Real Estate in Brooklyn

Real estate in Brooklyn for living, investment and residence permit

- ✓ Verified properties directly from developers

- ✓ No overpayments or commissions

- ✓ Guarantee of transaction purity and post-purchase support

Our managers will help you choose a property

Liliya

International Real Estate Consultant

Need help choosing a property?

Leave a request and our manager will contact you.

Our managers will help you choose a property

Liliya

International Real Estate Consultant

Hot Deals

For Sale Real Estate in Brooklyn

24 listings

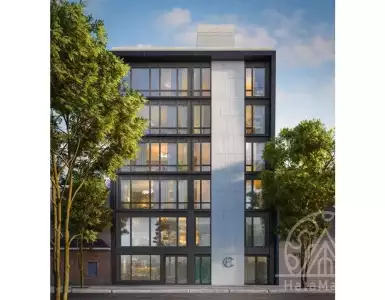

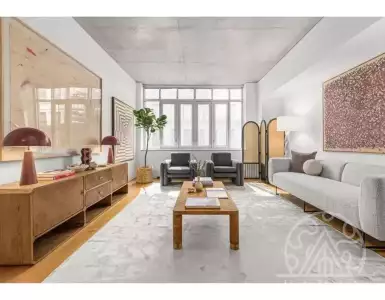

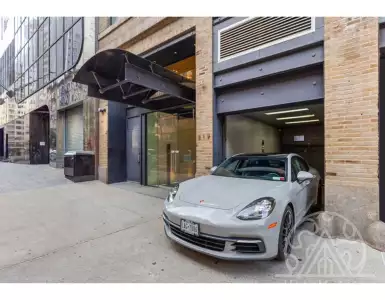

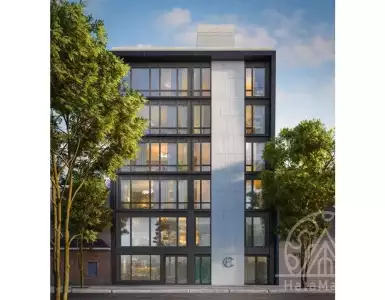

Introducing a new full-floor condominium that combines stunning interiors and a private outdoor space with the trendy lifestyle of Williamsburg....

Submit Request

Fantastic development of ready to live villas and townhouses in the quiet Spanish town of Las Palas. Located just 5km...

Submit Request

Hot Deals

Popular

19 October

19 October

19 October

19 October

\''921 Oriental Boulevard is a 5 bedroom, 6 bathroom oceanfront home with nearly 6,000 square feet of living space. It...

Submit Request

Real estate in Brooklyn for living, investment and residence permit

- ✓ Verified properties directly from developers

- ✓ No overpayments or commissions

- ✓ Guarantee of transaction purity and post-purchase support

Our managers will help you choose a property

Liliya

International Real Estate Consultant

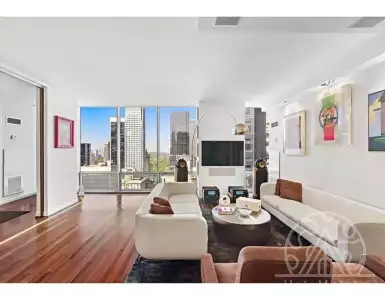

Residence 11B is a unique two-bedroom apartment in the prestigious Quay Tower complex in Brooklyn Heights. Each room offers panoramic...

Submit Request

This deep three-bedroom plus office, 3.5-bathroom home occupies approximately 2,497 +-- square feet and is located on the desirable northwest...

Submit Request

Welcome to 343 Prospect Avenue! Meticulously designed by architect Ben Herzog, this newly remodeled townhouse spans four spacious floors. At...

Submit Request

Recommended to see

THE CONDOMINIUM, 246 WEST 17th STREET Superbly located in the endlessly thriving, always bustling, and perpetually coveted neighborhood of Chelsea,...

Submit Request

The iconic Olympic Tower building at 641 5th Ave, residence 31C, is one of the most sought after by celebrities,...

Submit Request

This sunny and spacious duplex loft at Magnolia Mansion Lofts offers 14-foot high ceilings, large north-facing windows, in-unit washer-dryer, hardwood...

Submit Request

PRIVATE TERRACE == SEPARATE ROYAL BEDROOMS == WARDROBES == 1600 SF! LIVE IN THIS IMPRESSIVE RENOVATION IN THE HEART OF...

Submit Request

Classic luxury of Upper East Side. Created for the modern era. Elegant and bright, with a private backyard and thoughtful...

Submit Request

The first four photos are a virtual render and previous renovation that do not reflect the current layout and finishes....

Submit Request

City living is easy! Located on the 32nd floor, this renovated 2-bedroom, 2.5-bathroom corner apartment offers over 1,300 +-- sf...

Submit Request

Ciao, East Village! Modern Italian Luxury Welcome to this stunning 3 bedroom 3 bathroom penthouse at 75 First Ave with...

Submit Request

At the crest of the hill leading to the Firefighters Memorial in the historic Riverside West End neighborhood sits a...

Submit Request

Recognized as the building of the year in 2022! On-site model apartment buildings are now available for inspection by appointment:...

Submit Request

Sunny and impressive! Residence 9B at The Merritt House is a magnificent example of pre-war elegance and proportions combined with...

Submit Request

Real Estate in Brooklyn

Real estate in Brooklyn for living, investment and residence permit

- ✓ Verified properties directly from developers

- ✓ No overpayments or commissions

- ✓ Guarantee of transaction purity and post-purchase support

Our managers will help you choose a property

Liliya

International Real Estate Consultant

Need help choosing a property?

Leave a request and our manager will contact you.

Our managers will help you choose a property

Liliya

International Real Estate Consultant

Need help choosing real estate in Brooklyn?

Leave a request and we will select the 3 best options for your budget

!

!

For sale Flat in Brooklyn, USA 1 739 519 $

Introducing a new full-floor condominium that combines stunning interiors and a private outdoor space with the trendy lifestyle of Williamsburg....

🇺🇸 Brooklyn, NY Property Market: Brownstones, Condos, Waterfront, Neighborhood Prices

Brooklyn is a vast and diverse borough that blends historic brownstones, waterfront high-rises, creative industrial pockets and family-friendly streets into a single, dynamic market. Located directly across the East River from Manhattan, Brooklyn offers distinct lifestyles from the leafy blocks of Park Slope to the waterfront skyline of DUMBO and the cultural energy of Williamsburg. For buyers and investors considering property in Brooklyn, the borough delivers a mix of strong rental demand, steady capital appreciation and a deep ecosystem of schools, hospitals, parks and transport links that support long-term value.

🏙️ Brooklyn city overview and lifestyle for buyers considering property in Brooklyn

Brooklyn sits south and east of Manhattan and comprises more than a dozen major neighborhoods, each with clearly different characters and lifestyle appeal. The borough’s climate is temperate, with warm summers and cold winters influenced by the Atlantic; residents enjoy beaches and boardwalks at Coney Island and Brighton Beach along the southern shore.

Brooklyn combines urban density and low-rise residential streets: Downtown Brooklyn and DUMBO provide high-rise living and proximity to Manhattan, while Park Slope, Carroll Gardens and Brooklyn Heights are known for tree-lined streets and brownstones.

Brooklyn’s lifestyle is supported by cultural venues, independent restaurants, craft breweries and major parks; Prospect Park and Brooklyn Bridge Park are two signature green spaces that significantly raise neighborhood desirability and long-term market stability.

- Key lifestyle anchors: Prospect Park, Brooklyn Bridge Park, Coney Island Boardwalk

- Major education hubs: Pratt Institute, NYU Tandon (MetroTech), Brooklyn College

- Cultural draws: Barclays Center, Brooklyn Museum, Brooklyn Academy of Music

🚦 Which district of Brooklyn to choose when you want to buy property in Brooklyn

Brooklyn Heights and DUMBO appeal to buyers seeking proximity to Manhattan and premium resale property, typically attracting executives and downsizers. These neighborhoods feature waterfront parks, historic architecture and high demand for luxury condos and townhouses.

Williamsburg and Greenpoint attract younger professionals and creatives; the waterfront developments here deliver modern condos and strong short-term rental demand due to nightlife, restaurants and ferry connections.

Park Slope, Carroll Gardens and Prospect Lefferts Gardens are family-oriented, with top-rated public and private schools, playgrounds and mid-rise apartment buildings or brownstones—ideal for long-term residency and stable rental tenants.

- Close-to-Manhattan, high-price: DUMBO, Brooklyn Heights, Downtown Brooklyn

- Trendy, high-growth: Williamsburg, Greenpoint, Bushwick (select corridors)

- Family neighborhoods: Park Slope, Carroll Gardens, Prospect Lefferts Gardens

- Affordable/value and redevelopment potential: Sunset Park, East New York, Bay Ridge

- Buyer profiles: luxury buyers, investors (short-term and long-term), families, first-time buyers

💶 Property prices in Brooklyn and market overview for real estate in Brooklyn

Brooklyn’s market shows a wide price spread driven by neighborhood, building type and lot value. Prime waterfront neighborhoods like DUMBO and Brooklyn Heights often command $1,200–$1,800 per sq ft (~$12,900–$19,400 per sq m). Mid-market neighborhoods such as Williamsburg and Park Slope often range $700–$1,200 per sq ft (~$7,500–$12,900 per sq m). More affordable pockets in southern and eastern Brooklyn commonly list $300–$600 per sq ft (~$3,200–$6,500 per sq m).

Townhouses and brownstones have a separate premium: family brownstones in Park Slope or Carroll Gardens typically sell from $2M to $6M, with well-preserved landmark properties exceeding $10M. Condos and new developments show segmentation between entry-level studios and luxury penthouses.

Recent market movements have delivered moderate appreciation in prime corridors and faster price growth in neighborhoods undergoing rezoning and waterfront redevelopment; rental yields remain stronger in outer neighborhoods while central neighborhoods trade for capital-growth potential.

- Prices by district (typical ranges):

- DUMBO / Brooklyn Heights: $1.2k–$1.8k / sq ft

- Williamsburg / Greenpoint: $700–$1.2k / sq ft

- Park Slope / Carroll Gardens: $800–$1.4k / sq ft (condos/townhouses higher)

- Bay Ridge / Coney Island / East Flatbush: $300–$600 / sq ft

- Property type pricing: Studio/1BR condos $400k–$900k; 2–3BR condos $800k–$2.5M; Townhouses $1.5M–$10M+

- Average gross rental yields typically 3%–6% depending on neighborhood and tenancy mix

🚆 Transport and connectivity for homeowners buying property in Brooklyn

Brooklyn’s transport grid is one of its strengths: multiple subway lines connect neighborhoods to Manhattan and to each other, with major hubs such as Atlantic Terminal / Barclays Center serving LIRR plus subway lines 2/3/4/5/B/D/N/Q/R. Ferries operated by NYC Ferry link DUMBO, Williamsburg and Sunset Park to Manhattan waterfronts.

Road access includes the Brooklyn-Queens Expressway (BQE/I-278), the Gowanus Expressway and the Verrazzano-Narrows Bridge for Staten Island — all important for car owners and logistics. Travel times vary: DUMBO to Manhattan Financial District ~10–15 minutes by subway or 5–10 minutes by ferry; Midtown 20–35 minutes depending on line and connection.

Brooklyn’s growing bike and pedestrian infrastructure, plus expanding ferry services and shuttle links from new developments, improve first- and last-mile access and support both resident mobility and tourist footfall.

- Key transit nodes and lines: Atlantic Terminal/Barclays Center (LIRR + multi-lines), Jay St-MetroTech, 9th Street (F), L train corridor

- Airports: JFK reachable ~30–45 minutes, LaGuardia via highway/bus 25–40 minutes, Newark 35–60 minutes depending on traffic

- Additional options: NYC Ferry, Citibike and growing shuttle/ride-hailing services

🏥 Urban infrastructure and amenities that shape real estate in Brooklyn

Brooklyn is served by major hospitals and medical centers including Maimonides Medical Center, NYU Langone Hospital—Brooklyn, Brooklyn Hospital Center and SUNY Downstate, all of which reinforce demand for family housing and senior living. Education infrastructure includes Pratt Institute, NYU Tandon, Brooklyn College, and numerous high-performing public and private schools.

Retail and leisure infrastructure is robust: Brooklyn Commons/Atlantic Terminal Mall, boutique shopping corridors in Williamsburg and Atlantic Avenue, plus food markets and hospitalities that sustain year-round tourism and resident convenience. Parks and waterfront projects like Brooklyn Bridge Park and Prospect Park are major contributors to neighborhood desirability and sustained pricing strength.

Cultural and sports facilities—Barclays Center, Brooklyn Academy of Music, Brooklyn Museum—create event-based rental demand and drive hospitality investment.

- Major facilities and hubs: Barclays Center, Brooklyn Bridge Park, Pratt Institute, Maimonides Medical Center

- Shopping and leisure nodes: Atlantic Terminal, Fulton Mall, Smith Street culinary corridor

- Sports and culture: BAM, Brooklyn Museum, seasonal events and festivals

📈 Economic environment and city development influencing real estate investment in Brooklyn

Brooklyn’s economy blends creative industries, tech startups, advanced manufacturing and an expanding healthcare sector, driven in part by redevelopment zones like the Brooklyn Navy Yard and Industry City. Tourism and dining contribute to substantial foot traffic in central neighborhoods, increasing short-term rental and retail revenue potential.

Large-scale projects and rezoning efforts have catalyzed new office space and mixed-use developments, attracting corporate tenants and remote-work relocations that raise long-term demand for both rental and owner-occupied housing. Employment hubs in Downtown Brooklyn, the Navy Yard and the waterfront spur commuter flows and support consistent rental markets.

Municipal investment in infrastructure and waterfront activation supports ongoing capital inflows; investors looking at real estate investment in Brooklyn should factor in employment mix, tourism trends and planned public works when modeling ROI.

- Key economic drivers: creative industries, tech startups, healthcare, manufacturing at Brooklyn Navy Yard

- Growth indicators: rising office conversions, increased ferry ridership, expanded retail demand

- Investment catalysts: rezoning corridors, waterfront redevelopment, university expansion

🏘️ Property formats and housing types available when you buy property in Brooklyn

Brooklyn offers a full spectrum: prewar brownstones and row houses, mid-rise walkups, modern condominium towers, rental apartments, townhouses, and mixed-use commercial-residential buildings. New developments in waterfront neighborhoods emphasize amenities, concierge services and luxury finishes while resale properties deliver character and established neighborhood fabric.

Off-plan property and new build property in Brooklyn are commonly offered along the East River, Downtown Brooklyn and Williamsburg, with varying sizes from studios (~350–500 sq ft / 32–46 sq m) to multi-bedroom family units (1,000–3,000+ sq ft / 93–279+ sq m). Resale property in Brooklyn includes co-op apartments (still common in older buildings) and condo units, with co-op purchases sometimes subject to board approval and stricter financing rules.

Conversions and adaptive reuse—industrial lofts turned residential—remain a notable feature in neighborhoods like DUMBO, Williamsburg and Bushwick, attracting buyers seeking unique floorplates and high ceilings.

- Typical unit sizes: Studios 30–50 sqm, 1–2BR 50–120 sqm, Townhouses 150–500+ sqm

- Formats: new developments, off-plan property, resale property, co-ops, condos, brownstones

- Amenity differences: luxury amenity towers vs. low-rise brownstones without elevator access

🏗️ Developers and key residential projects shaping real estate in Brooklyn

Several established developers and owners are active in Brooklyn’s pipeline and resale markets. Two Trees Management is synonymous with waterfront transformation in DUMBO and the Domino Sugar site; Jamestown operates Industry City’s commercial and creative campus; JDS Development Group delivered signature towers such as The Brooklyn Tower. Greenland USA is involved in larger master-planned projects like Pacific Park (formerly Atlantic Yards) alongside other partners.

Projects range from high-rise luxury towers in Downtown and DUMBO to mid-rise courtyards in Williamsburg and brownstone restorations in Park Slope. New developments focus on transit-oriented locations with concierge, fitness centers and co-working spaces; resale inventory includes carefully restored historic properties with premium finishes.

Construction quality and developer track records vary: buyers often prioritize developers with local completions, transparent financials and positive homeowner reviews when assessing off-plan property and new build property in Brooklyn.

- Notable developers: Two Trees Management, Jamestown, JDS Development Group, Greenland USA, L+M Development Partners

- Representative projects: Pacific Park (Atlantic Yards), Domino Sugar redevelopment, 9 DeKalb Ave (The Brooklyn Tower), Industry City conversions

- Project features to evaluate: warranty terms, amenity offerings, HOA/condo fee trends, completion history

💳 Mortgage, financing and installment options for property in Brooklyn

Foreign buyers can obtain financing for property in Brooklyn, but banks typically require larger down payments than for US residents—commonly 30%–50% down for condos and 35%–50% for co-ops or investment purchases. Mortgage terms depend on credit, income documentation and lender: fixed-rate and adjustable-rate mortgages are available with typical loan terms of 15–30 years.

Developer installment plans are offered in some new developments and off-plan sales; these plans vary by project and can include staged deposits tied to construction milestones or interest-bearing interim financing. Buyers can often combine developer installment plans with external mortgage financing at closing.

Transaction-level costs to plan for include down payment/deposit, lender fees, title insurance, attorney fees and transfer taxes; closing costs generally range between 2% and 6% of purchase price depending on transaction structure.

- Typical foreign buyer financing facts: 30%–50% down payment, documentation requirements, possible need for US bank accounts or ITIN

- Mortgage options: fixed-rate, adjustable-rate, bridge loans for investors, purchase-money mortgages for condos

- Developer financing: off-plan installment plans, staged deposits, and sometimes interest-bearing escrow arrangements

📝 Property purchase process in Brooklyn for foreign and domestic buyers

The typical purchase process starts with property selection and making a written offer, often accompanied by an earnest money deposit held in escrow. Buyer and seller sign a contract subject to due diligence and mortgage contingency if financing is used; both parties then proceed to inspection, title search and attorney review.

Closing follows mortgage commitment, settlement of all fees and transfer of funds; title is transferred and recording occurs at the county clerk. Foreign buyers should plan for additional documentation such as passport identification, proof of funds, and potentially an Individual Taxpayer Identification Number (ITIN) for US tax purposes.

Payment methods commonly include bank wire transfers for down payments and closing funds; cash purchases require proof of source of funds and can shorten closing timelines. Expect negotiations on closing timelines, escrows for repairs and potential board approvals for co-op purchases.

- Step-by-step highlights: offer → contract/earnest money → inspections → mortgage commitment → title/attorney review → closing

- Common payment methods: wire transfers, certified checks, escrow accounts

- Additional steps for foreigners: ITIN, proof of funds, possible translation of documents

⚖️ Legal aspects and residence options when buying property in Brooklyn

Foreigners have the right to buy and hold property in Brooklyn with no citizenship requirement; ownership is typically fee simple for condos and townhouses. Co-op purchases can be more restrictive because buildings maintain board approval rights and may request detailed financial disclosure.

Property taxes are assessed by New York City and vary by property class; homeowners should budget for annual property taxes and possible special assessments. Rental income is subject to US federal and state taxation; non-resident landlords must file tax returns and may face withholding requirements on rental proceeds.

Purchasing property in Brooklyn does not automatically grant residency or immigration status; buyers seeking residence permits must pursue visa options independently, such as employment-based or investor visa routes, where applicable and subject to immigration law.

- Legal/transactional checklist: title search, attorney review, transfer tax, HOA/condo document review

- Tax notes: property tax, income tax on rentals, possible FIRPTA-like requirements for certain transfers

- Residency: property ownership ≠ residence permit, immigration visas must be arranged separately

🔍 Property use cases and investment strategies for real estate investment in Brooklyn

Property in Brooklyn suits multiple strategies: buy-to-let for steady rental cash flow, short-term rentals in high-tourism neighborhoods, capital appreciation in waterfront growth corridors, and owner-occupier purchases for relocation or second homes.

For long-term rentals and stability, consider Park Slope, Bay Ridge and Crown Heights for family tenants and students near universities. For short-term rental or tourist-driven revenue, DUMBO, Williamsburg and Downtown Brooklyn provide higher nightly rates though regulatory compliance is essential. For value appreciation and redevelopment upside, Sunset Park, East New York and parts of Red Hook have potential tied to rezoning and infrastructure projects.

Investors often combine strategies: acquire resale property for immediate rental income, and hold new developments off-plan for targeted capital gains. Risk management includes tenant screening, conservative vacancy assumptions and legal compliance for rentals.

- Use cases and recommended neighborhoods:

- Permanent residence / family: Park Slope, Carroll Gardens (brownstones, multi-BR condos)

- Long-term rental investment: Bedford-Stuyvesant, Crown Heights (multi-family buildings, condos)

- Short-term rental / tourism: DUMBO, Williamsburg, Coney Island (seasonal) (studios, 1BR condos)

- Value-growth / off-plan focus: Atlantic Avenue corridor, Sunset Park, East New York (off-plan property, new developments)

Brooklyn’s market rewards detailed local knowledge: understanding block-level micro-markets, developer reputations, building rules and transport linkages makes the difference between a resilient investment and an overexposed purchase. If you aim to buy property in Brooklyn with mortgage or in installments, prioritize verified documentation, realistic yield assumptions and a legal team familiar with New York real estate nuances before committing funds.

Frequently Asked Questions

Typical listing/sale prices in Brooklyn vary by product and neighborhood. Co‑ops commonly sell for $300,000–$900,000. Condos usually range $600,000–$1.6M. Single‑family rowhouses and brownstones span $700,000–$3M+. Median sale prices for condos/co‑ops in central Brooklyn neighborhoods sit roughly $850,000–$950,000. Prices vary widely between waterfront/prime areas and outer neighborhoods.

Yes—foreign nationals can own property in Brooklyn with no ownership restriction. Financing is available but often requires 25–30% down (sometimes more), an ITIN/SSN and US bank documentation. Buying property does not grant residency or visa rights. On sale, FIRPTA can require withholding (commonly up to 15%) and US tax filings; buyers/sellers should engage a US tax advisor and attorney.

Brooklyn typically delivers strong rental demand and steady liquidity in popular corridors. Gross rental yields vary: central neighborhoods 3–5% (condos), outer and multi‑unit properties can reach 5–7%+; cap rates for small multifamily often 4–6%. Seasonality hits tourist areas (higher summer demand). Resale liquidity is generally good in transit‑connected or amenity‑rich areas but slows at high price points.

For families look at Park Slope, Brooklyn Heights, Carroll Gardens, Bay Ridge and Ditmas Park—areas known for parks, primary schools and quieter streets. Expect single‑family and large co‑ops; typical home prices in these neighborhoods range $800K–$2.5M depending on size. Consider proximity to subway lines, day‑care availability, and local public/private school ratings when choosing.

Investment-friendly Brooklyn neighborhoods include Williamsburg and DUMBO (higher rents, lower yields), Bed‑Stuy, Crown Heights and Bushwick (lower entry prices, higher yields), and Sunset Park for industrial/immigrant demand. Expect average monthly rents from $2,000 in outer neighborhoods to $3,500+ in prime areas; choose areas with transit access, growing employment nodes and limited new supply for steadier returns.

Short‑term rentals in NYC are tightly restricted. Entire‑unit rentals when the owner/primary occupant is absent are generally prohibited; hosting a guest in your primary residence while you’re present is usually allowed for stays <30 nights. Enforcement is active and violations can lead to fines and orders. Also factor in transient occupancy tax and HOA/co‑op rules that often ban short lets.

Timelines vary: cash purchases can close in 2–4 weeks; mortgage purchases typically 30–60 days. Co‑ops add board application/review which can take 4–8+ weeks. New construction/condo closings depend on build stage—pre‑construction buyers often wait 6–24 months to closing. Allow extra time for inspections, mortgage underwriting, attorney review and any co‑op/board requirements.

Expect NYC and NYS transfer taxes plus buyer closing costs. NY state transfer tax is 0.4% of sale price; NYC Real Property Transfer Tax (residential) is commonly 1% up to $500K and ~1.425% over $500K. Sales over $1M may trigger the NY mansion tax (1% at threshold). Add title/attorney fees, lender fees and recording costs—total buyer closing costs typically 2–5% of purchase price. Property tax effective rates commonly fall in the 0.8–1.5% range of market value.

Yes—Brooklyn offers widespread high‑speed internet (fiber in many areas), abundant cafés and coworking spaces, and vibrant neighborhoods for long stays. Typical consumer broadband speeds often exceed 100 Mbps in built‑out areas. Note US visa rules for stays longer than tourist limits; choose larger apartments for a home‑office setup and check noise, elevator access and building internet provisioning before signing a lease or purchase.

New‑build/off‑plan risks include construction delays (commonly 6–24 months), cost overruns, changes to finishes and financing contingencies. Typical buyer deposits start at 10–20% with total down payments 20–30% at closing. Protect yourself by reviewing the offering plan, construction schedule, Certificate of Occupancy history, DOB filings, contractor/performance bonds, and using a buyer’s attorney to verify escrow handling and closing protections.

Property by cities

- Real estate in New York (124)

Properties by Region

Services in Brooklyn

Properties by Country

- Real estate in Bulgaria (11392)

- Real estate in Montenegro (5361)

- Real estate in Indonesia (2423)

- Real estate in Spain (2289)

- Real estate in Portugal (1975)

- Real estate in Italy (1926)

- Real estate in Turkey (1699)

- Real estate in Cyprus (1577)

- Real estate in Thailand (1564)

- Real estate in Croatia (1428)

- Real estate in Greece (1082)

- Real estate in USA (1013)

- Real estate in France (1006)

- Real estate in Georgia (519)

- Real estate in Serbia (329)

- Real estate in Slovenia (122)

- Real estate in Egypt (23)

Get the advice of a real estate expert in Brooklyn — within 1 hour

Looking for a property in Brooklyn? Leave a request — we will help you take into account all the nuances, and we will offer objects according to your personal request.

Maria Guven

Head of Direct Sales Department

+90-507-705-8082