Real Estate in Baltimore

Real estate in Baltimore for living, investment and residence permit

- ✓ Verified properties directly from developers

- ✓ No overpayments or commissions

- ✓ Guarantee of transaction purity and post-purchase support

Our managers will help you choose a property

Liliya

International Real Estate Consultant

Need help choosing a property?

Leave a request and our manager will contact you.

Our managers will help you choose a property

Liliya

International Real Estate Consultant

Hot Deals

For Sale Real Estate in Baltimore

2 listings

Excellent 3 bedroom, 3 bathroom villa on Lake Santa Rosalia and resort (Torre-Pacheco, Murcia). This villa has 3 bedrooms, 3...

Submit Request

Real estate in Baltimore for living, investment and residence permit

- ✓ Verified properties directly from developers

- ✓ No overpayments or commissions

- ✓ Guarantee of transaction purity and post-purchase support

Our managers will help you choose a property

Liliya

International Real Estate Consultant

Beautiful huge villa with a stable and a small beauty salon, located in a quiet area, close to everything you...

Submit Request

Recommended to see

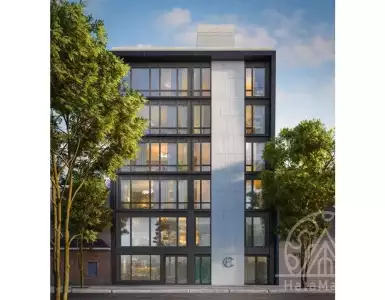

Maison Commonwealth is a boutique complex of 5 apartments, consisting of two combined brownstones and a brand new building overlooking...

Submit Request

Welcome to the embodiment of luxurious living in the heart of Brentwood. This luxurious building, The Dorothy-Granville, is a rare...

Submit Request

Located on Monument Square in a beautiful brick townhouse, this elegant three-story condominium offers two bedrooms and three bathrooms, as...

Submit Request

Located in the prestigious One Paraiso Edgewater complex in the heart of Miami, these exquisite 3-bedroom apartments embody luxury and...

Submit Request

Welcome to the home of your dreams in the heart of Gallery and Tanglewood district. This bright and open 3...

Submit Request

Beautiful oasis with 4 bedrooms and 3.5 baths in desirable Woodlake Forest IV. This bright and spacious home features gorgeous...

Submit Request

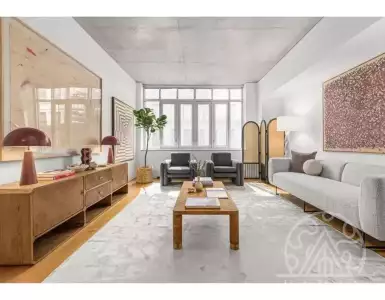

THE CONDOMINIUM, 246 WEST 17th STREET Superbly located in the endlessly thriving, always bustling, and perpetually coveted neighborhood of Chelsea,...

Submit Request

Well-maintained home in the northern part of Scottsdale on the Troon Monument golf course with beautiful views of Pinnacle Peak....

Submit Request

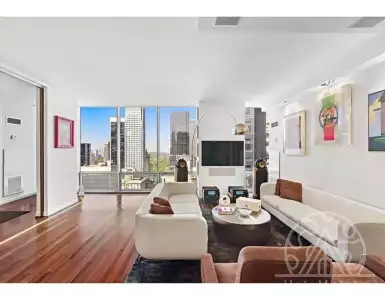

The iconic Olympic Tower building at 641 5th Ave, residence 31C, is one of the most sought after by celebrities,...

Submit Request

Introducing a new full-floor condominium that combines stunning interiors and a private outdoor space with the trendy lifestyle of Williamsburg....

Submit Request

This significant golf course lot, located in the highly sought-after Pinnacle Peak Country Club in North Scottsdale, overlooks the 11th...

Submit Request

Located on the beautiful street of Edgewood Drive, this colonial house boasts a huge lot and a swimming pool. Sun-drenched...

Submit Request

Real Estate in Baltimore

Real estate in Baltimore for living, investment and residence permit

- ✓ Verified properties directly from developers

- ✓ No overpayments or commissions

- ✓ Guarantee of transaction purity and post-purchase support

Our managers will help you choose a property

Liliya

International Real Estate Consultant

Need help choosing a property?

Leave a request and our manager will contact you.

Our managers will help you choose a property

Liliya

International Real Estate Consultant

Need help choosing real estate in Baltimore?

Leave a request and we will select the 3 best options for your budget

!

!

Other Properties for sale in Boston, USA 7 156 875 $

Maison Commonwealth is a boutique complex of 5 apartments, consisting of two combined brownstones and a brand new building overlooking...

!

!

For sale Flat in LA, USA 1 241 495 $

Welcome to the embodiment of luxurious living in the heart of Brentwood. This luxurious building, The Dorothy-Granville, is a rare...

🇺🇸 Baltimore, MD Real Estate: Rowhomes, Waterfront Condos, Historic Districts & Prices

Baltimore is a port city with a clear personality: a dense urban core, historic rowhouses, waterfront promenades, and strong anchors in healthcare and higher education. Buying property in Baltimore offers a mix of affordable entry points and premium waterfront opportunities, with neighborhood-level variation that matters for long-term returns and lifestyle. Whether you are looking to buy property in Baltimore as a private home, a rental investment, or part of a diversified portfolio, the city’s combination of steady rental demand, redevelopment corridors and a major seaport creates tangible opportunities.

🏙️ Baltimore city overview and lifestyle — property in Baltimore, what to expect

Baltimore sits on the Patapsco River at the head of the Chesapeake Bay and has a metropolitan area population that supports a broad housing market; the city itself has a population of around half a million to six hundred thousand residents, while the broader Baltimore–Washington corridor houses millions. The climate is humid subtropical with warm, humid summers and chilly winters, making waterfront living pleasant in spring and fall and drawing people to parks and bay beaches on weekends. The Inner Harbor and waterfront promenades remain focal points for tourism and lifestyle, while nearby Sandy Point State Park and Chesapeake Bay shoreline provide recreational beach and boating access within a short drive.

Baltimore’s character is defined by walkable historic neighborhoods, dense rowhouse blocks, and pockets of new-build mixed-use developments. Cultural life is strong — museums like the Walters and American Visionary Art Museum, the National Aquarium, and a lively food and craft-beer scene concentrated in Fells Point, Federal Hill and Hampden. The city offers more affordable alternatives to neighboring Washington DC and Philadelphia, with lifestyle trade-offs balanced by accessible waterfront, green spaces and a deep sense of local identity.

Buying property in Baltimore means evaluating micro-markets: waterfront condos and new developments attract buyers seeking premium amenities, while student and medical-professional rentals near Johns Hopkins and UMMC generate reliable cash flow. Market-savvy buyers and investors look at commute times, school districts, crime statistics by block, and planned public- and private-sector projects such as the Port Covington redevelopment when modeling ROI.

💶 Property prices in Baltimore — current market ranges and per-square-foot guidance

Prices for real estate in Baltimore vary widely by neighborhood, property type and building quality; average values in the city are well below many coastal metros but offer selective premium pockets. Typical price ranges by district are:

- Harbor East / Inner Harbor: $400,000 – $2,500,000 for waterfront condos and luxury units; average $350–$600 per sq ft.

- Federal Hill / Fells Point / Canton: $350,000 – $1,200,000 for historic rowhouses and modern townhouses; typical $300–$450 per sq ft.

- Locust Point / Silo Point: $250,000 – $1,000,000 for high-rise condos and single-family homes; $250–$450 per sq ft.

- Mount Vernon / Midtown: $200,000 – $900,000 for flats and brownstones; $200–$450 per sq ft.

- Roland Park / Mt Washington / Guilford: $400,000 – $1,500,000+ for larger single-family homes; $250–$500 per sq ft.

- South and East Baltimore (Curtis Bay, Brooklyn): $100,000 – $300,000 for lower-cost single-family homes and resales.

Price segmentation by property type:

- Condominiums (waterfront and downtown): mid-to-high range, premium per sq ft.

- Rowhouses and townhouses (historic neighborhoods): mid-range with steady demand.

- Detached single-family homes (suburban enclaves): higher price points in Roland Park and northern neighborhoods.

- Commercial and mixed-use units: strongly location-dependent; retail on waterfront commands premium rents.

Recent price dynamics show moderate appreciation with neighborhood-level outperformance near major projects such as Port Covington and Harbor East. Average price per square foot in desirable central neighborhoods commonly sits in the $300–$450 per sq ft band, while entry markets around the city can present $150–$250 per sq ft opportunities for investors seeking cash-flow properties.

🚏 Which district of Baltimore to choose for buying property — neighborhoods explained

Harbor East and the Inner Harbor are the city’s most polished waterfront districts offering luxury condos, hotels, fine dining and corporate offices, ideal for buyers seeking premium urban amenities and strong tourist appeal. These areas are popular with executives, empty-nesters and investors targeting upscale short-term rentals or long-term leases to professionals. Building density is mixed—high-rise towers alongside boutique mid-rise conversions—and safety and amenities are generally above the city average.

Federal Hill, Fells Point and Canton are historic, walkable neighborhoods with strong nightlife, restaurants and restored rowhouses that attract young professionals and investors targeting long-term and short-term rental demand. Proximity to downtown, easy harbor access and robust pedestrian infrastructure make these districts competitive and price-sensitive. Development intensity is focused on renovation and infill projects rather than large greenfield builds.

Roland Park, Guilford and Mount Washington are residential enclaves with tree-lined streets, larger lots and top private schools, appealing to families and buyers seeking single-family homes with higher privacy. These neighborhoods register higher price points and demonstrate steady, conservative appreciation. Neighborhoods near major medical centers—Charles Village, Bolton Hill and Waverly—are strong for student and medical-staff rentals due to proximity to Johns Hopkins and University of Maryland campuses.

🚗 Transport and connectivity in Baltimore — getting around and regional access

Baltimore offers multiple transport layers: the Baltimore/Washington International Thurgood Marshall Airport (BWI) lies roughly 10–15 miles from downtown and is typically a 15–30 minute drive depending on traffic; MARC Penn Line and Amtrak provide commuter rail to Washington, DC in about 35–50 minutes by train. Major highways serving the city include I‑95, I‑83 (Jones Falls Expressway), I‑695 (Baltimore Beltway) and I‑97 for southern connections.

Public transit options include the MTA Light RailLink, the Metro SubwayLink, extensive bus routes and commuter rail; Light Rail connects north–south corridors and links downtown with BWI via a transfer to MARC/Amtrak at Penn Station. Typical downtown commutes average 25–35 minutes, with peak congestion on I‑95 and key urban arterials; proximity to transit hubs like Penn Station and Harbor East improves both rental appeal and resale value.

For investors, connectivity to job centers is crucial: Johns Hopkins Hospital, University of Maryland Medical Center and Harbor East are all within 10–15 minutes from many central neighborhoods, while Port Covington redevelopment and new mixed‑use projects aim to improve intra-city access and create new employment nodes that shorten commute times for nearby residents.

🏥 Urban infrastructure and amenities in Baltimore — education, health, parks and leisure

Baltimore’s medical and academic infrastructure is a major asset for real estate demand, anchored by Johns Hopkins Hospital and Johns Hopkins University, University of Maryland Medical Center, and a cluster of research and biotech spin-offs that drive housing for professionals. Major hospitals and medical campuses create consistent rental pools and long-term employment stability around East Baltimore and the medical corridor. Top private schools and magnet public schools also shape family relocation decisions.

Parks and cultural amenities enrich quality of life: Druid Hill Park, Patterson Park, the Inner Harbor promenade, and waterfront green space attract outdoor activity year-round. Museums and cultural venues—The Walters Art Museum, American Visionary Art Museum, and the National Aquarium—support tourism and create recurrent short-term rental demand patterns. Retail centers such as Towson Town Center and neighborhood retail in Harbor East complement city-center shopping and services.

Transport-linked amenities include marinas and sailing clubs on the Chesapeake and Patapsco, state parks like Sandy Point for beaches and boating access, and a growing culinary and craft-beer scene concentrated in Fells Point, Federal Hill, and Hampden. Developers and municipalities often highlight proximity to these facilities when marketing new developments or resale properties.

📈 Economic environment and city development — drivers of real estate investment in Baltimore

Baltimore’s economy is anchored by healthcare, higher education, the Port of Baltimore and growing tech and logistics sectors; Johns Hopkins is the largest private employer and the port remains one of the busiest auto and cargo terminals on the East Coast. The presence of hospitals and universities supports stable employment and a steady rental market for medical professionals, students and research staff. Logistics and manufacturing tied to the port also underpin industrial and mixed-use real estate demand.

Major redevelopment initiatives, most notably Port Covington led by Sagamore Development, are reshaping the city’s waterfront and creating new office, residential and retail inventory that can drive long‑term capital appreciation. The city’s business districts—Harbor East, downtown and bio‑innovation corridors—are focusing on mixed-use growth, attracting private investment and institutional partnerships. Tourism adds cyclical but significant demand to waterfront hospitality and short-stay accommodations.

Economic indicators for real estate investors include persistent rental demand near hospitals and universities, moderate vacancy rates in stabilized neighborhoods, and municipal incentives in certain redevelopment zones. Careful neighborhood selection and attention to planned public investments are essential for maximizing return on investment in Baltimore real estate.

🏘️ Property formats and housing types available in Baltimore — new developments and resale

Baltimore’s housing stock combines historic rowhouses and brownstones, modern mid- and high-rise condominiums, townhouse infill and single-family detached homes in suburban-style neighborhoods. Rowhouses dominate central districts and offer a familiar format for both owner-occupiers and buy-to-let investors, with typical unit sizes ranging from 800–1,800 sq ft for classic two- to three-bedroom layouts. Condos and high-rise apartments downtown often offer 800–2,500 sq ft units with amenity packages.

New developments in Port Covington, Harbor East and select infill sites deliver new build property in Baltimore with contemporary finishes, structured parking and amenity floors; these projects typically market units by square footage and sometimes by off-plan reservation. Resale property in historic neighborhoods often requires renovation but benefits from character and stable tenant interest. Commercial units and mixed-use ground-floor retail are concentrated around the Inner Harbor and emerging mixed-use corridors.

Investors evaluating formats should weigh maintenance and HOA costs for condos versus potential renovation capex for resale rowhouses. Typical condo HOA fees in higher-end projects can range from $0.40–$1.00+ per sq ft per month depending on services, while maintenance and renovation budgets for brownstone conversions should be factored into yield calculations.

🏗️ Developers and key residential projects in Baltimore — who to know

Several established developers and contractors are active in Baltimore’s residential and mixed‑use sectors; notable names include Sagamore Development (Port Covington redevelopment), The Bozzuto Group (regional residential projects), Struever Bros. Eccles & Rouse (historic Harbor East revitalization) and Cordish Companies (entertainment-led mixed-use). These players shape large-scale waterfront and downtown projects and influence local supply pipelines. Wood Partners and other national multifamily developers also pursue infill apartment projects in transit-friendly corridors.

Representative projects and product types buyers will encounter include:

- Port Covington master-planned residential and mixed-use parcels (Sagamore Development).

- Harbor East condominium towers and boutique luxury conversions driven by private developers and institutional partners.

- Silo Point and Locust Point condo conversions and high-rise residential buildings near the waterfront.

Construction quality varies by developer and project scale; institutional developers typically deliver stronger warranties and more robust amenity programs, while smaller local firms often specialize in historic renovations and neighborhood-scale infill.

💳 Mortgage, financing and installment options for buying property in Baltimore

Foreign buyers can obtain mortgage financing in the United States, though lending criteria differ from domestic borrowers; typical conditions for non‑resident buyers include down payments of 20–30% or higher, loan terms up to 30 years, and underwriting that verifies foreign income or requires additional documentation. Major U.S. banks and regional lenders, as well as mortgage brokers, provide purchase financing; availability depends on borrower residency, credit profile and documentation such as passport, tax returns and possibly an ITIN.

Buyers should be aware of developer financing and installment plans primarily used on new developments or off‑plan property in large master-planned communities like Port Covington; seller or developer installment plans can reduce initial cash needs and are negotiated on a project-by-project basis. Typical mortgage structures include fixed-rate and adjustable-rate mortgages; non‑resident borrowers may face slightly higher interest premiums or limitations on conforming loan options.

Practical financing tips include arranging pre-approval with a lender experienced in international transactions, budgeting for closing costs (usually 2–5% of purchase price), and confirming whether lenders accept foreign credit history. Buyers interested in property in Baltimore with installment plan or property in Baltimore with mortgage should evaluate total financing costs, HOA obligations, and tax implications before committing.

🧾 Property purchase process in Baltimore — step-by-step for foreign buyers

Finding and securing property in Baltimore generally follows these steps:

- Engage a local real estate agent and solicitor to identify suitable listings, provide market comparables and draft offers.

- Submit an offer with earnest money deposit (commonly 1–3% of purchase price), negotiate terms and sign a purchase agreement subject to inspection and financing contingencies.

- Conduct inspections and appraisal, secure mortgage commitment if using financing, obtain title search and insurance, and schedule settlement/closing with a Maryland settlement agent or attorney.

Closing costs typically include lender fees, title insurance, recording fees and transfer taxes, which combined can be 2–5% of the sale price. Foreign buyers may need to obtain an ITIN for tax reporting and should be prepared for additional documentary requirements for mortgage underwriting. Common payment methods at closing are wire transfers through escrow accounts or certified funds; cash purchases are common for investors seeking speed and lower financing complexity.

⚖️ Legal aspects and residence options when you buy property in Baltimore

Foreign nationals can freely buy and hold property in the United States; no citizenship or local residency is required to purchase real estate in Baltimore. Buyers must register the deed at closing, pay local property taxes and comply with federal tax reporting for rental income. Annual property tax rates in Baltimore City are relatively high compared with some suburbs—expect property tax rates roughly in the 2% range of assessed value in the city and lower rates in Baltimore County (closer to 1–1.5% in many areas).

Purchasing property does not automatically confer immigration status or a residence permit; options for residence through investment are separate processes, such as business-based visas or federal investor programs that require substantial qualifying investment and job-creation metrics. Tax matters are important: rental income is taxable in the U.S. and foreign owners must obtain an ITIN and file returns; FIRPTA rules may apply on sale if the owner is a foreign seller, so buyers and sellers should consult tax counsel.

Title insurance, clear chain of title and professional closing services are standard; engaging local attorneys and experienced agents reduces legal risk and ensures compliance with Maryland recordation and transfer regulations.

💼 How property in Baltimore fits different buyer goals — use cases and strategies

Baltimore accommodates diverse strategies: buy-to-let investors, owner-occupiers, short-term rental operators and long-term capital-growth buyers. For each use case, district and property type matter:

- Long-term rental / stable cash flow: Charles Village, Hampden, areas near Johns Hopkins and UMMC; property types — multi-bedroom rowhouses and small multifamily buildings.

- Student and medical staff rentals: Remington, Keswick, Station North, Charles Village; property types — multi-bedroom units and duplexes close to campus.

- Short-term and premium holiday rentals: Inner Harbor, Harbor East, Fells Point; property types — waterfront condos and luxury one- to two-bedroom units.

- Capital-growth and new-development upside: Port Covington, Harbor East infill; property types — off-plan condos, mixed-use units and townhouses.

- Family primary residence and premium lifestyle: Roland Park, Guilford, Mount Washington; property types — detached single-family homes with yards and higher privacy.

Investors seeking investment property in Baltimore should model gross rental yield expectations (commonly 5–9% gross in stable neighborhoods), factor in vacancy, maintenance and HOA fees, and account for local management if not resident. Short-term rental strategies must observe local regulations and HOA restrictions, especially in condo buildings.

Baltimore’s mix of affordability, institutional employment and major redevelopment corridors creates tactical opportunities for both conservative income investors and buyers seeking appreciation tied to urban renewal projects.

Baltimore’s market rewards discipline: precise neighborhood selection, realistic underwriting of rents and renovation costs, and familiarity with local tax and legal requirements separate successful buyers from casual entrants. If you are considering how to buy property in Baltimore — whether as a home, an investment, or part of a wider portfolio — engaging local advisors, reviewing recent sales comps and factoring in proximity to hospitals, transit and redevelopment projects will help you target the right asset at the right price.

Frequently Asked Questions

Baltimore prices vary widely by type and neighborhood. Condos/inner‑city units typically range $150,000–$450,000; rowhouses and starter single‑family in many city neighborhoods $80,000–$300,000; higher‑end areas (Roland Park, Guilford, Inner Harbor condos) $350,000–$1,200,000+. Nearby suburbs (Towson, Owings Mills) commonly list $250,000–$550,000. Expect price gaps between investment corridors and historic/family neighborhoods.

Yes — non‑US citizens can buy and hold Baltimore real estate with no blanket ownership ban. Practicals: many lenders require 30–50% down for nonresidents and may charge higher rates; buyers need passport and often an ITIN for tax filings. Sales to foreign sellers are subject to FIRPTA withholding on disposition; nonresidents must file US tax returns on rental income and capital gains.

Baltimore offers clear investment niches: student/medical rentals (near Johns Hopkins), young‑professional areas (Canton, Federal Hill) and value buys in West/North Baltimore. Typical gross rental yields range roughly 5–10% citywide; some value neighborhoods can exceed that. Vacancy and turnover vary by area; liquidity is moderate compared with larger metro markets and seasonality is limited (not a resort market).

Typical timelines: cash closings can complete in 7–21 days; financed purchases usually close in 30–60 days. Standard escrow periods: inspection contingency 7–10 days, appraisal and underwriting 21–45 days. New‑build or off‑plan purchases can take 12–36 months for completion. Factor in time for title search, local permits, and HOA document review.

For families: Roland Park, Guilford — quieter streets, higher prices ($400k–$1M+). For young professionals/rentals: Canton, Federal Hill, Fell’s Point — condos and rowhomes ($250k–$700k). Student/medical rentals: Charles Village, Station North, areas near Johns Hopkins — strong tenant demand, lower entry prices ($120k–$350k). Value/opportunity: parts of West and East Baltimore with lower entry costs but higher rehab needs.

Short‑term rentals are regulated in Baltimore: hosts must register with the city, meet safety and zoning rules, and collect/transmit applicable lodging taxes. Certain residential zones and condo/HOA rules can restrict rentals. Expect local registration, inspections, and compliance with transient occupancy taxes and neighborhood limits; check the city registry and zoning before listing.

Baltimore is viable for remote workers: many central neighborhoods offer gigabit‑capable cable/fiber and average wired speeds commonly 100–1,000 Mbps in serviced areas. Cost of living and short‑term rental options are generally lower than nearby DC. There are co‑working spaces and cafés with reliable internet. Long stays require appropriate US visas; tourist/visa rules depend on your passport and US federal policy.

Expect multiple costs: Baltimore City property tax rates typically fall in the roughly 1.8%–2.5% range of assessed value (county rates differ). Buyer closing costs (title, recording, lender fees) commonly total 2%–5% of price; sellers often pay ~5%–6% commission. Transfers incur state and local transfer/recordation fees. Capital gains are taxed federally and at state level; foreign sellers face FIRPTA withholding rules.

Many Baltimore houses are historic — common risks include lead paint, outdated electrical/plumbing, deferred maintenance, and higher rehab costs. Expect inspection‑found repairs often ranging $5,000–$100,000+ depending on scope; structural, roof, or mold issues can be costly. Lenders or insurers may require remediation. Always order a full home inspection, specialized surveys (lead, termite), and get contractor estimates before closing.

Check permits, certificates of occupancy, warranty terms, escrow of deposits, and lien searches. Request project timelines and milestone payment schedules; typical construction delivery ranges 12–36 months. Verify past project completions, local building department records, and independent inspections at key milestones. Ensure contracts include completion deadlines, remedies for delays, and clear warranty/service obligations.

Properties by Region

Services in Baltimore

Properties by Country

- Real estate in Bulgaria (11408)

- Real estate in Montenegro (5186)

- Real estate in Indonesia (2423)

- Real estate in Spain (2289)

- Real estate in Portugal (1975)

- Real estate in Italy (1922)

- Real estate in Turkey (1699)

- Real estate in Cyprus (1571)

- Real estate in Thailand (1565)

- Real estate in Croatia (1431)

- Real estate in Greece (1082)

- Real estate in USA (1013)

- Real estate in France (1006)

- Real estate in Georgia (519)

- Real estate in Serbia (329)

- Real estate in Slovenia (123)

- Real estate in Egypt (23)

Get the advice of a real estate expert in Baltimore — within 1 hour

Looking for a property in Baltimore? Leave a request — we will help you take into account all the nuances, and we will offer objects according to your personal request.

Maria Guven

Head of Direct Sales Department

+90-507-705-8082