Privatization: sale of state shares for 20 billion Strategies and debts - a 30-year journey

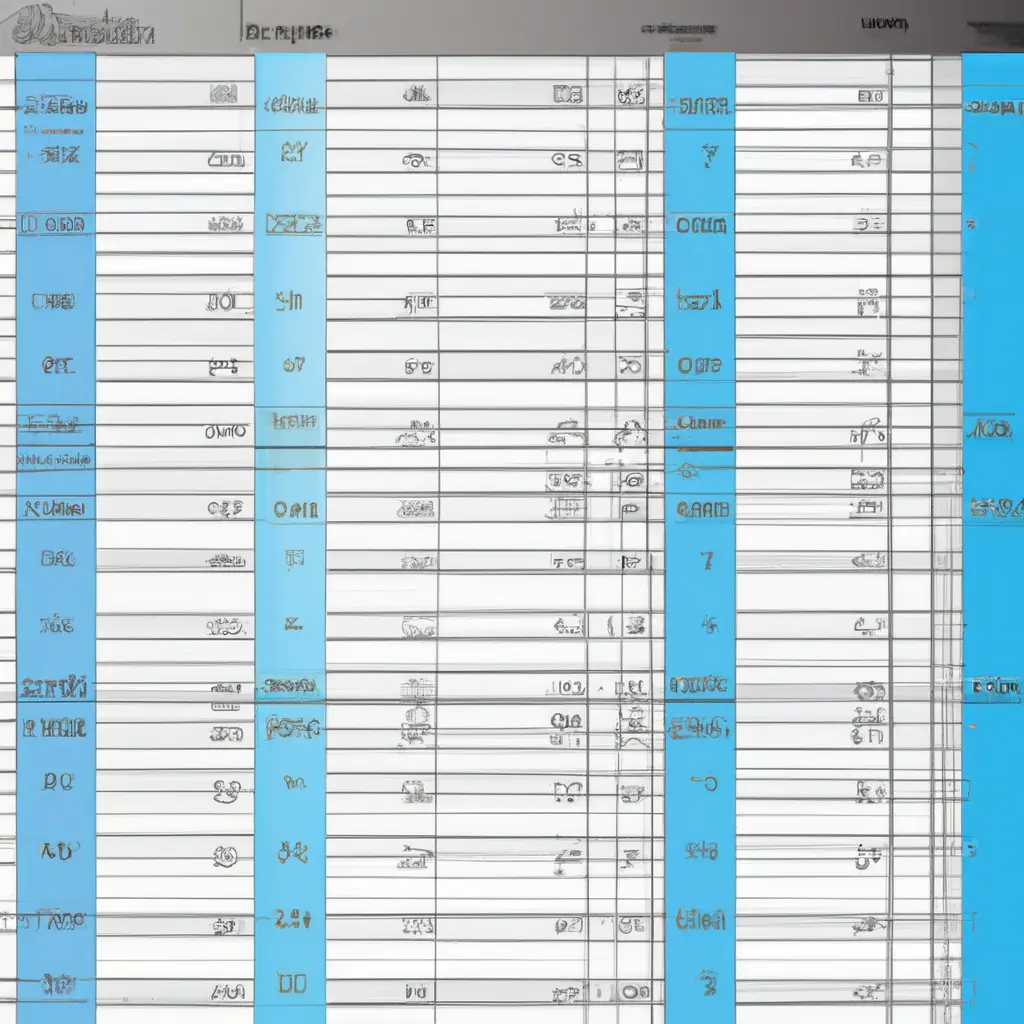

In contrast to previous governments that privatized public assets to reduce debt, the Meloni government is revisiting the practice. In the 1990s, privatizations became necessary because of the high level of indebtedness of state-owned companies and the government. The sale of state-owned enterprises raised about 200 billion euros over 15 years. Privatizations began in 1993 with the sale of Nuovo Pignone and Sme, followed by the record years of 1996 and 1997, when €9.3 billion and €19.6 billion worth of assets were sold, respectively. In 1998, 48.4 billion euros were raised, including the sale of significant stakes in Eni and Bnl.

Once the 2000s began, however, the situation changed.

14 May 2025

13 May 2025

In the following years, privatizations were less relevant and Monti's government sold 10 billion euros worth of assets in 2013 to avoid the infraction procedure. The Letta government failed to implement its privatization plans due to its short term in office. Renzi's government sold shares in Enel, RaiWay, Ansaldo Energia, Fincantieri, Cdp Reti and Enav. Gentiloni's government had planned to sell shares in Eni and Enav, but eventually abandoned the idea. The Conte I government planned to raise 18 billion euros, but got almost nothing. The Gualtieri government is focusing on real estate sales.

The Meloni government and Minister Giorghetti plan to privatize to the tune of 20 billion euros. However, the Financial Times doubts that they are willing to give up large state-owned companies. Perhaps they will focus on selling lighter assets such as the 41% stake in Ita Airways and the 64% stake in Monte dei Paschi. Nevertheless, it will be difficult to reach the €20 billion target in three years, given previous experience.

Comment

Popular Offers

Subscribe to the newsletter from Hatamatata.com!

Subscribe to the newsletter from Hatamatata.com!

I agree to the processing of personal data and confidentiality rules of Hatamatata