Real Estate in Kansas City

Real estate in Kansas City for living, investment and residence permit

- ✓ Verified properties directly from developers

- ✓ No overpayments or commissions

- ✓ Guarantee of transaction purity and post-purchase support

Our managers will help you choose a property

Liliya

International Real Estate Consultant

Need help choosing a property?

Leave a request and our manager will contact you.

Our managers will help you choose a property

Liliya

International Real Estate Consultant

Hot Deals

For Sale Real Estate in Kansas City

Recommended to see

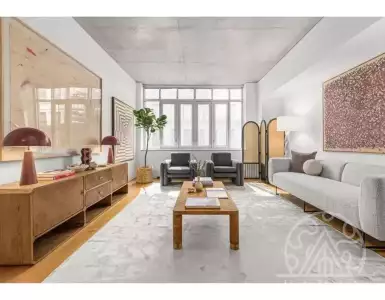

Maison Commonwealth is a boutique complex of 5 apartments, consisting of two combined brownstones and a brand new building overlooking...

Submit Request

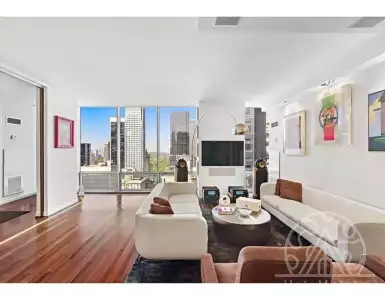

Welcome to the embodiment of luxurious living in the heart of Brentwood. This luxurious building, The Dorothy-Granville, is a rare...

Submit Request

Located on Monument Square in a beautiful brick townhouse, this elegant three-story condominium offers two bedrooms and three bathrooms, as...

Submit Request

Located in the prestigious One Paraiso Edgewater complex in the heart of Miami, these exquisite 3-bedroom apartments embody luxury and...

Submit Request

Welcome to the home of your dreams in the heart of Gallery and Tanglewood district. This bright and open 3...

Submit Request

Beautiful oasis with 4 bedrooms and 3.5 baths in desirable Woodlake Forest IV. This bright and spacious home features gorgeous...

Submit Request

THE CONDOMINIUM, 246 WEST 17th STREET Superbly located in the endlessly thriving, always bustling, and perpetually coveted neighborhood of Chelsea,...

Submit Request

Well-maintained home in the northern part of Scottsdale on the Troon Monument golf course with beautiful views of Pinnacle Peak....

Submit Request

The iconic Olympic Tower building at 641 5th Ave, residence 31C, is one of the most sought after by celebrities,...

Submit Request

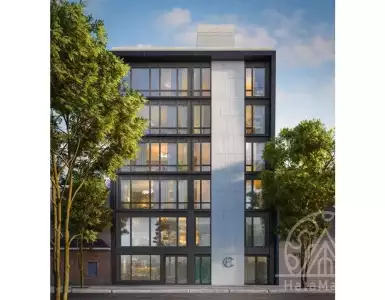

Introducing a new full-floor condominium that combines stunning interiors and a private outdoor space with the trendy lifestyle of Williamsburg....

Submit Request

This significant golf course lot, located in the highly sought-after Pinnacle Peak Country Club in North Scottsdale, overlooks the 11th...

Submit Request

Located on the beautiful street of Edgewood Drive, this colonial house boasts a huge lot and a swimming pool. Sun-drenched...

Submit Request

Didnt find the right facility?

Leave a request - we will handle the selection and send the best offers in a short period of time

Irina Nikolaeva

Sales Director, HataMatata

Real Estate in Kansas City

Real estate in Kansas City for living, investment and residence permit

- ✓ Verified properties directly from developers

- ✓ No overpayments or commissions

- ✓ Guarantee of transaction purity and post-purchase support

Our managers will help you choose a property

Liliya

International Real Estate Consultant

Need help choosing a property?

Leave a request and our manager will contact you.

Our managers will help you choose a property

Liliya

International Real Estate Consultant

Need help choosing real estate in Kansas City?

Leave a request and we will select the 3 best options for your budget

!

!

Other Properties for sale in Boston, USA 7 156 875 $

Maison Commonwealth is a boutique complex of 5 apartments, consisting of two combined brownstones and a brand new building overlooking...

!

!

For sale Flat in LA, USA 1 241 495 $

Welcome to the embodiment of luxurious living in the heart of Brentwood. This luxurious building, The Dorothy-Granville, is a rare...

🇺🇸 Kansas City, MO real estate: affordable homes, historic bungalows, Crossroads condos

Kansas City, Missouri offers a mix of Midwestern calm and growing urban energy that makes it a unique target for buyers from first-time homeowners to institutional investors. Located at the confluence of the Missouri and Kansas rivers, the city blends a compact downtown, historic neighborhoods, and extensive parkland, with a climate of hot summers and cold winters that supports year-round cultural life and strong local sports fandom. The city’s central location in the US, combined with expanding tech and healthcare employment, keeps demand steady for both owner-occupiers and those seeking investment property in Kansas City.

💼 City overview and lifestyle in Kansas City

Kansas City is anchored by Downtown, the Power & Light District, and the Crossroads Arts District, creating a dense center for nightlife, arts, and commerce. Residents benefit from walkable entertainment corridors, a growing streetcar line, and cultural anchors such as the Kauffman Center for the Performing Arts and the National WWI Museum at Liberty Memorial. The lifestyle is balanced: urban loft living and luxury condo options sit alongside leafy family districts like Brookside and the Country Club District.

Kansas City’s climate supports outdoor living with Swope Park (about 1,800 acres) and dozens of neighborhood parks, plus riverfront trails. The city does not have beaches, but the Missouri River and nearby lakes provide water recreation within short drives. The local food scene—BBQ, craft breweries, and farm-to-table restaurants—adds to the city’s appeal for newcomers and tenants alike. For buyers focused on real estate investment in Kansas City, this lifestyle mix translates into diverse rental audiences and steady occupancy rates.

Kansas City is recognized for value relative to major coastal metros, attracting relocators and investors looking for positive cash flow. Infrastructure upgrades, repeat championship events at Arrowhead Stadium and Kauffman Stadium, and steady corporate presence support tourism and business travel, improving short-term and medium-term ROI for investment property in Kansas City.

🎯 Which district of Kansas City to choose for buying property in Kansas City

Downtown and the River Market are prime for buyers seeking new developments and short-term rental income due to proximity to Union Station, the Power & Light District, and the KC Streetcar corridor. Typical property types here are condos and lofts, with buyers ranging from young professionals to investors targeting urban tenants. Development intensity is high, with frequent conversions of historic warehouses into residential units.

Country Club Plaza and the Country Club District are the city’s premium residential areas, notable for tree-lined streets, high-end retail, and schools. Properties here are predominantly single-family homes with larger lot sizes and higher price points; target buyers include families and premium lifestyle purchasers. Brookside and Waldo offer a neighborhood feel with local shops and strong school options, attractive for long-term owner-occupiers.

North Kansas City, Midtown, and parts of Westport are suited for value-oriented investors and renovation projects. These districts typically have lower entry prices, high redevelopment potential, and proximity to industrial or business hubs. Safety and infrastructure vary by block, so buyers—especially those considering resale property or off-plan property—should perform granular due diligence and work with local agents to assess growth dynamics.

💶 Property prices in Kansas City

Overall market segmentation in Kansas City offers a wide entry spectrum, with average price per square foot generally between $160–$220 per sq ft, while premium downtown or Plaza-area units can reach $300+ per sq ft. Price ranges by district look approximately like this:

- Downtown / River Market / Crossroads: $200,000–$900,000 for condos and lofts, with luxury penthouses above that range.

- Country Club Plaza / Country Club District / Brookside: $600,000–$3,000,000 for single-family homes and estate properties.

- Midtown / Westport / West Plaza: $300,000–$800,000 for renovated historic homes and newer townhouses.

- North Kansas City and transitional neighborhoods: $120,000–$450,000, attractive for buy-to-rent strategies.

Price segmentation by property type:

- Apartments / Condos: $200k–$900k depending on location and amenities.

- Townhouses: $300k–$700k typically in infill neighborhoods.

- Single-family homes: $250k–$3M depending on district and lot size.

- Commercial units / retail storefronts: variable, often assessed per sq ft and tied to foot-traffic corridors.

Market dynamics show steady appreciation with single-digit annual growth in many corridors and accelerated revaluation in transit-oriented and Plaza-adjacent locations. Investors tracking new developments in Kansas City should monitor the KC Streetcar extension and downtown office-to-residential conversions, which are key drivers for capital appreciation.

🚆 Transport and connectivity in Kansas City

Kansas City’s transport backbone includes I‑70, I‑35, and I‑435, providing direct access to regional and interstate freight and commuter routes. Kansas City International Airport (MCI) sits roughly 15 miles north of downtown, typically a 20–30 minute drive depending on traffic, making national and international connections straightforward for frequent travelers and business tenants. The Port of Kansas City on the Missouri River supports logistics and industrial activity.

Public transit is centered on KCATA buses and the KC Streetcar, a downtown circulator of about 2.2 miles connecting River Market to Union Station and Crown Center. There is no metro or subway; commuting relies on buses, cars, and increasingly bike lanes and ride-share. Typical downtown-to-suburb commutes average 20–35 minutes, though congestion increases during peak hours near stadium events and major intersections.

Good road access and central geographic location make Kansas City attractive for logistics-sensitive investors and businesses. For residents, proximity to major highways and relatively shorter commutes compared with larger metros improve quality of life and widen tenant pools for rental properties.

🏫 Urban infrastructure and amenities in Kansas City

Kansas City’s healthcare network is strong, anchored by Children’s Mercy Hospital, Saint Luke’s Health System, and University Health / Truman Medical Center, providing both employment and specialized services that support medical-driven rental demand. Educational institutions such as University of Missouri–Kansas City (UMKC), Rockhurst University, and the Kansas City Art Institute create pockets of student and faculty housing demand.

Retail and leisure infrastructure include the historic Country Club Plaza, Crown Center, and neighborhood commercial strips on Ward Parkway and Brookside Boulevard. Parks and recreation are abundant, with Swope Park, Loose Park, and riverfront trails supporting outdoor lifestyles. Cultural venues like the Kauffman Center, the Nelson-Atkins Museum, and the annual First Fridays in Crossroads add to the city’s attraction for tenants and buyers.

Business hubs in downtown, the Power & Light District, and emerging corridors near airport-adjacent corporate campuses support corporate demand. Hospitality capacity for tourism and events—hotels around Crown Center and near Arrowhead—also supports short-term rental markets in selected districts.

📈 Economic environment and city development in Kansas City

Kansas City’s economy is diversified across healthcare, technology, finance, manufacturing, and logistics. Major employers and corporate presences include regional health systems, technology firms (notably the presence of large health-tech companies), and a growing startup ecosystem. The Port of Kansas City and central location make the city a logistics hub for distribution and manufacturing.

Public and private investment has focused on downtown activation and transit-oriented development, with targeted incentives and Tax Increment Financing (TIF) used to catalyze projects. Tourism and sports contribute materially: NFL and MLB events, conventions at Union Station and Crown Center, and a steady calendar of cultural events add to short-term rental demand and retail occupancy. For investors, these macro trends support steady rental demand and moderate capital growth, particularly in transit-proximate and mixed-use corridors.

🏠 Property formats and housing types in Kansas City

Buyers can choose between new developments in the downtown and streetcar corridors versus resale property across the city’s historic neighborhoods. Typical building formats include high-rise and mid-rise condos downtown, loft conversions in Crossroads and River Market, townhouse infill in Midtown and Waldo, and detached single-family homes in Brookside and Plaza areas. Off-plan property and new build property in Kansas City often appear along major corridors and are typically marketed with staged deposits and phased construction timelines.

Resale property provides immediate cash flow options for buy-to-rent strategies, while new developments offer modern amenities and sometimes limited-time pricing advantages. Architectural character varies by neighborhood: brick loft conversions in Crossroads, Spanish and Tudor revivals in the Country Club District, and modern mixed-use developments near the streetcar line.

🏗️ Developers and key residential projects in Kansas City

Several locally based and national development firms are active in Kansas City’s real estate scene. Notable names include:

- The Cordish Companies (known for Power & Light District revitalization)

- Copaken Brooks (mixed-use retail and residential projects)

- J.E. Dunn Construction and McCownGordon (major local builders and contractors)

Signature and area projects you’ll encounter when researching real estate in Kansas City:

- Power & Light District residential towers and mixed-use expansions

- KC Streetcar corridor infill developments and downtown loft conversions

- River Market residential conversions and new condominium offerings

- Neighborhood redevelopment projects in Crossroads and Midtown designed to add retail and rental inventory

These developers typically deliver a range of finishes and amenity packages; working with local brokers helps you verify construction quality, warranty terms, and timeline reliability for new build property in Kansas City.

💳 Mortgage, financing, and installment options for property in Kansas City

Foreign buyers commonly finance purchases through US banks, regional lenders, or international banks with US operations. Typical mortgage parameters for non-resident buyers are down payments of 20–30%, though some lenders may require 30–40% depending on borrower profile. Loan terms can reach 15–30 years, and interest rates follow national market conditions; buyers should expect rates comparable to domestic borrowers adjusted for risk and documentation.

Developer installment plans and off-plan financing are occasionally offered for new developments in Kansas City, often structured with staged deposits during construction and a final payment at closing. These plans vary by developer and project and may be most prevalent on larger mixed-use projects along the streetcar corridor. Buyers seeking to buy property in Kansas City with mortgage or to buy property in Kansas City in installments should secure pre-approval and clarify foreign-buyer policies early in the process.

Cash purchases remain common among international investors due to speed and simplicity, but financing can improve leverage and ROI when interest rates and loan terms align with investment goals.

📝 Property purchase process in Kansas City for foreign buyers

Start the property purchase process by engaging a licensed local real estate agent who understands Kansas City neighborhoods and the distinctions between new developments and resale property. After identifying a target, buyers typically submit a written offer with an earnest money deposit held in escrow while inspections and title search proceed. Inspections, appraisal (for financed purchases), and a title company’s closing process finalize the sale.

Foreign buyers should prepare for additional documentation: proof of funds, passport, and sometimes an ITIN for tax reporting. Funds transfers for closing must comply with US banking and anti-money-laundering rules and are typically processed through escrow accounts at title companies. Buyers using mortgage financing will coordinate an appraisal and underwriting with their lender and should account for closing costs, property taxes, and homeowners association fees where applicable.

Buyers seeking off-plan property in Kansas City must review developer contracts carefully—look for completion guarantees, deposit protections, and clear timelines. Using an experienced real estate attorney to review purchase agreements and local regulations reduces transaction risk.

⚖️ Legal aspects and residence options when buying property in Kansas City

Foreign nationals can own property in Kansas City with no special restrictions; ownership is available to individuals, corporations, and trusts. Property taxes in Jackson County and surrounding jurisdictions typically run in the range of about 1.0–1.5% of assessed value annually, though effective rates vary by school district and local levies. Transfer and recording processes are handled at county offices, and title insurance is commonly purchased to protect ownership.

Purchasing property in Kansas City does not automatically confer a US residence permit. Investors interested in immigration routes should explore federal programs such as EB‑5 (which targets larger capital thresholds and job-creation requirements) or consult immigration counsel about E‑2 and other visa options where eligible. Tax considerations—income tax on rental revenue, capital gains tax on disposals, and FIRPTA-related rules for sellers—require coordination with US tax advisors to optimize ROI and compliance.

🎯 Property use cases and investment property in Kansas City

Kansas City supports multiple property strategies, each matching neighborhoods and property types:

- Long-term rental for steady cash flow: Midtown, Waldo, North Kansas City — duplexes, townhouses, and small apartment buildings.

- Short-term rental and tourism-driven income: River Market, Downtown, near Crown Center — condos and centrally located apartments.

- Capital-growth and renovation plays: transitional neighborhoods near Crossroads and parts of North KC — single-family homes and flip opportunities.

- Premium lifestyle purchases and family homes: Country Club Plaza and Brookside — large single-family residences with top schools and amenities.

- Commercial mixed-use investments: Power & Light District and major corridor storefronts — ground-floor retail with residential or office above.

Investors focused on rental yield should model operating expenses, vacancy, and property management costs; owner-occupiers should prioritize school districts, commute times, and neighborhood amenities when choosing a property in Kansas City.

Kansas City’s combination of affordability, improving urban infrastructure, and a diversified economy offers a compelling landscape for buyers seeking resale property, new developments in Kansas City, or off-plan property opportunities. Whether you’re looking to buy property in Kansas City with mortgage financing, secure a property in Kansas City with installment plan options on a new build property, or acquire investment property in Kansas City for long-term portfolio growth, the city presents transparent market niches and professional service infrastructure to support your purchase and ongoing property management.

Frequently Asked Questions

Prices vary by type and location. Within Kansas City, condos/downtown units commonly range $120,000–$350,000; older single-family city homes $150,000–$350,000; suburban family homes $250,000–$500,000. Price per sq ft typically falls between $130–$220. Expect higher prices and tighter supply in popular neighborhoods and lower prices in outer neighborhoods. USD shown.

Yes—non‑US citizens can buy and hold real estate in Kansas City. There are no state restrictions on foreign ownership, but federal rules apply: proof of funds, US tax ID (ITIN) often needed for tax reporting, and FIRPTA may withhold tax on gains at sale. Buying property does not grant a visa or residency; immigration status is handled federally.

Kansas City offers steady rental demand, relatively low entry prices and positive cash‑flow potential. Typical gross rental yields range about 6%–10% depending on neighborhood; vacancy rates often 5%–8%. Liquidity is moderate — single-family homes sell within weeks to months in active areas. Seasonality is mild; spring and summer see higher listings and rent movement.

Typical timeline: 30–60 days from accepted offer to closing. Expect 7–14 days for inspections, 2–4 weeks for mortgage underwriting and appraisal, plus title work and closing prep. Transaction costs: buyer closing costs often 2%–5% of price (fees, title, recording); property taxes prorated. Common pitfalls: skipped inspections, financing delays, and unclear title issues.

Top rental-friendly areas: downtown/Power & Light for young professionals and short leases; Crossroads and Westport for nightlife-driven demand; Brookside and Waldo for stable family renters; North KC neighborhoods (revitalizing areas) for higher yield but more active management. Choose based on target tenant, commute, and property type—yields vs. long‑term appreciation differ by area.

Short‑term rentals are allowed but regulated. Hosts must register with the city, collect and remit local occupancy taxes, and meet safety/inspection requirements; certain zoning or HOA rules can restrict operations. Income can be higher seasonally in entertainment districts, but factor in permit fees, higher insurance and variable occupancy when modeling returns.

Yes. Kansas City has widespread high‑speed internet (fiber and cable available in many neighborhoods), affordable rents ($900–$1,800/mo for typical units) and ample coworking/cafés. Quality of life: good food scene, parks and transit options. For stays over 90 days, check US visa rules; many nomads use long‑stay rentals or furnished month‑to‑month leases.

Expect property taxes roughly around 1.0%–1.5% of assessed value annually (bills vary by parcel), state income tax on rental income (~4%–6% marginal range), and federal taxes on gains. Closing costs typically 2%–5% of price. Also budget for insurance, HOA fees, maintenance (1%–2% of value/yr) and local licensing or inspection fees for rentals.

Off‑plan purchases can offer lower entry prices but carry risks: construction delays, permit issues, and value uncertainty. Protect yourself via clear contracts, escrowed deposits, performance timelines, lien waivers, and inspection/acceptance clauses. Verify local building permits and obtain a completion guarantee or warranty when possible. Factor in 6–18 month construction timelines.

Investment purchases prioritize yield, tenant demand and exit liquidity; expect different financing (higher rates or down payment), insurance, and property management needs. Living buyers focus on schools, commute, and lifestyle. For investors model cash flow (rent minus mortgage, taxes, fees) and vacancy; for owners factor in long‑term appreciation and personal utility rather than short‑term income.

Properties by Region

Services in Kansas City

Properties by Country

- Real estate in Bulgaria (11408)

- Real estate in Montenegro (5186)

- Real estate in Indonesia (2423)

- Real estate in Spain (2289)

- Real estate in Portugal (1975)

- Real estate in Italy (1924)

- Real estate in Turkey (1699)

- Real estate in Cyprus (1571)

- Real estate in Thailand (1565)

- Real estate in Croatia (1431)

- Real estate in Greece (1082)

- Real estate in USA (1013)

- Real estate in France (1006)

- Real estate in Georgia (519)

- Real estate in Serbia (329)

- Real estate in Slovenia (123)

- Real estate in Egypt (23)

Get the advice of a real estate expert in Kansas City — within 1 hour

Looking for a property in Kansas City? Leave a request — we will help you take into account all the nuances, and we will offer objects according to your personal request.

Maria Guven

Head of Direct Sales Department

+90-507-705-8082