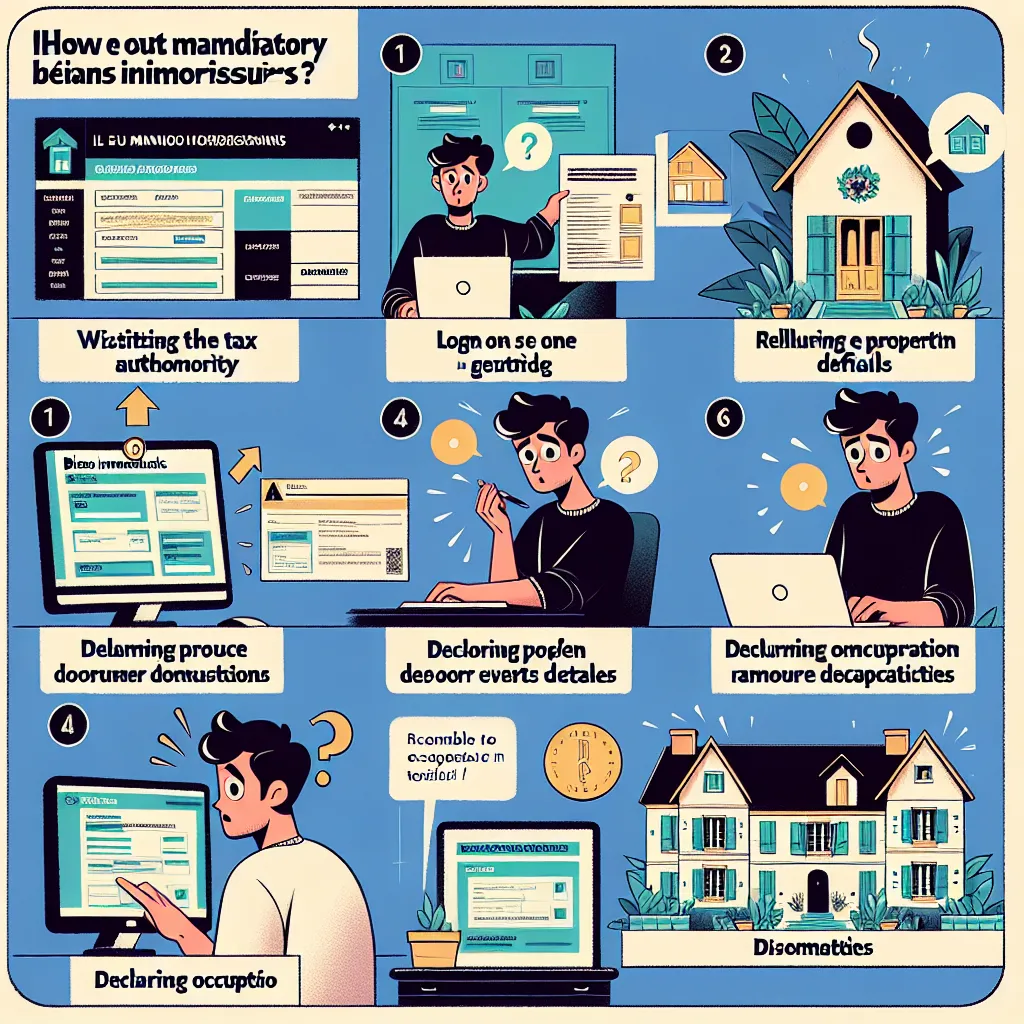

Updated guide to completing the French ownership form (with photos)

More than 34 million property owners have to submit information by June 30, 2023. If you own a property in France, you will have to fill in a form. French tax authorities have received around 150,000 calls from people in different regions of France asking how to do this. The Connexion has updated its basic step-by-step guide to filling out the form to include screenshots. We've also published a few other articles that you may find useful.

Step by step:

- Step 1: Go to impots.gouv.fr/accueil and click "Your personal account" in the upper right corner of the website. Note that there is a link at the bottom to use the process in English.

- If you are'. 'property owner through SCI, you will need to click on "Your Professional Office" and then "Procedures" and then "Manage My Property". In this guide, we will go over how to fill out the individual property owner form found in "Your Personal Office" as shown here.

- Step 2: Log into your personal account using your tax registration number and password. If you don't have a tax registration number, read our guide here.

- Step 3: Click on the "Real Estate" section at the top of the page.

- Step 4: This page will show a list of your properties known to the taxing authorities. For most people, this will only be one property. Click the 'View' button' 'to view the information the taxing authorities have about your property.

- Step 5: Click 'Declaration of Use' to begin completing the declaration.

- Step 6: Check to make sure the data is displaying correctly.

14 May 2025

14 May 2025

Some other useful'. 'tips:

- It is possible to complete the form over the phone by calling the tax authorities on 0809 401 401, however this is only possible when calling from France.

- You can find FAQs and a user guide in English from the tax authorities on the website.

- The paper version is not offered and the declaration must be completed online or by phone.

- Although the deadline to complete the form is June 30, 2023, leniency is expected this year.

Have something to say about this? Have you filled out the form or are you still struggling? Is there anything preventing you from submitting the declaration? If you are a non-resident and are having problems completing the form, please let us know at' 'news@connexionfrance.com.

Comment

Popular Posts

Popular Offers

Subscribe to the newsletter from Hatamatata.com!

Subscribe to the newsletter from Hatamatata.com!

I agree to the processing of personal data and confidentiality rules of Hatamatata