Real Estate in Loveland

Real estate in Loveland for living, investment and residence permit

- ✓ Verified properties directly from developers

- ✓ No overpayments or commissions

- ✓ Guarantee of transaction purity and post-purchase support

Our managers will help you choose a property

Liliya

International Real Estate Consultant

Need help choosing a property?

Leave a request and our manager will contact you.

Our managers will help you choose a property

Liliya

International Real Estate Consultant

Hot Deals

For Sale Real Estate in Loveland

Recommended to see

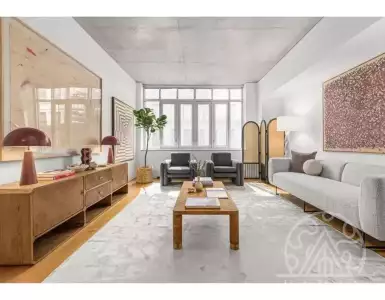

Maison Commonwealth is a boutique complex of 5 apartments, consisting of two combined brownstones and a brand new building overlooking...

Submit Request

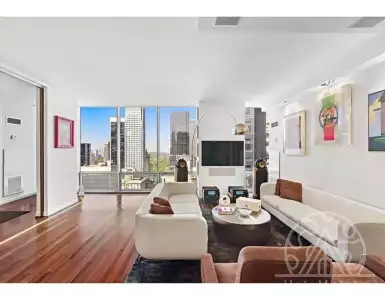

Welcome to the embodiment of luxurious living in the heart of Brentwood. This luxurious building, The Dorothy-Granville, is a rare...

Submit Request

Located on Monument Square in a beautiful brick townhouse, this elegant three-story condominium offers two bedrooms and three bathrooms, as...

Submit Request

Located in the prestigious One Paraiso Edgewater complex in the heart of Miami, these exquisite 3-bedroom apartments embody luxury and...

Submit Request

Welcome to the home of your dreams in the heart of Gallery and Tanglewood district. This bright and open 3...

Submit Request

Beautiful oasis with 4 bedrooms and 3.5 baths in desirable Woodlake Forest IV. This bright and spacious home features gorgeous...

Submit Request

THE CONDOMINIUM, 246 WEST 17th STREET Superbly located in the endlessly thriving, always bustling, and perpetually coveted neighborhood of Chelsea,...

Submit Request

Well-maintained home in the northern part of Scottsdale on the Troon Monument golf course with beautiful views of Pinnacle Peak....

Submit Request

The iconic Olympic Tower building at 641 5th Ave, residence 31C, is one of the most sought after by celebrities,...

Submit Request

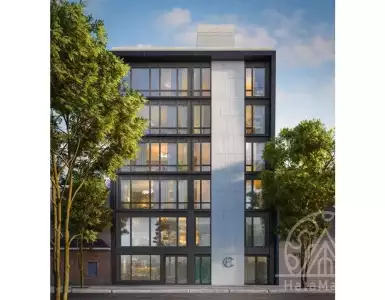

Introducing a new full-floor condominium that combines stunning interiors and a private outdoor space with the trendy lifestyle of Williamsburg....

Submit Request

This significant golf course lot, located in the highly sought-after Pinnacle Peak Country Club in North Scottsdale, overlooks the 11th...

Submit Request

Located on the beautiful street of Edgewood Drive, this colonial house boasts a huge lot and a swimming pool. Sun-drenched...

Submit Request

Didnt find the right facility?

Leave a request - we will handle the selection and send the best offers in a short period of time

Irina Nikolaeva

Sales Director, HataMatata

Real Estate in Loveland

Real estate in Loveland for living, investment and residence permit

- ✓ Verified properties directly from developers

- ✓ No overpayments or commissions

- ✓ Guarantee of transaction purity and post-purchase support

Our managers will help you choose a property

Liliya

International Real Estate Consultant

Need help choosing a property?

Leave a request and our manager will contact you.

Our managers will help you choose a property

Liliya

International Real Estate Consultant

Need help choosing real estate in Loveland?

Leave a request and we will select the 3 best options for your budget

!

!

Other Properties for sale in Boston, USA 7 156 875 $

Maison Commonwealth is a boutique complex of 5 apartments, consisting of two combined brownstones and a brand new building overlooking...

!

!

For sale Flat in LA, USA 1 241 495 $

Welcome to the embodiment of luxurious living in the heart of Brentwood. This luxurious building, The Dorothy-Granville, is a rare...

🇺🇸 Buying real estate in Loveland, Ohio: riverfront & historic homes, Cincinnati commute

Loveland, Ohio sits on the banks of the Little Miami River inside the Cincinnati metropolitan area, offering a blend of small-city character, riverfront recreation, and commuter-friendly access to a major urban economy. Residents value tree-lined streets, a walkable downtown anchored by local shops and the Little Miami Scenic Trail, and a community atmosphere that supports both families and professionals. The city’s population is around 13,000, with the wider metro area providing employment, cultural institutions, and education options within easy driving distance.

💠 City overview and lifestyle in Loveland — Property in Loveland and daily life

Loveland combines riverside recreation with suburban convenience, making property in Loveland attractive to buyers seeking a balance between outdoors life and city access. The Little Miami Scenic Trail runs through town and brings consistent tourism and weekend activity that boosts short-term rental demand and local retail. Climate is humid continental with four distinct seasons, supporting year-round outdoor activities from boating and fishing to autumn foliage walks.

Neighborhood life centers around Historic Downtown Loveland along Loveland-Madeira Road and the river corridor, where restaurants, galleries and a small civic hub concentrate community events. Public green spaces include several riverfront parks and trailheads offering easy access to cycling and paddling, which is a key lifestyle selling point for second-home buyers and families. Proximity to Cincinnati means cultural amenities, professional services and international air connections are within a 20–30 minute drive for most parts of the city.

Buyers considering real estate in Loveland find a mix of single-family homes, townhouses, and some walk-up condominium options; the market supports both owner-occupiers and investors who target long-term rentals or short-term stays focused on trail and river tourism. Local events and a stable community association network support steady demand for well-maintained properties.

🏘️ Which district of Loveland to choose for buying property — Real estate in Loveland by neighborhood

Downtown Loveland (river corridor and Loveland-Madeira Road) offers historic homes, walkability and proximity to the Little Miami Scenic Trail, ideal for short-term rental investors and buyers seeking lifestyle amenities. Properties here tend to be older stock with character, smaller lots in some pockets, and higher demand for boutique renovation projects.

- Typical buyer: investors in short-term rentals, professionals, empty-nesters

- Development intensity: low to medium, with historic preservation considerations

- Infrastructure: restaurants, bike trail access, community shops

East Loveland and the Symmes Township edge include newer subdivisions and family-oriented developments with larger lots and modern floorplans. These areas are safer by suburban standards, feature top-rated schools in the Loveland City School District, and provide easy highway access for commuters.

- Typical buyer: families, long-term rental investors

- Infrastructure: parks, playgrounds, and commuter routes

West Loveland and the Hamilton County neighborhoods are more suburban and spread out, with a mix of mid-century homes and newer single-family builds. These districts often offer better value per square foot for buyers seeking space and privacy.

- Typical buyer: first-time buyers, relocators, long-term owners

- Development intensity: medium, with ongoing infill and new build opportunities

💶 Property prices in Loveland — Market overview and price segmentation

The market for property for sale in Loveland spans entry-level condos to premium riverfront homes. Single-family homes commonly range from $250,000 to $650,000, with pockets of riverfront and extensively remodeled properties exceeding $750,000. Condominiums and townhouses typically fall between $150,000 and $325,000 depending on size and location.

- Price by district: Downtown riverfront premium: $350k–$800k, East Loveland family subdivisions: $300k–$550k, West/suburban neighborhoods: $250k–$450k

- Price by type: Apartments/condos: $150k–$325k; Townhouses: $220k–$420k; Single-family homes: $250k–$750k+ Average price per square foot in Loveland typically sits in the range of $140–$220 per sq ft ($1,500–$2,400 per m²) depending on finish level and river proximity. Recent market dynamics show moderate appreciation driven by the Cincinnati metro demand and limited in-fill along the river corridor, translating to steady capital growth rather than speculative spikes.

🚗 Transport and connectivity to Loveland — Accessibility for homeowners and commuters

Loveland benefits from proximity to regional highways with I-275 forming a nearby loop and I-71 within a short drive, providing direct access to Cincinnati and surrounding employment centers. Average drive time to downtown Cincinnati is around 20–30 minutes depending on traffic and the specific Loveland neighborhood. The nearest major airport is Cincinnati/Northern Kentucky International Airport (CVG), roughly 25–35 miles by car.

- Local connectivity: Little Miami Scenic Trail (bike/pedestrian), regional bus links to Cincinnati, park-and-ride options

- Highway access: I-275 loop and state routes that connect to I-71 and US-50 Public transit options are limited compared to dense urban cores; most residents rely on private vehicles for daily commutes. Amtrak service is available from Cincinnati for regional rail travel, and several regional bus providers and commuter shuttle services link suburban nodes to downtown Cincinnati.

🏫 Urban infrastructure and amenities in Loveland — Schools, healthcare and leisure

Loveland’s public education is provided by the Loveland City School District, which is widely rated and a major draw for family buyers; Loveland High School and Loveland Intermediate are local anchors. For higher education and specialized programs, the University of Cincinnati and Miami University are reachable within a one-hour drive, expanding workforce and student rental demand.

- Schools: Loveland City School District (elementary through high school)

- Nearby universities: University of Cincinnati, Miami University, Xavier University Healthcare access includes regional hospital systems and medical centers within the Cincinnati metro, with local clinics and urgent care facilities in and around Loveland. Major hospital systems such as Mercy Health and Cincinnati-based hospitals serve the region. Retail and leisure infrastructure includes boutique shops in Historic Downtown, neighborhood grocery stores, Kings Island and other regional attractions within easy driving distance that support tourism and family recreation.

💼 Economic environment and real estate investment in Loveland — Employment and growth drivers

Loveland’s economy draws strength from the broader Cincinnati metro economy, with employment in healthcare, manufacturing, education, and professional services. Nearby business parks and corporate headquarters in the metro area support commuter demand for mid-priced and family housing in Loveland. Tourism along the Little Miami Scenic Trail produces seasonal revenue streams for hospitality and short-stay rentals.

- Key sectors: healthcare, education, manufacturing, retail, tourism

- Employment access: Cincinnati downtown and suburban business parks within commuting distance Real estate investment in Loveland benefits from steady job-market linkage to Cincinnati, moderate local housing supply constraints along the river, and a consistently active rental market for family and seasonal tenants. Investors targeting ROI typically forecast gross rental yields of 3%–6% depending on property type and management model.

🏗️ Property formats and new developments in Loveland — New build property and resale property

The Loveland market comprises a mix of new developments in suburban lots, infill renovations in the historic downtown, and a steady supply of resale property. New developments in surrounding Clermont and Warren counties are often single-family subdivisions and planned communities by regional builders; infill projects near the river emphasize adaptive reuse and pedestrian orientation.

- Formats: single-family homes, townhouses, condominiums, mixed-use infill

- New builds vs resale: New builds are common in expanding suburban tracts; resale inventory drives downtown availability Buyers considering off-plan property in Loveland or new developments should look to suburbs adjacent to Loveland for larger parcels and contemporary community amenities, whereas buyers seeking character often purchase resale property for renovation and value-add strategies.

🏢 Developers and residential projects in Loveland — Builders and ongoing activity

Regional developers active in the Greater Cincinnati market and near-Loveland areas include companies such as Fischer Homes, Drees Homes, M/I Homes, PulteGroup, and Lennar, which regularly build subdivisions across Clermont, Hamilton, and Warren counties. Within Loveland itself, redevelopment focuses on small-scale mixed-use projects and riverfront adaptive reuse rather than large master-planned communities.

- Notable developer presence: Fischer Homes, Drees Homes, M/I Homes, PulteGroup, Lennar

- Project types: suburban subdivisions, infill renovations, riverfront adaptive reuse When evaluating new developments and builders, check local permitting history, builder warranties, and reviews; regional builders typically offer standard warranties and financing partnerships that support purchase with installment plans or incentivized mortgage products.

💳 Mortgage and financing for property in Loveland — Loans, instalments and foreign buyer conditions

Financing options in Loveland follow general US mortgage practices: conventional loans, FHA for qualified US buyers, and portfolio lending for investors. For foreign buyers, many lenders require higher down payments—commonly 30% or more—and documented income, while loan terms often range 15–30 years. Interest rates are market-dependent and vary by borrower profile.

- Typical financing: conventional mortgages, bank portfolio loans, developer installment options

- Foreign buyer norms: downpayment 30%–50%, strict documentation, possible higher interest premiums Developers occasionally offer installment plans or incentive-based financing on new build property in Loveland and surrounding suburbs; buyers should ask for written terms, payment schedules, and completion guarantees. Property in Loveland with mortgage or property in Loveland with installment plan options exist but depend on lender and developer policies.

📝 Property purchase process when buying property in Loveland — Steps for domestic and international buyers

The purchase process follows a standard US sequence: property search, offer and negotiation, contract execution with earnest money deposit, inspections and contingencies, title search, mortgage finalization, and closing at escrow. Foreign buyers frequently use a local real estate attorney and title company to manage closing and ensure clear title.

- Standard steps: search → offer → inspection → title/escrow → closing Payment methods include bank wire transfers, escrowed funds, and certified checks for down payments and closing costs; international buyers often set up U.S. bank accounts and obtain an ITIN for tax reporting. Inspections and title insurance are critical safeguards for resale property in Loveland, especially for older riverfront homes.

🔐 Legal aspects and residence options for property in Loveland — Ownership, taxes and visas

Non-resident foreigners may buy and own real estate in Loveland without special restrictions; ownership does not automatically grant residency in the United States. Property tax rates vary by county and are billed annually; typical effective property tax rates in Ohio range around 1%–2% of assessed value depending on local levies and assessments.

- Ownership: foreign nationals can hold title in personal name or via entities

- Taxes: annual property tax, potential local assessments, federal income tax on rental income for non-residents Investors interested in residence options should consult immigration counsel about visa pathways such as investor visas or employment-based routes; purchasing real estate alone is not a direct immigration shortcut. Compliance with IRS reporting (including FIRPTA when selling) and local tax filings is essential for foreign owners.

🎯 Use cases and investment strategies for property in Loveland — How to buy property in Loveland for different goals

Permanent residence: Families targeting Loveland’s school district and suburban amenities should focus on East Loveland subdivisions and larger single-family homes with 3–5 bedrooms and 1,800–3,500 sq ft. Long-term rentals: Suburban neighborhoods near commuter routes yield stable occupancy and tenant profiles.

- Best districts: East Loveland and West suburban pockets for family homes and long-term rental units Short-term rental and holiday use: Downtown Loveland and riverfront properties near the Little Miami Scenic Trail perform well for short-term stays due to trail tourism and events.

- Best districts: Historic Downtown and river corridor for short-term rental property and boutique guest stays Buy-to-flip and renovation: Older river homes and downtown cottages present value-add opportunities for renovation and resale; buyers targeting ROI should budget for renovation, permitting, and seasonal demand fluctuations. For investors focused on diversification, mixed holdings of new build property in Loveland and resale property across the Cincinnati metro can stabilize income while capturing capital growth.

Loveland’s mix of riverfront charm, commuter access, and stable suburban neighborhoods makes it a practical choice for buyers seeking lifestyle value or steady real estate investment in the Cincinnati region. Whether pursuing a family home, an investment property in Loveland, or a new build property in Loveland with an installment plan or mortgage, local market familiarity and professional guidance—agent, lender, attorney—are the cornerstones of successful acquisition and long-term ownership.

Frequently Asked Questions

Loveland prices vary by property type: single-family homes commonly range USD 350,000–475,000; townhouses often USD 260,000–350,000; condos USD 200,000–300,000. Long-term rentals typically list USD 1,300–2,000/month depending on size. Price tiers reflect lot size, school district and proximity to downtown or riverfront.

Yes — non‑US citizens can buy Loveland property. Financing is harder and lenders may require larger down payments. Foreign sellers face FIRPTA withholding (commonly ~15% of gross sale) on dispositions; buyers and sellers should get an ITIN and US tax advice. Property ownership does not confer residency or a visa.

Loveland, a Cincinnati suburb, shows steady family rental demand from commuters. Typical gross rental yields for single-family rentals are around 5%–8%; occupancy tends to be moderate to high in family neighborhoods. Liquidity is reasonable but slower than urban cores; market activity is strongest in spring/summer.

Expect annual property tax bills roughly in the 1.2%–1.8% range of assessed value (varies by county and levies). Closing costs typically total 2%–5% of purchase price (title, escrow, recording fees, lender fees). Check county treasurer for exact rates and any local levies or school district charges.

For families, consider historic Downtown Loveland for walkability and community amenities; established subdivisions east/west of downtown for larger yards and proximity to Loveland City Schools; riverfront and rural edge parcels for bigger lots and privacy. Prioritize homes within the Loveland school district for resale and quality of life.

Short‑term rentals depend on zoning, city rules and HOA covenants. Loveland is not a resort market, so many neighborhoods restrict STRs; you may need registration, a business or lodging tax remittance, and compliance with local safety codes. Always verify city planning and HOA rules before listing.

Yes — many Loveland neighborhoods have reliable broadband (100+ Mbps available in much of the city) and a quiet, family‑friendly lifestyle. Coworking spaces are limited in‑city but accessible in nearby Cincinnati. Long stays are practical via rentals; check specific addresses for fiber or high‑speed options before committing.

Typical timelines: 30–45 days from accepted offer to close with mortgage financing; 7–14 days for cash deals. Allow 7–10 days for inspection contingencies, plus time for appraisal and title search. New‑builds or off‑plan purchases can add months depending on construction schedules and permits.

Key risks: construction delays, contractor insolvency, mechanic’s liens, and scope changes. Protections: insist on a detailed contract with completion dates, escrowed deposits, inspection milestones, warranty terms and verified building permits. Check local building‑department records and request progress photos and lien waivers.

Financing: investment loans usually need 20%–25%+ down and higher interest. Taxes: rental income requires US tax filings and allows depreciation/deductions; capital gains rules differ on sale. Management: rentals need tenant screening and maintenance budgeting. For living, prioritize schools, commute and comfort; for investing, focus on cash flow, yield and tenant demand.

Properties by Region

Services in Loveland

Properties by Country

- Real estate in Bulgaria (11408)

- Real estate in Montenegro (5186)

- Real estate in Indonesia (2423)

- Real estate in Spain (2289)

- Real estate in Portugal (1975)

- Real estate in Italy (1924)

- Real estate in Turkey (1699)

- Real estate in Cyprus (1571)

- Real estate in Thailand (1565)

- Real estate in Croatia (1431)

- Real estate in Greece (1082)

- Real estate in USA (1013)

- Real estate in France (1006)

- Real estate in Georgia (519)

- Real estate in Serbia (329)

- Real estate in Slovenia (123)

- Real estate in Egypt (23)

Get the advice of a real estate expert in Loveland — within 1 hour

Looking for a property in Loveland? Leave a request — we will help you take into account all the nuances, and we will offer objects according to your personal request.

Maria Guven

Head of Direct Sales Department

+90-507-705-8082