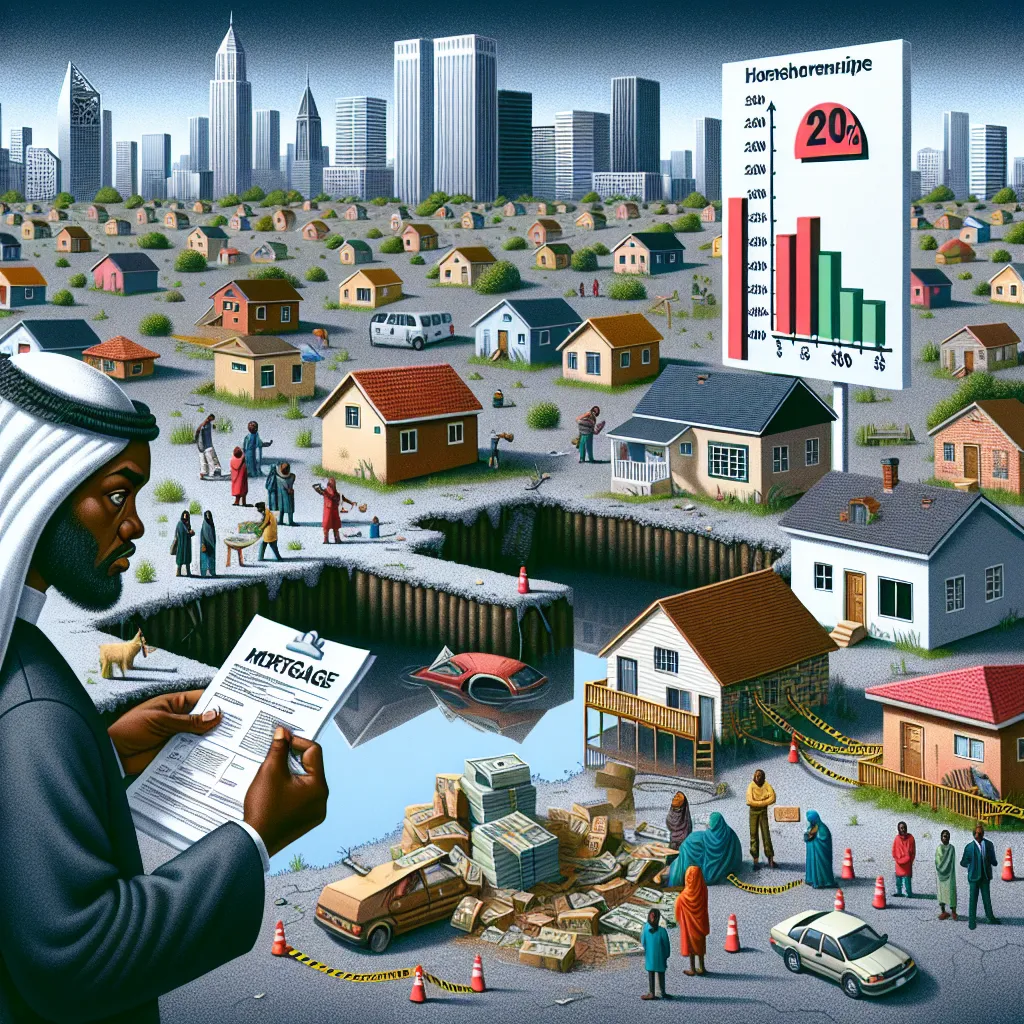

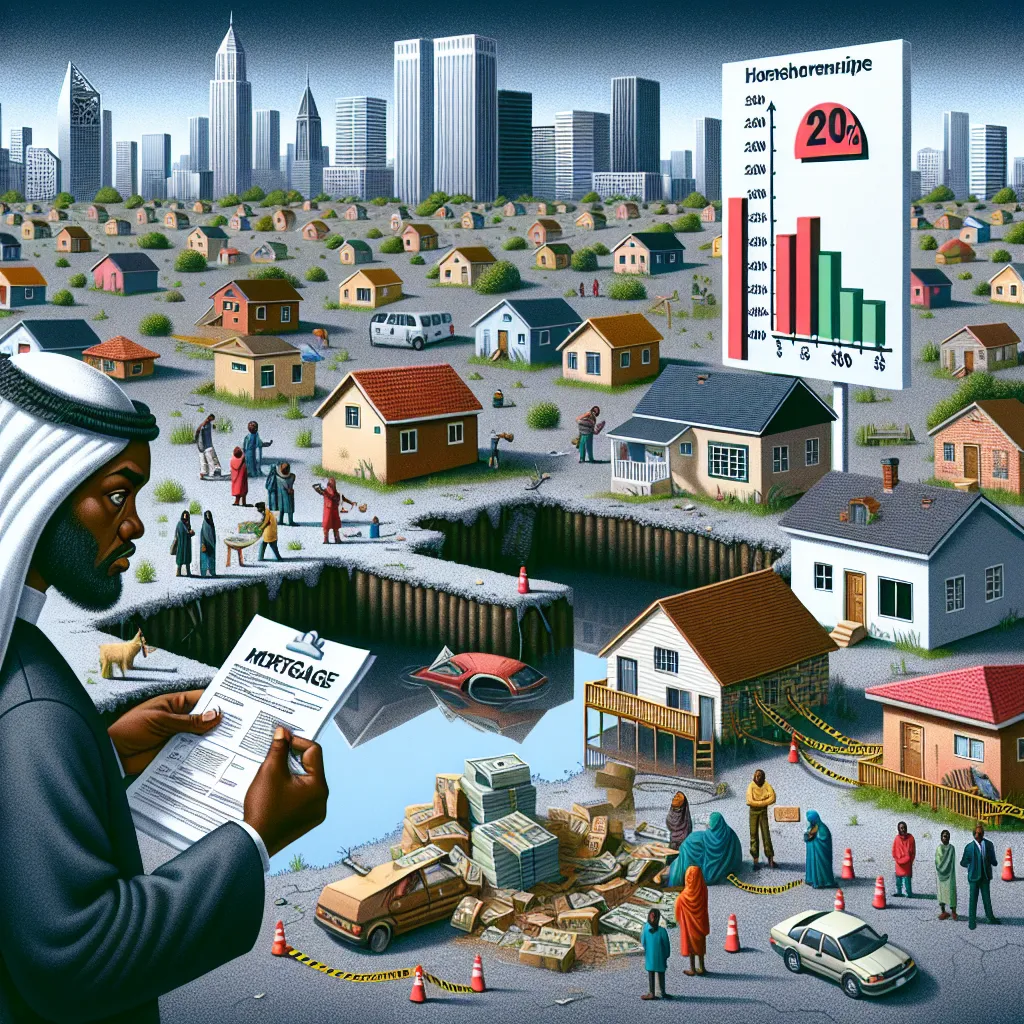

High mortgage costs and other factors are denying Nigerians access to housing.

The high cost of borrowing for home ownership in the mortgage loan market is a major reason why many Nigerians remain without their own homes, writes Josephine Ogundeji.

Operators in the construction sector have reported that Nigeria has only a 20 percent home ownership rate among a population of 223 million, which is far below the level in comparable countries. For example, South Africa with a population of 56 million boasts a home ownership rate of 67.7%.

In turn, even smaller countries such as the Republic of Benin with a population of 11.8 million (about half the population of Lagos) have a home ownership rate of 61%.''₦ trillion, while the real estate sector contributed an additional ₦ 7 trillion, leading to a total of ₦ 20 trillion added to GDP.

Further analysis of the report showed that the real estate sector witnessed a nominal growth rate of 9.13% for the period, surpassing the growth rate witnessed in the same period in 2021 by 0.50%. However, it was 3.68% lower than the previous quarter. The real estate sector's path to positive growth began in the last quarter of 2020, marking a recovery from six consecutive quarters of recession. This recovery followed the latest positive growth rate of 0.93% recorded in the first quarter of 2019.

Despite this positive trend, the housing segment of the sector still''struggling with a growing deficit of over 28 million housing units.

According to the latest data provided by the Nigerian Bureau of Statistics, the sector contributed a total of ₦8.33 trillion during the quarter, lower than the ₦9 trillion generated in the fourth quarter of 2022. The decline is attributed to the unfavorable impact of the cash crunch experienced during the quarter.

Analysis showed that the real growth rate of the construction sector declined by 1.56% year-on-year.

The Organization of Associations of Housing Corporations of Nigeria had earlier expressed concern over the low level of home ownership in the country and stated that Nigeria ranks last with 25% ownership rate compared to Brazil (74%), Kenya (75%), South Africa (70%) and''Indonesia (84%).

Speaking on the occasion of the 2023 International Day of the World Habitat for Humanity with the theme, "Forget no one and leave no one behind," the President of the Association of Housing Corporations in Nigeria, Dr.

1 May 2025

13 May 2025

He said: "Inapplicable mortgage lending systems that still largely depend on the complete sale of houses that are not affordable to people who really need them; lack of housing finance and other factors are some of the challenges facing the housing sector.

'Slow mortgage market without a dynamic platform that would provide ready access to affordable''mortgages as well as exit points for developers who have invested in housing and the wrong land administration that can offer acceptable terms and conditions to access proper and viable real estate transactions are undermining the sector,' he added.

Meanwhile, a real estate expert, Timothy Gbadeyan, said high interest rates and low wages are some of the major factors making it difficult for most Nigerians to access home mortgages.

He said: "Getting a mortgage in Nigeria at a rate of about 17% or in some rare cases 16% is very difficult. If a bank wants to give you 14 million ₦ and your salary is 120,000 ₦, for example, in a government''Osogbo Capital. Out of this 120,000 ₦ your mortgage payment should be no more than 40,000 ₦. What kind of home can you buy if 40,000 ₦ must service your principal with interest over a period of 10 years? Thus, commercial mortgages are out of the reach of the masses. "

Comment

Popular Posts

Popular Offers

Subscribe to the newsletter from Hatamatata.com!

Subscribe to the newsletter from Hatamatata.com!

I agree to the processing of personal data and confidentiality rules of Hatamatata