Real estate market downturn: High housing costs, higher mortgage payments

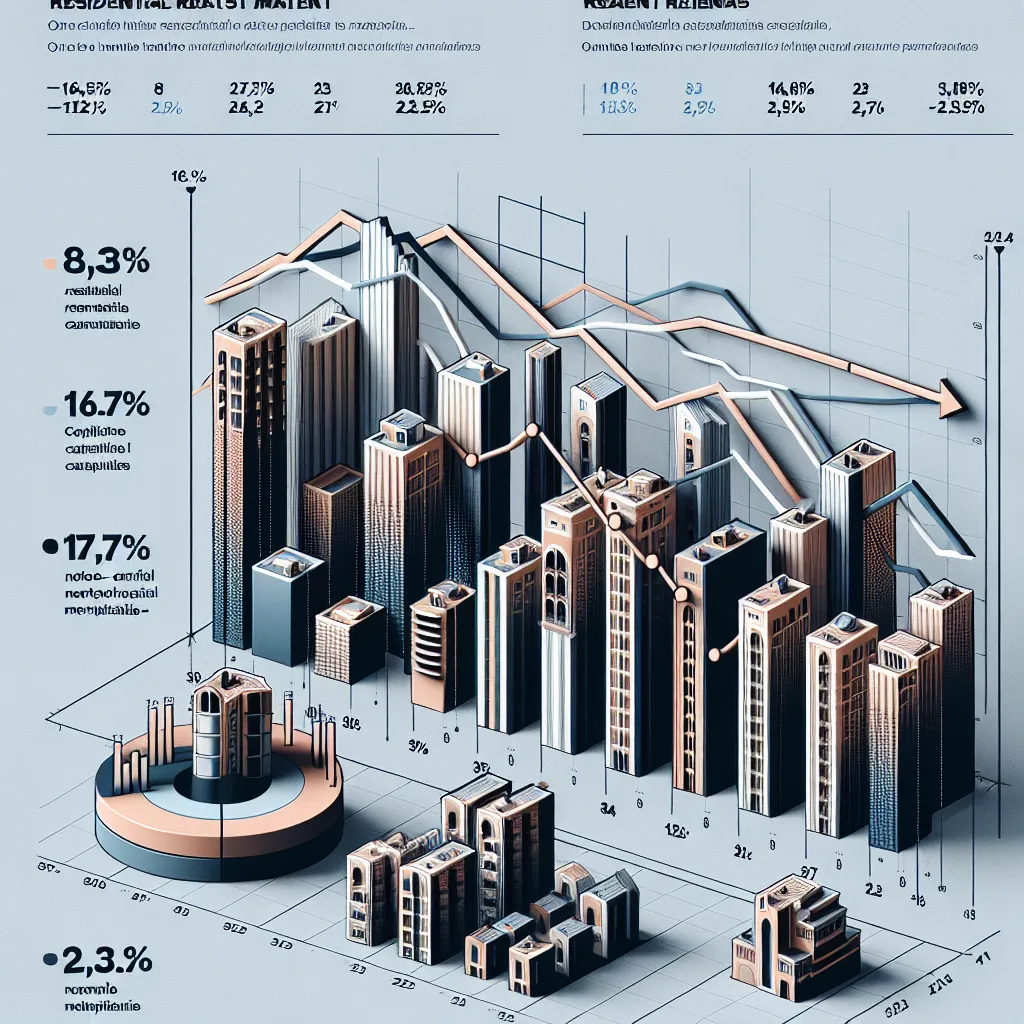

The real estate market sector in Italy continues to see a negative trend. After a decline of 2.1% in the fourth quarter of 2022 compared to the same period of the previous year, the first three months of 2023 registered an even greater decline of 8.3%, with a total number of transactions of 166,745, 15,000 fewer. According to an analysis by Abitare Co. specializing in real estate brokerage and services, drawing on data from the Federal Tax Agency's Property Market Observatory (OMI), metropolitan cities (-10.6%) recorded the largest decline compared to non-metropolitan cities (-7.4%). The strongest decline is recorded in Northwest metropolitan cities (-12.5%), while the only increase is in' 'difficult for many people.

Analyzing the main Italian cities

In the first quarter of 2023, a significant decrease in the number of transactions was observed compared to the same period of the previous year. The most affected metropolitan cities are Bologna (down 23.9% with 1,264 transactions) and Milan (down 22.9% with 5,920 transactions). Other metropolitan cities are also experiencing a negative trend, albeit to a lesser extent, with Rome seeing a 10.3% decline (8,274 deals), Florence down 9.4% (1,208 deals), Turin down 7.1% (3,552 deals), Naples down 7.0% (1,952 deals), Genoa down 5.5% (2,034 deals) and Palermo down 4.4% (1,598 deals).

"The trend in residential real estate transactions in Italy in the first quarter of this year confirms the forecasts made at the end of last year, namely that 2023' 'year will be a year of stagnation in transaction growth, possibly throughout the year,' said Alessandro Ghisolfi, head of research at Abitare Co.

"Rising mortgage interest rates are affecting buyers' decisions and it seems that the peak of interest in spacious accommodation, which was evident in the post-pandemic period, has passed. Indeed, there has been a decline in demand for apartments in general, especially those with more than 100 square meters. If this affects sale prices, we are likely to see a decline only in the second half of the year, especially for older and houses in need of renovation. "

Housing prices

There is also a problem with house prices. According to an analysis of the real estate market conducted by Immobiliare.it,' 'Rents in Italy continue to rise, as student protests show, up 2% for the month (in May compared to April), while sale prices are stable in the same period with a jump of 0.3%. Compared to the previous year, rental rates in the country increased by 7%, reaching an average rate of 12.4 euros per square meter, while sale prices increased by 3%, reaching 2,118 euros per square meter.

Milan remains the most expensive city in Italy with an average price of over €5,200 per square meter, up 0.6% in the last month.

Bolonia, in addition to surpassing Rome in terms of rents, has also become the fourth most expensive place to live in Italy. The average price per square meter in Bolonia is 3,356 euros, while Rome stopped at 3,341 euros, remaining stable over the last month.

Among the other Italian cities above the 3,000 euros per square meter mark are Venice and Trento, both slightly above this level, around 3,005 euros per square meter. Right after them is the Tuscan city of Siena, and the top 10 also includes Naples and Rimini, both around 2,725 euros per square meter.

The cases of Biella and Caltanissetta, two provincial capitals where the sale price is below 800 euros per square meter, should be noted.' 'The average price in Biella is €716 per square meter and in Caltanissetta it is only €704 per square meter.

Mortgage loans

Mortgage loans are another significant problem. According to research, mortgage rates in June 2023 could be a serious problem for Italian families who have opted for variable interest rates and have many more years to pay. Inflation and stagflation are reaching ever higher percentages and are having a significant impact on the real estate market. Forecasts for the next two years are worrying, especially as variable interest rates for mortgages in June 2023 are extremely high. In addition to the fact that fixed rates have saved many Italian' 'families, the same cannot be said for variable rates. The situation became critical already a few years ago.

For example, if we consider a mortgage with a fixed rate of around 5% for a sum of €200,000 to be repaid over 25 years, the current monthly payment would be around €1,218. If the rate were variable, the monthly payment would increase by at least 65% in June 2023.

This monthly payment is too high for most Italians, given the average salary. The European Central Bank has already expressed that rates will rise from zero and could reach 4%.

The bailout options for those with variable mortgage rates in June 2023 are minimal. However, some sensible options may' 'be possible, such as refinancing the mortgage, if contractually stipulated, or renegotiating the mortgage by converting variable interest rates to fixed rates.

Tags

Comment

Popular Offers

Subscribe to the newsletter from Hatamatata.com!

Subscribe to the newsletter from Hatamatata.com!

I agree to the processing of personal data and confidentiality rules of Hatamatata