Flooding reduces the value of real estate in Italy by 60%.

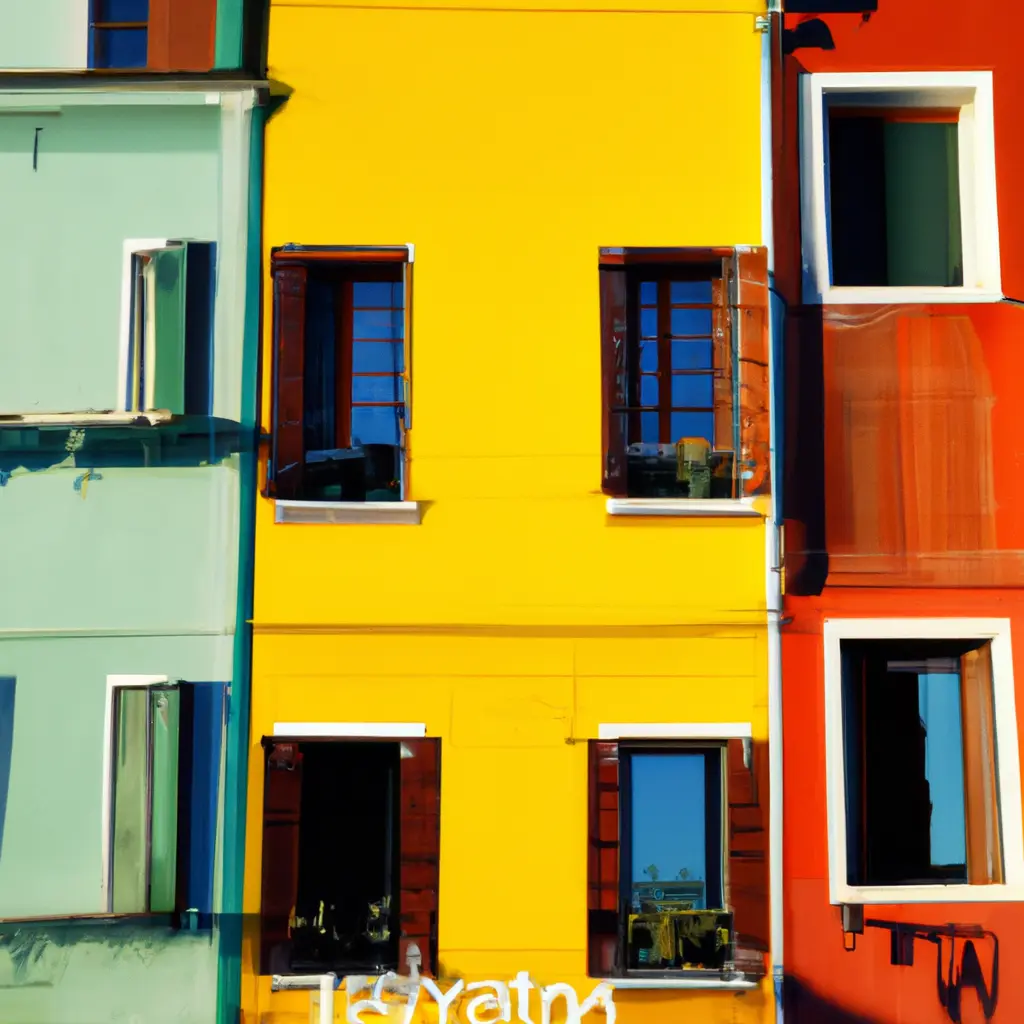

Italy continues the series of floods, landslides and storms that have hit many regions of the country in recent years. According to the Institute for Environmental Protection and Research (ISPRA), some 94% of Italian cities are at risk of destruction and more than 8 million people live in dangerous areas. Antonio Coviello, a researcher at the National Institute for Innovation and Services Research (CNR-IRISS), has compiled data showing that about 78% of residences in Italy are at high or medium high risk of flooding, river flooding and landslides. Coviello points out that the most vulnerable areas of Italy are northwestern Liguria and the Padana Plain, Piedmont, Tuscany, Emilia-Romagna and Veneto, but no region of Italy can be considered completely flood-proof.

This situation is alarming, especially considering that the value of residential real estate in Italy at risk of flooding is almost €1 trillion, according to the Bank of Italy. This translates into a significant drop in property values (up to 60% of the original value) in floods and an expected annual loss of €3 billion. The problem is compounded by the fact that residential homes account for half of the total net worth of Italian families, who still view real estate as a haven for investment and a source of permanent income through renting or selling. Therefore, the decline in housing values has a negative impact on the real wealth of Italians and is linked to both the crisis in the real estate market and possible environmental disasters.

In addition, the risk of meteorological, hydrological and hydrodynamic disasters is strongly influenced by human activities. As the Civil Protection Department points out in its communication, “population density, abandoned mountain areas, continuous deforestation, obscene agricultural practices and inadequate maintenance of slopes and riverbeds definitely aggravate the destruction”, increasing the vulnerability of an already fragile Italian territory to hazards. In such a context, reckless urbanization and massive violation of building regulations are also relevant, as evidenced by the latest data from the Institute of Statistics (Istat), which found violations of building regulations in Calabria and Basilicata (54%) and, in turn, in Campania (50%). This problem has regained public attention after the tragic flooding that occurred on the island of Ischia in November 2022, especially in the commune of Casamicciola Terme, where every second house was built without authorization in dangerous areas.

Therefore, the most appropriate solution for coping with the dangers of extreme events is to choose insurance that can cover all potential damages.

There are many ways to encourage Italians to show more interest in insurance, beyond the tax incentives already in place, such as the 19% tax rebate on the taxable base. There is also a need for sufficient insurance education. This is an issue in which Italy ranks among the last compared to other European countries, as our per capita insurance spending is less than a third of French or German spending, despite the great need. According to a study conducted by the Institute for Insurance Surveillance (IVASS), only 63% of Italians know the concept of “insurance premium” and less than 60% understand what a “deductible” is. This cultural gap should be the first priority for the Ministry for the Protection of Civil Security, headed by Nello Musumeci, which has been reinstated by the government after 21 years.

Tags

Comment

Popular Offers

Subscribe to the newsletter from Hatamatata.com!

Subscribe to the newsletter from Hatamatata.com!

I agree to the processing of personal data and confidentiality rules of Hatamatata