Prospects for real estate investment in Ireland

- Investing in real estate in Ireland

- Investing in real estate in Dublin: how to choose the right property for rental

Ireland: Investment Prospects in Real Estate

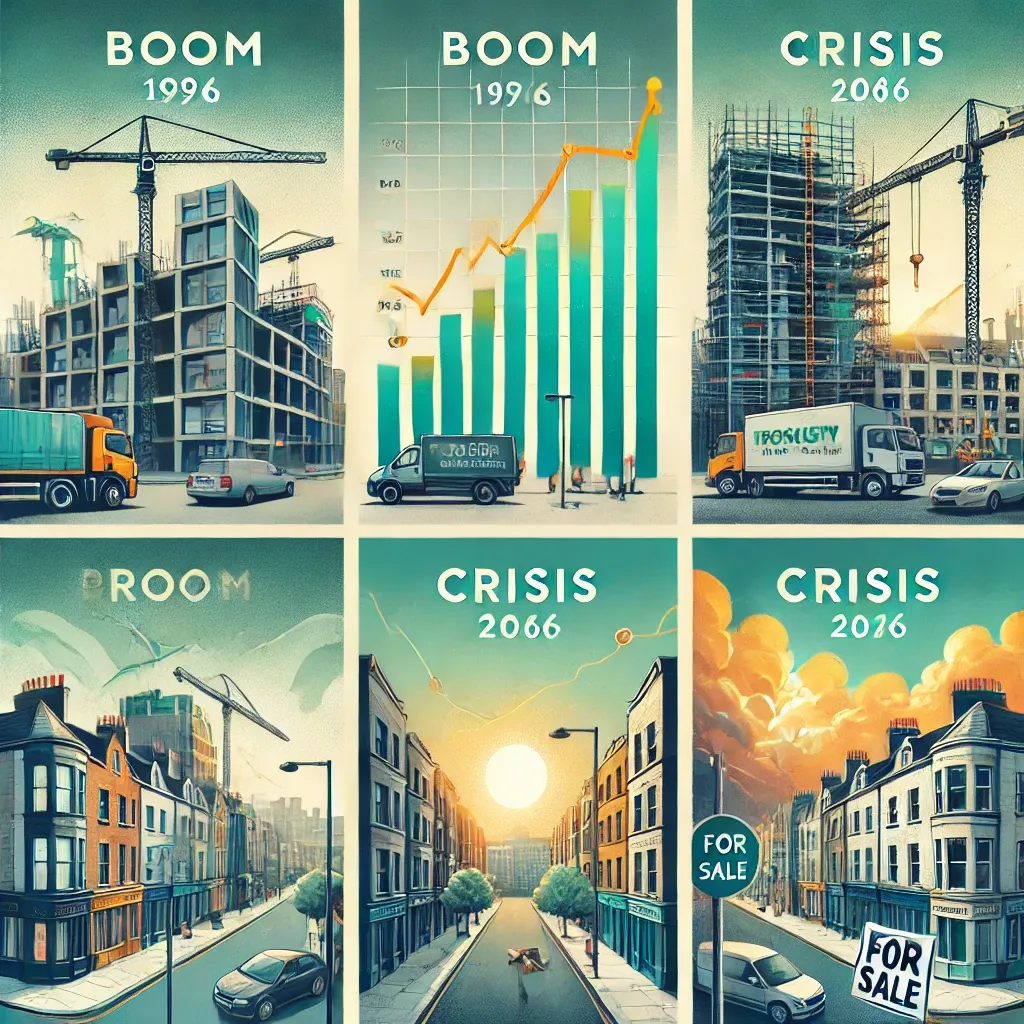

Over the past ten years, Ireland has had significant growth in real estate from 1996 to 2006. House prices rose by up to 20% annually, especially in popular areas of Dublin. But, as in other countries, Ireland's real estate boom has long since ended. The economic downturn led to increased unemployment, a collapse in securities and investigations into financial fraud related to Anglo Irish Bank mortgage programs, which undermined confidence in the financial system.

Crisis budget and protests

In response to the crisis in April, the Irish government implemented a crisis budget to stabilize the financial sector, which sparked a wave of protests from trade unions. In an uncertain environment, investing in Irish real estate may seem risky, but the drop in prices after a period of growth makes such investments appealing.

Low housing prices

Experts note that for investors with available funds is the moment to buy real estate. Ken MacDonald of Hooke & MacDonald, which specializes in the sale of new buildings, notes that house prices in Ireland with a favorable location on average 40% lower than in Britain. "Standard house prices in Ireland range from €118,000 to €328,000 per property. Dublin's real estate market bodes well, outperforming some other European capitals."

Essential considerations when investing in real estate

In addition to Dublin, Ken Macdonald recommends that investors pay attention to areas with developed transport infrastructure near business centers. He believes that the most promising investments can be made in cities such as Dublin in the east, Galway in the west, and Cork in the south of Ireland. "In Dublin, there is significant investment potential in properties in the city center, including the Docklands area, as well as along the DART and LUAS lines, such as Dublin 4, Stillorgan, Sandyford, Rialto, Drumcondra, and Sentry."

Investing in real estate in Ireland

Thus, Ireland remains attractive to investors due to falling prices and the prospects for urban development, despite last year's crisis in the real estate market.

It is important to take into account the demand of potential tenants when deciding to invest in real estate for future rent. According to experts, two-bedroom apartments and three-bedroom houses are in the highest demand.

According to expert Ken Macdonald's forecasts, two-bedroom apartments in a good area of Dublin can bring in between 1200 and 1500 euros per month, while one-bedroom apartments can yield between 1000 and 1100 euros monthly. It is recommended to avoid densely built-up areas in western Dublin, where infrastructure and public transport are poorly developed. An exception is the area around the Royal Canal, which is close to the city center and has easy access to Pearse Station for the DART train.

Prices for luxury real estate in Ireland have become more affordable, dropping by a third compared to the peak in 2006. An example is a three-bedroom house on Mountpleasant Avenue, which can now be purchased for 1 million euros, significantly lower than two years ago. However, expensive properties do not always guarantee high rental income, unlike apartments and smaller houses.

Among the elite areas, where property prices have also fallen, include Ballsbridge, Donnybrook, Rathmines and part of the city near the South Circular Road. CEO of real estate agency Sherry Fitzgerald, Michael Gran, notes that the future recovery of the Irish real estate market is due to the interest of buyers from the UK. Britons, traditionally interested in buying vacation homes in Ireland, could be the engine of the market's recovery, especially given the decline in real estate prices.

Conclusions

Over the past ten years, Ireland has experienced an astonishing surge in real estate market activity. Prices were rising by up to 20% each year, but today, following a decline in economic activity, they have decreased, and the financial situation has stabilized thanks to the crisis budget approved by the Irish government in April.

For those looking for promising real estate investments, it is worth paying attention to properties located in the center of Dublin, near major business centers and infrastructure facilities. Two-bedroom apartments and three-bedroom houses are in the highest demand among tenants and can bring their owners an income of 1,000 to 1,500 euros per month.

More expensive real estate will only pay off through resale, but there are great opportunities to make a very profitable deal when buying. Besides Dublin, investors should also pay attention to major cities like Galway and Cork, where properties are purchased for less than in Britain.

Ken MacDonald from Hooke & MacDonald is confident that investors who have the full amount on hand can make a profitable deal and achieve stable returns on their investments.

Comment

Popular Posts

9 October 2024

1485

29 September

384

Popular Offers

Subscribe to the newsletter from Hatamatata.com!

Subscribe to the newsletter from Hatamatata.com!

I agree to the processing of personal data and confidentiality rules of Hatamatata