Discover incredible tax rates in Spain: you won't believe how much you'll save!

Types of taxes in Spain

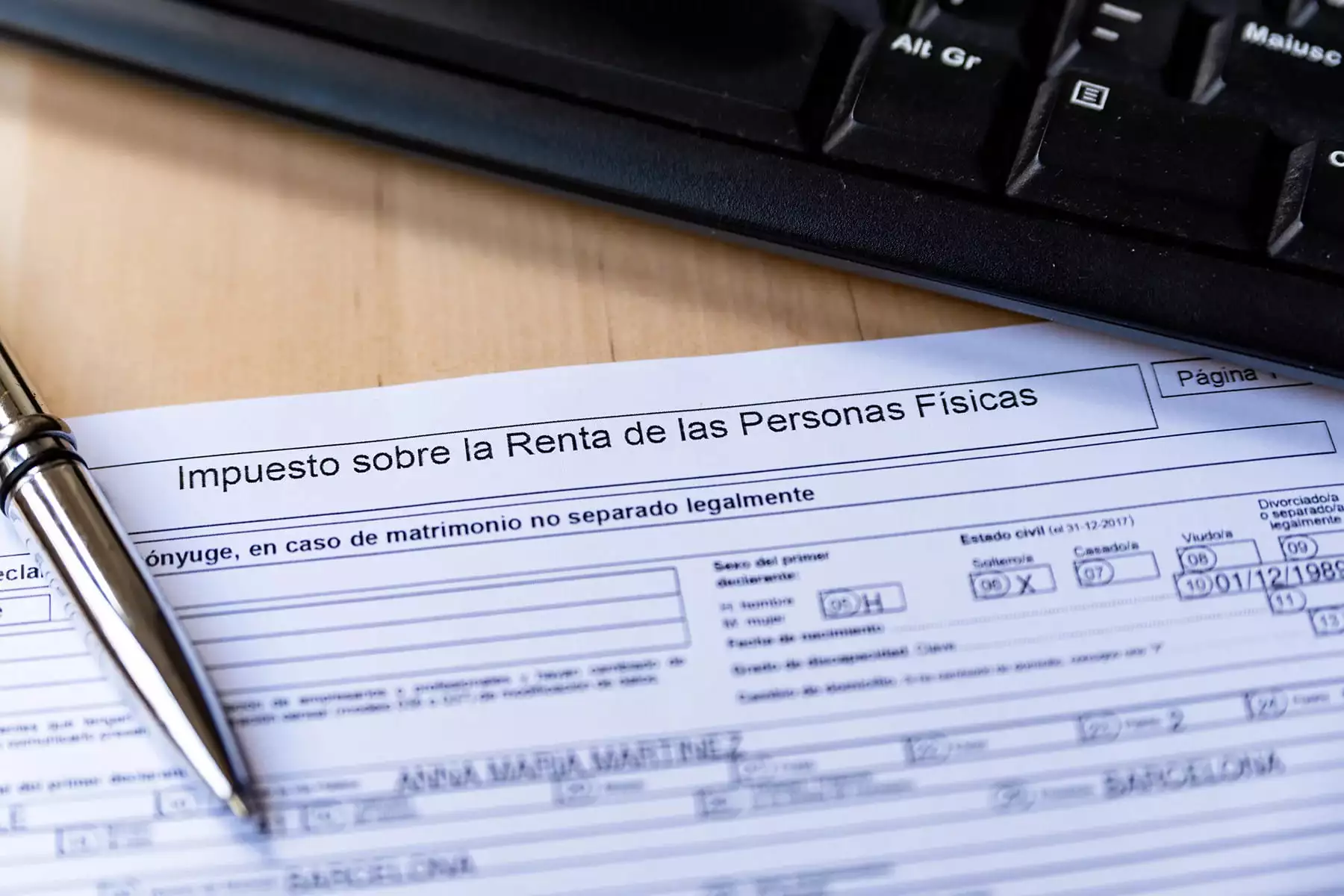

Income tax: In Spain, income tax is paid by all individuals who earn income from sources such as wages or capital gains. Tax rates are progressive, meaning higher earners pay more than lower earners. Income tax rates can range from 19% for people earning less than €12,450 per year to 45% for those earning more than €300,000 per year.

Value Added Tax (VAT): VAT is a type of indirect taxation that applies to most goods and services sold in Spain. The standard rate is 21%, although some goods may be subject to a reduced rate (4% or 10%) or no VAT at all.

Wealth tax: the wealth tax was abolished in 2008 but reinstated in 2011 with an annual rate ranging from 0.2%-2.5%.

Who pays taxes in Spain?

Taxpayers must register with the local authorities upon arrival in Spain, after which they will have to pay taxes on any income earned while in the country, as well as on any property located in Spain at any time during the year for which they are liable to pay taxes. This applies to both residents and non-residents who own property located in Spain at any time during the year for which they are liable to pay taxes.

Changes in the Spanish tax system over time

Since its inception, the Spanish tax system has undergone a number of changes; these changes have been introduced by both government legislation and judicial decisions on taxation. One example is the introduction of new laws regarding inheritance and gift taxation, which were introduced after a court ruled the previous laws unconstitutional. Another recent change was the repeal of the wealth tax in 2005, which was reintroduced six years later after lawmakers deemed it necessary due to the economic circumstances of the time.

Conclusion

In conclusion, taxpayers looking to save money should consider living and working in Spain due to its progressive income tax rates combined with low VAT taxes compared to other European countries. In addition, those considering moving abroad should also keep an eye out for changes over time to government legislation or court decisions that may affect the amount you owe each financial period. All in all, if you want to keep your finances organized while saving money whenever possible, taking advantage of the incredible tax rates available in Spain could be just what you need!

We will find property in Spain for you

- 🔸 Reliable new buildings and ready-made apartments

- 🔸 Without commissions and intermediaries

- 🔸 Online display and remote transaction

Our managers will help you choose a property

Liliya

International Real Estate Consultant

Subscribe to the newsletter from Hatamatata.com!

Subscribe to the newsletter from Hatamatata.com!

We will find property in Spain for you

- 🔸 Reliable new buildings and ready-made apartments

- 🔸 Without commissions and intermediaries

- 🔸 Online display and remote transaction

Our managers will help you choose a property

Liliya

International Real Estate Consultant

Subscribe to the newsletter from Hatamatata.com!

Subscribe to the newsletter from Hatamatata.com!

I agree to the processing of personal data and confidentiality rules of Hatamatata

Need advice on your situation?

Get a free consultation on purchasing real estate overseas. We’ll discuss your goals, suggest the best strategies and countries, and explain how to complete the purchase step by step. You’ll get clear answers to all your questions about buying, investing, and relocating abroad.

Irina Nikolaeva

Sales Director, HataMatata