Moving towards an energy transformation: Legrand, The Invisible and Ambitious Leader.

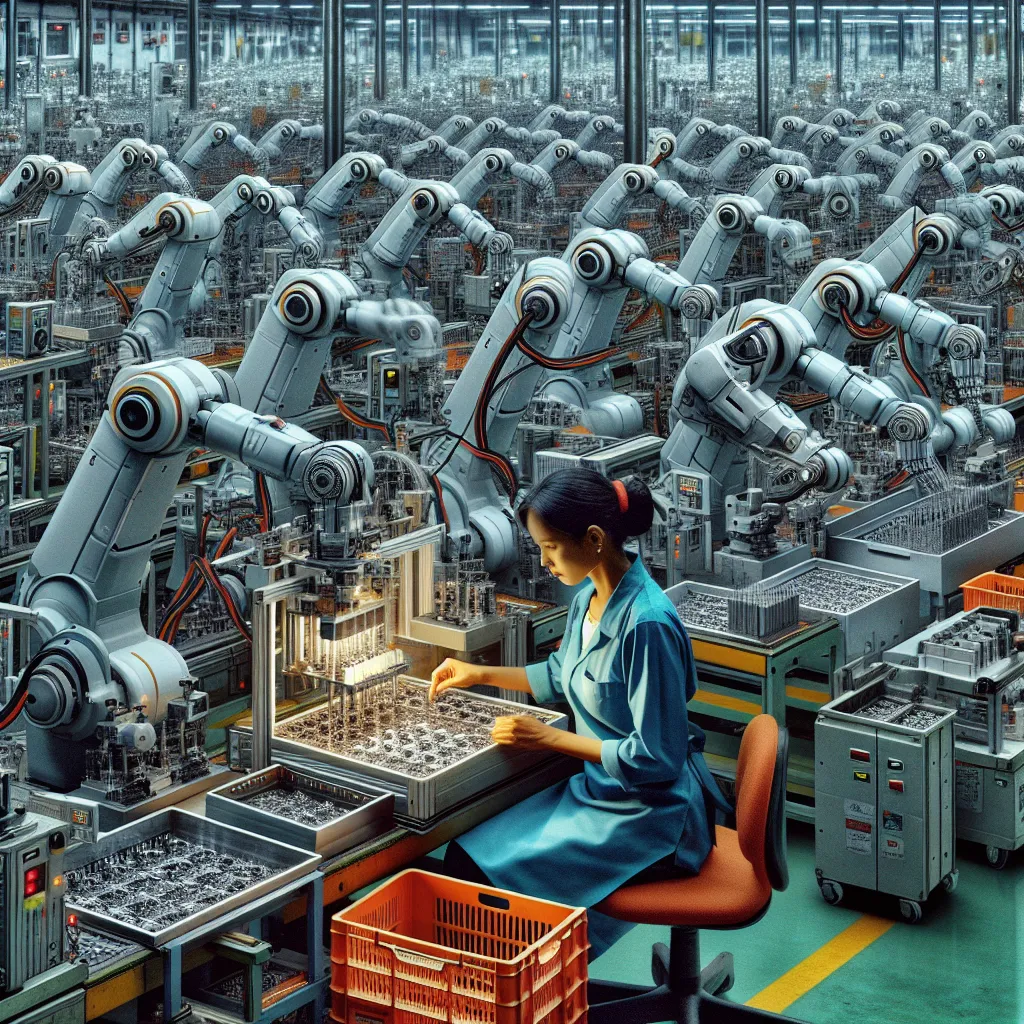

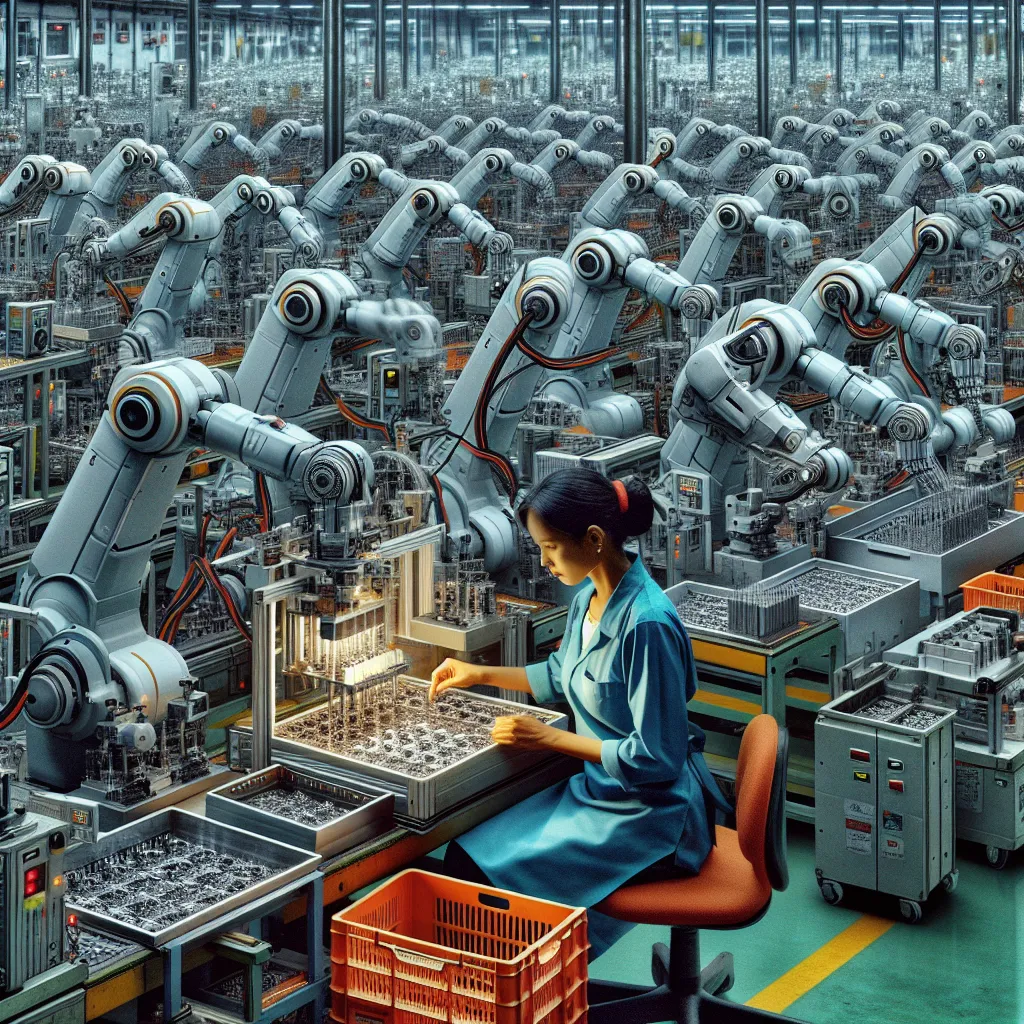

In a noisy factory, machines sort thousands of parts in an organized fashion, which they then spit out in drips. The task of the neighboring robots is to assemble these parts. The only human presence is an operator watching this strangest ballet in silence. At the end of the line, she packs each product for its shipment, repeating this choreography an infinite number of times. This triple ensemble is capable of producing one switch per second. Such a frenzied rhythm, which allows Legrand to strengthen its leading role in the global electrical market every year.... But it does it rather discreetly.

Since its panels, sockets and thermostats, as well as other electrical devices, are distributed in 180 countries, the group,''located in Limoges (Haute-Vienne), remains little known to the public. But that doesn't embarrass this aged porcelain manufacturer, which switched to electrical equipment in the 1950s. "The pivot was undertaken long before the startup era with the motto: 'Take a position on niche products that are considered critical by our customers [note: distributors, installers, etc.] and provide opportunities for innovation,'" says Legrand CEO Benoit Kocar.

Since joining the Legrand group at the age of 22, this Toulouse lad has followed the example of many of his 38,000 colleagues around the world: he has never left.

Taken over in 2018, he sees this niche strategy as a 'natural barrier' to Chinese competitors who,''in his opinion, are unwilling to produce thousands of product variations to meet electrical codes that differ from country to country. And he is right. With its 300,000 items, Legrand sees its turnover exceed €8 billion in 2022. The group, which has subsidiaries in 90 countries including India and China, makes the bulk of its sales in Central and North America as well as Europe. Year after year, it has posted high operating margins that range between 19 and 20 percent.

Without feeling the impact of Covid, the company is weathering a crisis that is heating up in real estate as well as inflation. Except when its unions put up a united front at the beginning of the year, demanding wage increases commensurate with the index''consumer prices. This is quite rare for a group whose one-quarter of global production is accounted for by 5,000 French employees. Although the group went through a wave of closures at the turn of the century, France is still home to 20 of its 120 plants worldwide... Proof that it is possible to produce more than just premium products in France. "One third of the cost of production is the cost of raw materials. To be competitive in our industry, it is important to buy well," justifies Benoit Kocar. Defying fierce competition in this market, the Limoges-based group has entered the charging market''stations for electric vehicles.This is the advantage Legrand is putting at stake to secure a firm place in the energy transformation thanks to its extensive offering.

It seems that this appeal has resonated at the very top of the state. In its new energy reduction plan, the executive branch has decided to subsidize the purchase of such devices. But Legrand believes that the Ministry of Housing's enhanced program is insufficient because it believes that''connected thermostats must be accounted for in Diagnostic Performance Evaluations (DPEs). However, tenants and landlords must be prepared to use them.... This is why the government is resisting their inclusion in the same plan as insulation and boiler replacement work, which are clearly costly but apparently immune to human failure.

But whether the position is favorable or not, Legrand remains confident that it has an open door thanks to the electrification of processes and the need to reduce energy consumption. "In the medium term, energy efficiency, data centers and the connected home will account for 50% of our activities, up from the current 33%," predicts''Benoît Kocar, without giving an exact date. To realize its predictions, Legrand buys competencies. In large numbers. Five years ago, this international group acquired the French start-up company Netatmo to consolidate itself in the software sector. In Brazil, it acquired a company specializing in low voltage for photovoltaic modules. Since 2010, Legrand says it has made more than 60 acquisitions totaling €5.6 billion. "We have already announced two deals this year. If others follow, it means we have not been successful in our work," jokes the head, who never spares a sharp word.

But such exuberant buying activity is not without its dangers. "Unless Legrand can accelerate synergies between different brands and''to optimize costs, it could lead to fragmentation. This could ultimately slow its growth', warns Alban Dubois, an energy, innovation and climate expert at Sia Partners' cabinet. That's the challenge facing the Legrand group, one of the smallest in the CAC 40, to move from shadow to light.

Comment

Popular Posts

Popular Offers

Subscribe to the newsletter from Hatamatata.com!

Subscribe to the newsletter from Hatamatata.com!

I agree to the processing of personal data and confidentiality rules of Hatamatata