in infrastructure projects — transit improvements, waterfront resiliency and mixed-use developments such as Hudson Yards — fuels real estate development and urban renewal. Office-to-residential conversions in lower Manhattan have expanded the housing stock and created new rental avenues. For long-term investors, real estate investment in Manhattan offers exposure to a resilient, globally connected economy.

Economic highlights:

- Core sectors: finance, technology, media, healthcare, tourism

- Major business hubs: Midtown, Hudson Yards, Financial District

- Development drivers: Hudson Yards (Related), adaptive reuse and office-to-residential conversions

🏘️ Property formats and housing types in Manhattan

Manhattan offers condos, co-ops, townhouses, lofts and high-rise rentals; understanding legal and operational differences is essential. Co-ops remain common on the Upper East and West Sides — these require board approval, often restrict subletting, and typically demand 20–30% down. Condos dominate new towers and Hudson Yards, providing easier rental flexibility and clearer title for foreign buyers. Townhouses provide private outdoor space and are prized for long-term ownership.

New developments often arrive as mixed-use towers with amenity packages (doormen, gyms, concierge, private dining), while resale properties can offer value and immediate occupancy. Off-plan property in Manhattan exists but is less prevalent than in some global cities; where available, off-plan sales include staged deposit schedules and developer-backed installment plans. Buyers should weigh maintenance (co-op maintenance fees), property taxes, and potential assessment fees.

Formats bullet list:

- Condominiums: flexible, common in new build property in Manhattan

- Co-ops: board-controlled, often lower price per share but stricter rules

- Townhouses: limited supply, high maintenance yet strong capital preservation

- Rentals: institutional rental buildings and smaller landlords, variable yields

🏗️ Developers and key residential projects in Manhattan

Leading developers and signature projects anchor Manhattan’s market. Notable developers include Related Companies (Hudson Yards), Extell Development (One57, Central Park Tower), Tishman Speyer, Silverstein Properties and Vornado Realty Trust. Signature projects that define the skyline and set pricing benchmarks:

- Hudson Yards (Related & Oxford): large-scale mixed-use with public spaces and transit connections

- One57 and Central Park Tower (Extell): super-prime residential towers along Billionaires’ Row

- 432 Park Avenue: high-profile supertall with distinctive floorplates

- 220 Central Park South: trophy condominium targeting ultra-high-net-worth buyers

Project features vary: some emphasize full-service amenities and private outdoor space, others focus on location and views. Developer reputations are critical when considering new build property in Manhattan and off-plan property in Manhattan; buyers should review completion records, construction warranties and escrow handling.

Project/developer bullet list:

- Related Companies — Hudson Yards, mixed-use megaproject

- Extell Development — One57, Central Park Tower (super-prime)

- Tishman Speyer — high-quality office/residential developments

- Silverstein Properties — World Trade Center area development

🧾 Mortgage, financing, and installment options for property in Manhattan

Financing conditions differ for residents and foreign buyers. Domestic buyers commonly secure mortgages with 20% down, while foreign nationals should expect 30–40% down or lower LTV from some lenders. Bank underwriting considers credit history, income documentation, and debt-to-income ratios; non-resident loans may require additional reserves. Developer installment plans are available on select new developments, typically structured as staged deposits (e.g., 10–20% at contract, incremental payments, balance at closing).

Buy property in Manhattan with mortgage is feasible but often requires pre-approval and coordination with U.S. or international banks. Typical financing points:

- Down payment / deposit expectations: 20–40% depending on buyer status and property type

- Mortgage documentation: income verification, tax returns, bank statements, passport/ITIN

- Installment options: developer deposit schedules for new build property in Manhattan; some sellers offer short-term seller financing on resale property in Manhattan

Lenders may require title insurance and escrow accounts for taxes and insurance. For buyers prioritizing cash flow, comparing financing options and expected carrying costs (property tax, maintenance, HOA/co-op fees) is essential to calculate ROI and rental yield.

🧭 Property purchase process in Manhattan

Buying property in Manhattan follows a formal sequence: search and offer, attorney review of the contract, contract signing with deposit, due diligence and mortgage commitment, and closing with transfer of title and recording. Foreign buyers often engage a local attorney early to handle escrow, title, and tax withholding concerns. Typical payment methods are wire transfers and bank-certified funds for deposits and closing.

Key procedural steps:

- Offer and acceptance: attorney review and deposit (often 5–10% at contract)

- Inspections and due diligence: building financials, co-op board questionnaires (if applicable), condo offering plans

- Closing: transfer via title company, payment of closing costs, recording of deed

Timing may vary: closings on resale property in Manhattan commonly occur within 30–60 days, while new developments or off-plan purchases follow developer timelines and construction completion schedules. Buyers should plan for additional closing costs: NYC transfer taxes, mansion tax on purchases above $1M, and attorney/title fees.

⚖️ Legal aspects and residence options for property in Manhattan

Foreigners can hold property outright in Manhattan — there are no nationality-based ownership restrictions — but ownership does not automatically confer residency or work authorization. U.S. immigration pathways such as the EB-5 investor program exist but require significant capital and meeting job-creation criteria; buying residential property alone does not provide a residence permit. Tax considerations include local property tax, NYC and state transfer taxes, and potential capital gains tax on sale for non-resident aliens, with FIRPTA rules applying to certain transactions.

Legal and tax points:

- Ownership: foreigners may own freehold property without limitation

- Taxes: NYC transfer tax, State transfer tax, property tax, mansion tax on sales over $1M

- Immigration: no automatic residence permit; separate immigration channels (e.g., EB-5) have distinct requirements

Engaging a local real estate attorney and tax advisor early helps structure transactions, optimize tax exposure, and ensure compliance with reporting and withholding for international sellers and buyers.

📊 Property use cases and investment strategies in Manhattan

Manhattan accommodates a variety of ownership strategies depending on return expectations and lifestyle goals. For permanent residence, neighborhoods with family amenities like Upper West Side and Upper East Side and condos near top schools are suitable. For long-term rental income, Midtown South, Chelsea and Financial District attract professionals and offer stable leasing demand. For short-term rental strategies, buyers often target neighborhoods with tourist demand (subject to NYC short-term rental regulations), such as Chelsea and Midtown, but must comply with strict local laws.

Investment property in Manhattan and real estate investment in Manhattan strategies:

- Buy-and-hold for capital appreciation: prime trophy assets in Midtown, Tribeca, and Billionaires’ Row

- Long-term rental yield: Upper West Side, Midtown South, Financial District

- Value-add/resale: townhouse renovations or condo re-sales in emerging micro-markets

- New-build vs resale: off-plan property in Manhattan can offer early pricing advantages; resale property in Manhattan provides immediate income potential

Specific recommendations by use case:

- Permanent residence: Upper West Side (family-oriented condos/co-ops)

- Long-term rental: Midtown South, Chelsea (one- to two-bedrooms)

- Short-term rentals: cautious consideration of regulations; Battery Park City and select areas near tourist hubs

- Luxury lifestyle purchase: Tribeca, SoHo, Central Park-facing condos

Manhattan remains a highly liquid, globally recognized market where buyers—from private individuals to institutional investors—find opportunities across price bands and product types, provided they match neighborhood, financing and regulatory considerations to their intended use and time horizon.

Frequently Asked Questions

Manhattan price bands vary widely by building and area. Typical resale ranges: studios $400K–$800K, 1BR $600K–$1.5M, 2BR $1M–$3M; trophy/luxury units often sell for $5M+. Price per sq ft commonly ranges $1,200–$3,000 depending on neighborhood and building class. Co-ops often trade lower than condos but add board approval complexity.

Yes — there are no citizenship restrictions on owning property in Manhattan. Non-resident buyers often face higher financing requirements (common down payments 30%–50%), need an ITIN or tax ID for transactions, and should expect enhanced bank due diligence and wire documentation. Purchase does not grant residency or visa rights.

Manhattan offers strong liquidity and year-round rental demand but lower yields than many markets. Typical gross rental yields in core areas are ~2%–4%; outer neighborhoods can reach 4%–6%. Cap rates commonly sit around 3%–5%. Seasonality: leasing picks up in spring/early summer. Expect high turnover in renter-heavy districts and fast resale market for well-located assets.

Timelines vary: resale condo closings commonly 30–60 days from contract; mortgage approval 30–45 days; co-op purchases add board review, often 4–12 weeks for approval. Off-plan or new-build closings follow scheduled completion and can be 12–36+ months. Typical buyer closing costs run roughly 2%–5% of purchase price (excluding mortgage points and ongoing taxes/maintenance).

Top rental areas by demand: Midtown/FiDi for corporate and short-commute renters; Upper East/West Sides for families and long-term tenants; Chelsea/West Village for lifestyle and high nightly rates; Harlem and Inwood for value and yield growth. Typical market rents: studios $2K–3.5K, 1BR $2.5K–4.5K, 2BR $4K–8K monthly, varying by neighborhood and finish.

Short-term rentals under 30 days are heavily restricted in New York City unless the owner is present and the building allows it. Many platforms and listings are subject to enforcement; fines and penalties apply for illegal short stays. Owners should verify local rules, building bylaws, and occupancy limits before advertising short-term rentals.

Yes — Manhattan has excellent digital infrastructure (widespread fiber and 5G), many quiet residential pockets, cafes, and abundant coworking options. Broadband speeds commonly exceed 100–200+ Mbps in most buildings. High rents and smaller apartment sizes may influence workspace choices; long stays require appropriate visas or residency arrangements for foreign nationals.

Off-plan (presale) can offer lower entry prices or choice units but carries risks: construction delays, market fluctuation, and developer insolvency. Typical deposit structures are staged (e.g., 10% at contract then additional payments). Protections include escrowed deposits, clear contract contingencies, attorney review of offering plans, and verifying completion/occupancy procedures.

Buyers face transfer taxes and closing costs: New York State transfer tax (≈0.4% of price) plus NYC transfer tax (residential: ~1% for ≤$500K; higher bracket for amounts above that). Sales over $1M incur the NY "mansion" tax (~1%). Typical buyer closing costs are 2%–4% of price; annual property taxes for condos often equal roughly 0.7%–1.2% of market value (varies by property class).

Check public records for prior project completions, review the offering plan or condo documents, confirm escrow arrangements for deposits, and request proof of permits and builder insurance. Have an independent attorney review contracts, get third-party construction/financial reports if available, verify certificate of occupancy history for past projects, and examine HOA/condo budgets for realistic operating cost assumptions.

Property by cities

- Real estate in New York (124)

Properties by Region

Services in Manhattan

Properties by Country

- Real estate in Bulgaria (11408)

- Real estate in Montenegro (5186)

- Real estate in Indonesia (2423)

- Real estate in Spain (2289)

- Real estate in Portugal (1975)

- Real estate in Italy (1921)

- Real estate in Turkey (1699)

- Real estate in Cyprus (1566)

- Real estate in Thailand (1565)

- Real estate in Croatia (1431)

- Real estate in Greece (1082)

- Real estate in USA (1013)

- Real estate in France (1006)

- Real estate in Georgia (519)

- Real estate in Serbia (329)

- Real estate in Slovenia (123)

- Real estate in Egypt (23)

Get the advice of a real estate expert in Manhattan — within 1 hour

Looking for a property in Manhattan? Leave a request — we will help you take into account all the nuances, and we will offer objects according to your personal request.

Maria Guven

Head of Direct Sales Department

+90-507-705-8082