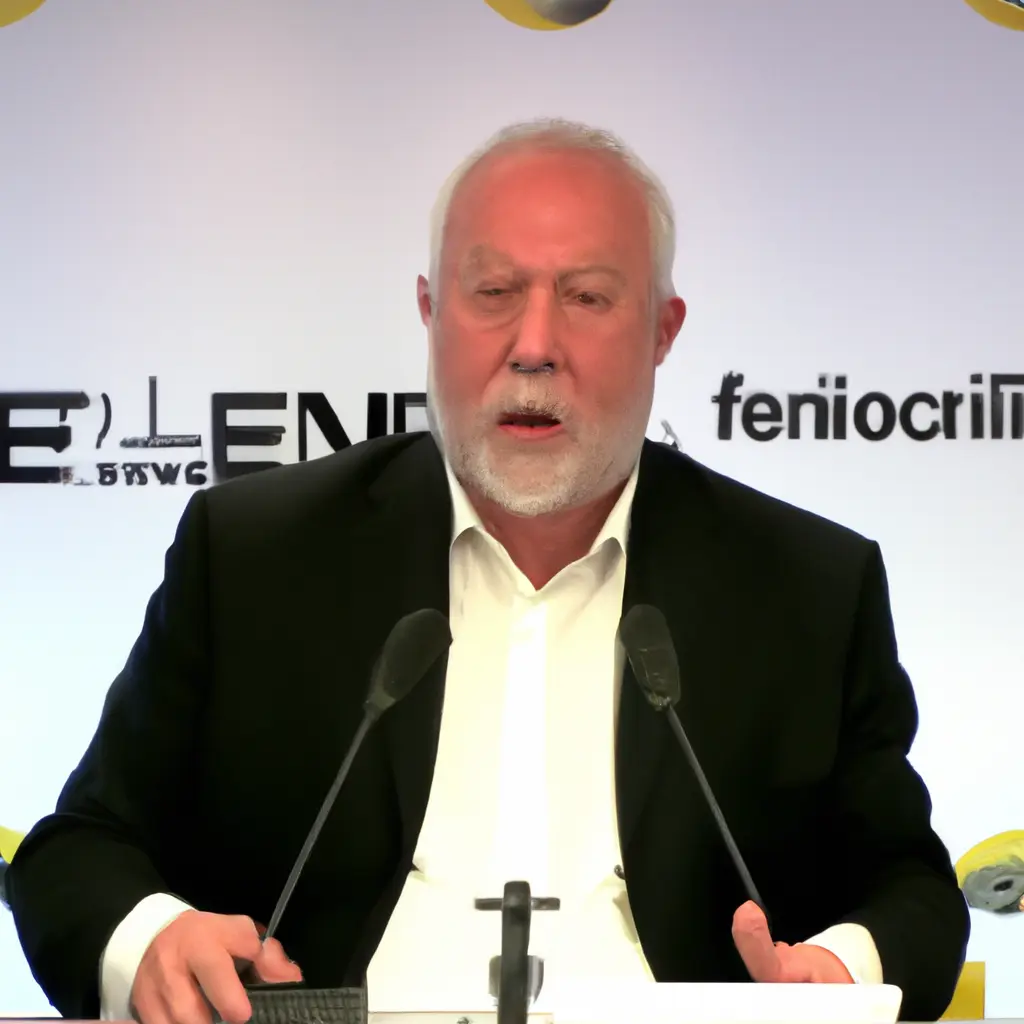

The decline in real estate prices: The President of Century 21 F believes it was time to adjust the market.

The president of the French company Century 21, Charles Marinakis, notes that alongside the decline in real estate prices, interest rates on loans have risen, reaching 3%, while a year ago they were around 1%.

On Monday, April 24, Charles Marinakis stated on French radio franceinfo that although real estate prices are declining, it is not necessarily "something dramatic." According to this real estate professional, "the time has come for the market to stabilize," especially considering that prices have risen "by 30% from January 1, 2019, to December 31, 2022." Charles Marinakis explains that "the turning point in the market was noticed in the summer of 2022 and became evident at the end of 2022, and 2023 is no exception."

The head of Nexity, Véronique Bédague, warns that the housing crisis conceals "a very serious social crisis."

At the national level, the average price decrease is around 6-7%, but "it is necessary for them to drop by 10-12% to align with the decline in affordability for families," believes the president of Century 21 France, Charles Marinakis. He notes that since last year there has been a "regionalization of prices." He points out that some regions have not been affected by the price drop, especially those that were relatively expensive before the successful years of 2020-2021, such as the French Riviera. He also mentions that "part of the west coast has been somewhat flooded with artificial supply that appeared on the market after Covid-19 and artificially raised prices."

Alongside the decline in real estate prices, interest rates on loans have risen, reaching 3%, while a year ago they were around 1%. This particularly affects "first-time buyers, whose affordability levels require attention from banks," according to Charles Marinakis. He also finds the "speed of interest rate changes" concerning.

If professionals have been warning about a crisis in the real estate sector for several years and believe that around 500,000 housing units need to be built annually over the next decade, Charles Marinakis regrets the "problem of land availability and the issue of the desire to increase building density." The head of Century 21 France also notes "a certain position of mayors, who were once considered respectable when they were builders, but are now seen as the bad guys." He rejects the idea of building according to a "coefficient" applicable to the entire territory and prefers that regions "adapt according to their level of housing pressure." "There are regions where we do not need housing, and other regions that are under pressure, and here we need to adopt the principle of density," he explains. Charles Marinakis specifically refers to "the latest report from the builders' federation, which states that there is a shortfall of 449,000 housing units every year for the next ten years."

A decrease in real estate prices in the market does not necessarily lead to a reduction in rental prices, according to Charles Marinakis, due to the "supply and demand problem." This "shortage of rental products" is the result, according to Charles Marinakis, of a "combination of unfavorable measures." "Today, renting has become a feat," he warns. If the "natural level of available housing is around 20-25%, it has now been halved," adds this real estate professional. This is explained by the fact that "people renting homes cannot find anything suitable to buy or re-rent, and if they do not leave, they do not free up housing." But Charles Marinakis also points to "thermal constraints": "In some of these residential properties, owners, lacking the financial or technical means for renovation, prefer to put them up for sale," he notes. He particularly condemns the "harshness and lack of consultation" in this fight against energy-inefficient homes, especially the obligations imposed on owners of properties with poor energy performance.

Comment

Popular Posts

Popular Offers

Subscribe to the newsletter from Hatamatata.com!

Subscribe to the newsletter from Hatamatata.com!

I agree to the processing of personal data and confidentiality rules of Hatamatata