Catching a wreck | Jonathan Mingle'.

The head of an oil company will play an important role at this month's United Nations climate meeting in Dubai, The Guardian recently reported.

The article mentioned calling attention to the fact that global warming is getting more serious every year, and this summer there were consequences that no one could ignore.

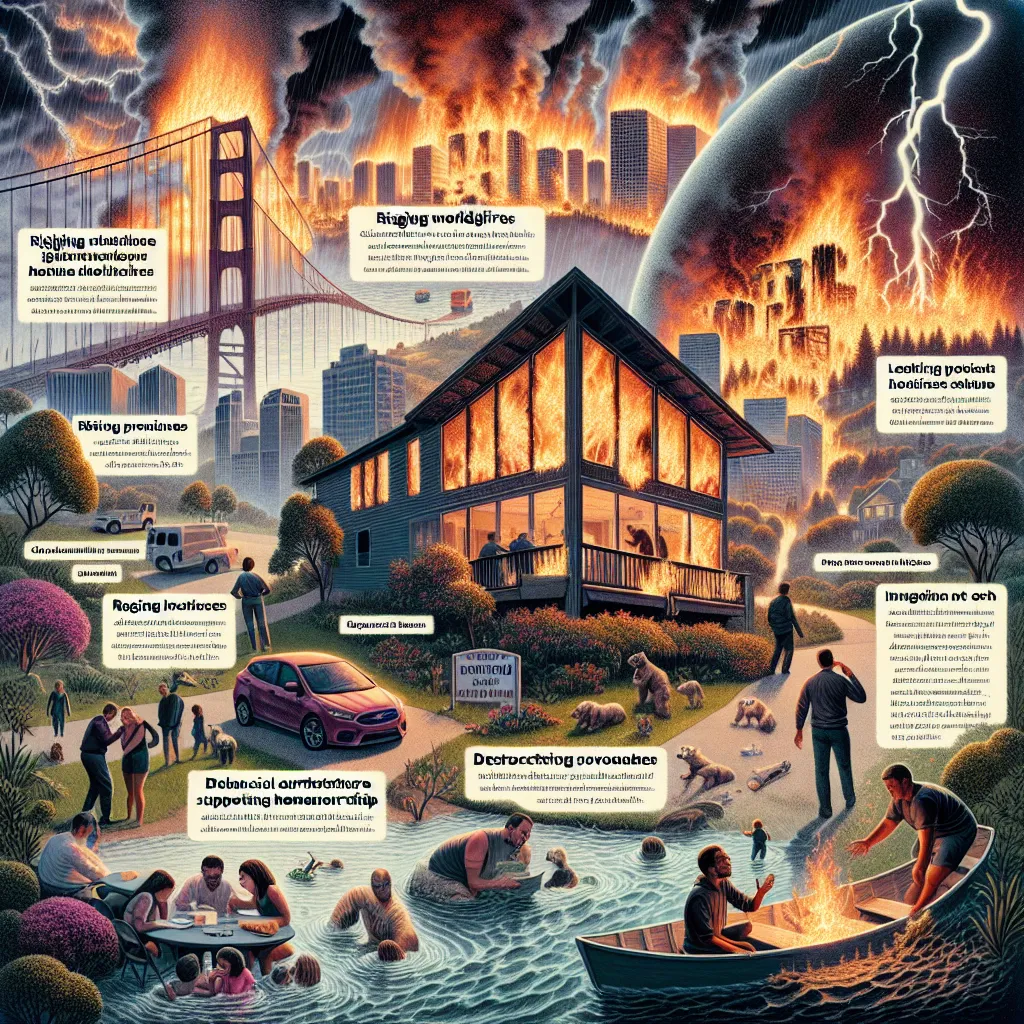

This has truly been a "terrible summer" - a huge number of extreme weather events beyond anything ever captured in human memory or modern temperature records.

The fires began engulfing Canadian forests in April and continued to burn through October, forcing air pollution levels to peak in cities from Chicago to' 'New York.

A hot front has blanketed the southern and central U.S., causing temperatures in Phoenix to exceed 110 degrees Fahrenheit for 31 consecutive days.

Floods hit communities from New England to South Korea, Slovenia to Hong Kong, Greece to Brazil, to Libya.

In August, the deadliest fire in a century destroyed the historic town of Lahaina on Maui, where 99 people died.

While these events are shocking, at least in the U.S., their more significant impacts are likely to be ignored. For decades, climate advocates have wondered if there will ever be a 'Big' catastrophic event that, like an invading army, will force the U.S. political class to address the root cause' 'climate crisis - exorbitant consumption of fossil fuels.

We already have enough evidence to conclude that no single event, or even a long summer stream of dramatic events, will become an inflection point. Just look back at climate shocks of the past: Katrina in 2005, Sandy in 2012, Garvey-Irma-Maria in 2017, and the Florence-Michael Camp Fire in 2018. Heat gusts are subsiding, post-flood water levels are dropping, and the danger signal that unites everyone is flooded with other emergencies.

This is already happening. The temperature extremes of this summer have already become the backdrop, giving way to the growing political crises of the fall at home and abroad.

But there is one event, perhaps' 'impossible to ignore. On the Friday before Memorial Day, State Farm quietly announced it would stop selling new home and business insurance policies in California, where it owns 20 percent of the homeowners market.

About a quarter of all California residents live in areas at high risk of fire, and one of the reasons the company cited is "catastrophe insurance is evolving rapidly." Yet State Farm has closed to new property owners not just in those areas, but across the state, which accounts for 20 percent of the nation's total housing stock. Other major insurers such as Allstate and Farmers have taken similar steps, limiting their exposures in the Golden State.

California is already one of the toughest housing markets for those who' 'more likely to be exposed to floods, windstorms or total destruction is getting more expensive. In 2022 alone, insurance companies suffered $99 billion in losses due to climate-related disasters.

Companies are finally starting to factor climate risks into premiums, which are rising across the country. But even with these increases, premiums can't cover the rising costs of paying claims after disasters and buying reinsurance (insurance for insurers).

As the Grist website recently reported, some insurers are addressing the problem by denying their existing customers renewals or not renewing their policies on homes in hazardous areas, or by withdrawing entirely from hurricane-affected states such as Louisiana.' 'They are starting to leave the more dangerous markets en masse, like fish schools going to friendly waters. Nobody wants to go broke.

These insurance companies are one of the few major institutions clearly assessing current climate instability and acting accordingly. No doubt this is a tough, narrow-minded understanding: millions of homeowners will be left without help, unable to rebuild or recover from the next catastrophe.

This situation poses a threat not just to individual homeowners, but to overall economic stability. Like a tectonic plate shift, the ongoing risk adaptation of insurance models to climate reality is beginning to send' 'seismic waves through the U.S.

14 May 2025

14 May 2025

13 May 2025

The value of the domestic housing market reached a record $47 trillion in the summer, exceeding the aggregate value of all publicly traded U.S. companies. Much of that appraised value is tied up in detached family homes, making the American middle class dream of a home with a fence and white picket fences one of the largest assets to invest in.

Homeownership is the largest source of wealth in the United States. The fact that climate risks are still unaccounted for in the real estate market means there's a huge bubble ready to burst.

One investor who foresaw the 2008 crisis believes a similar 'correction' is looming - a broad decline' 'real estate values. A study released in February says the real estate market could be overvalued by more than $200 billion due to flooding, with Florida overvalued by more than $50 billion.Another 2022 estimate by an actuarial firm suggested a much higher estimate: an overvaluation of $520 billion for flooding alone.

The First Street Foundation, a nonprofit that assesses risk from floods, wind damage and fires, recently concluded that overvalued homes account for a quarter of the total.

If you don't have insurance, it's nearly impossible to get a mortgage. (Almost all lenders require homebuyers to get insurance to completely replace the home before approval' 'mortgages.) Without insurance, real estate values plummet. This insurance-driven crisis will accelerate future climate impacts in advance, destroying the financial architecture of homeownership in many places long before they actually become uninhabitable due to water, wind and fire.

This will also literally hit their pockets. The immigration effect, which has already begun, will cause painful consequences for millions of Americans in their most sensitive places: their wallets.

"\''Work hard, save a little, send your kids to college so they can have a better life than you, and retire to a warmer climate'\''-that's the script we've all been given,'' wrote Lawrence Samuel in A Cultural History (2012).

For' 'Americans, as he noted, the home serves as a refuge, a status symbol, and a source of wealth all in one - a dream based on the assumption that one can always exchange the house for money.

What happens when it's no longer guaranteed? Premiums will continue to rise everywhere, but they will rise even faster for those who live in areas of the country most prone to fire and flooding.

Some homeowners will drop their insurance. All policyholders will pay more and more to maintain risky properties, which in turn will decrease in value.

One of the authors of the First Street analysis, Jeremy Porter, warned that this revaluation could happen very quickly. "To say that a tipping point has occurred to you is not a very' 'far away,'" he said. "It could happen one neighborhood at a time. It could be a big tipping point across the country in the real estate market.".

Tags

Comment

Popular Offers

Subscribe to the newsletter from Hatamatata.com!

Subscribe to the newsletter from Hatamatata.com!

I agree to the processing of personal data and confidentiality rules of Hatamatata