Real Estate in Chicago

Real estate in Chicago for living, investment and residence permit

- ✓ Verified properties directly from developers

- ✓ No overpayments or commissions

- ✓ Guarantee of transaction purity and post-purchase support

Our managers will help you choose a property

Liliya

International Real Estate Consultant

Need help choosing a property?

Leave a request and our manager will contact you.

Our managers will help you choose a property

Liliya

International Real Estate Consultant

Hot Deals

For Sale Real Estate in Chicago

2 listings

5-bedroom house with new renovation in the center of Chicago, USAChicago is located in northeastern Illinois, on the southwestern shore...

Submit Request

Real estate in Chicago for living, investment and residence permit

- ✓ Verified properties directly from developers

- ✓ No overpayments or commissions

- ✓ Guarantee of transaction purity and post-purchase support

Our managers will help you choose a property

Liliya

International Real Estate Consultant

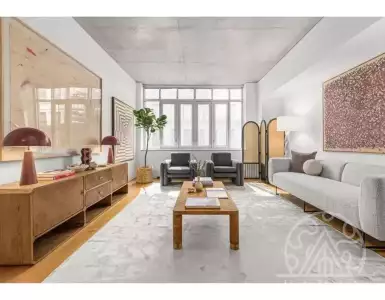

A condo with an equipped kitchen and two bedrooms in Chicago, USAThis charming 2-bedroom, 2-bathroom condo is located on the...

Submit Request

Recommended to see

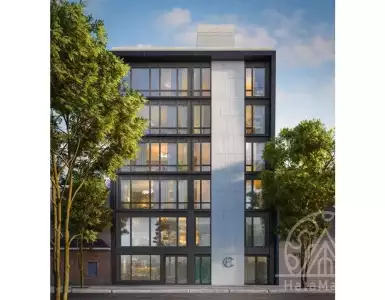

Maison Commonwealth is a boutique complex of 5 apartments, consisting of two combined brownstones and a brand new building overlooking...

Submit Request

Welcome to the embodiment of luxurious living in the heart of Brentwood. This luxurious building, The Dorothy-Granville, is a rare...

Submit Request

Located on Monument Square in a beautiful brick townhouse, this elegant three-story condominium offers two bedrooms and three bathrooms, as...

Submit Request

Located in the prestigious One Paraiso Edgewater complex in the heart of Miami, these exquisite 3-bedroom apartments embody luxury and...

Submit Request

Welcome to the home of your dreams in the heart of Gallery and Tanglewood district. This bright and open 3...

Submit Request

Beautiful oasis with 4 bedrooms and 3.5 baths in desirable Woodlake Forest IV. This bright and spacious home features gorgeous...

Submit Request

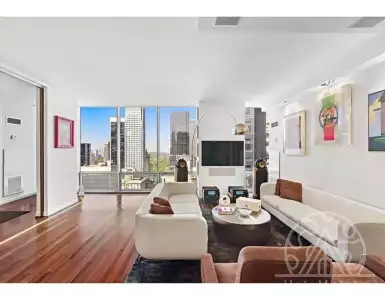

THE CONDOMINIUM, 246 WEST 17th STREET Superbly located in the endlessly thriving, always bustling, and perpetually coveted neighborhood of Chelsea,...

Submit Request

Well-maintained home in the northern part of Scottsdale on the Troon Monument golf course with beautiful views of Pinnacle Peak....

Submit Request

The iconic Olympic Tower building at 641 5th Ave, residence 31C, is one of the most sought after by celebrities,...

Submit Request

Introducing a new full-floor condominium that combines stunning interiors and a private outdoor space with the trendy lifestyle of Williamsburg....

Submit Request

This significant golf course lot, located in the highly sought-after Pinnacle Peak Country Club in North Scottsdale, overlooks the 11th...

Submit Request

Located on the beautiful street of Edgewood Drive, this colonial house boasts a huge lot and a swimming pool. Sun-drenched...

Submit Request

Real Estate in Chicago

Real estate in Chicago for living, investment and residence permit

- ✓ Verified properties directly from developers

- ✓ No overpayments or commissions

- ✓ Guarantee of transaction purity and post-purchase support

Our managers will help you choose a property

Liliya

International Real Estate Consultant

Need help choosing a property?

Leave a request and our manager will contact you.

Our managers will help you choose a property

Liliya

International Real Estate Consultant

Need help choosing real estate in Chicago?

Leave a request and we will select the 3 best options for your budget

!

!

Other Properties for sale in Boston, USA 7 156 875 $

Maison Commonwealth is a boutique complex of 5 apartments, consisting of two combined brownstones and a brand new building overlooking...

!

!

For sale Flat in LA, USA 1 241 495 $

Welcome to the embodiment of luxurious living in the heart of Brentwood. This luxurious building, The Dorothy-Granville, is a rare...

🇺🇸 Chicago homes for sale: lakefront condos, Lincoln Park listings, taxes & prices

Chicago is a city of neighborhoods and skyline moments, where Lake Michigan meets a dense urban grid of culture, commerce, and transit. For buyers ranging from private homeowners to institutional investors, Chicago offers a mix of high-rise luxury, historic townhouses, new developments and well-priced resale stock. The market balances steady rental demand from students, professionals and tourists with opportunities for capital appreciation driven by large-scale redevelopment corridors and strong institutional employers.

💫 Chicago city lifestyle and Property in Chicago overview

Chicago sits on the southwestern shore of Lake Michigan, giving downtown neighborhoods waterfront access, beaches and a compact central business district known as the Loop. The climate is continental — cold winters with lake-effect wind and warm summers that make beaches like North Avenue Beach, Oak Street Beach and Montrose Beach highly visited amenities that add lifestyle value to adjacent properties. Chicago’s character blends Midwestern pragmatism with global arts, sports and food scenes. Residents benefit from major cultural anchors such as the Art Institute of Chicago, Millennium Park and Navy Pier, and the city hosts multiple professional sports teams which support short-term rental demand near arenas and event venues. Property in Chicago attracts long-stay residents and investors because it combines diversified employment centers, tiered pricing by neighborhood and a long pipeline of both new developments and resale stock. For buyers who want real estate in Chicago with clear transport links, established services and predictable regulations, the city’s scale reduces single-point risk.

🎯 Which district of Chicago to choose for buying property in Chicago

Chicago’s districts vary sharply in proximity to the lake, density, and buyer profile. The Loop and Streeterville sit at the heart of commerce and tourism; River North and River West are premier gallery and nightlife districts; West Loop and Fulton Market are tech and food industry magnets; Lincoln Park, Lakeview and Gold Coast are classic residential neighborhoods; Hyde Park and University District are student- and research-oriented. Buyers should weigh safety, infrastructure and building type:

- Gold Coast / Streeterville: luxury high-rises, waterfront, high walkability, prime retail

- West Loop / Fulton Market: lofts, new glass towers, strong tech and restaurant scene, rapid price appreciation

- Lincoln Park / Lakeview: single-family greystones, townhomes, family-friendly parks and schools

- South Loop / Near South Side: new condos, museum campus access, proximity to the financial district Neighborhood growth dynamics differ: Fulton Market and West Loop saw aggressive redevelopment and rising prices driven by tech and corporate relocations; Lincoln Park and Lakeview offer stable family demand and slower, steady appreciation; Near South Side and South Loop have room for infill and new-build velocity. Target buyer profiles align accordingly: luxury buyers and second-home purchasers often favor Gold Coast and Streeterville; investors seeking rental yield and workforce housing look to Uptown, Bridgeport and parts of the Near North Side.

💶 Property prices in Chicago and market overview

Chicago’s price structure shows clear segmentation between prime downtown condos and outer neighborhoods. Citywide median sale prices vary by building type and district, and price per square foot reflects location and building age. Typical ranges:

- Gold Coast / Streeterville: $700–$1,500+ per sq ft, units often $800k–$5M

- West Loop / Fulton Market: $500–$900 per sq ft, new condos $600k–$3M

- Lincoln Park / Lakeview: $400–$900 per sq ft, townhouses $900k–$3M

- South Loop / Near South Side: $350–$700 per sq ft, condos $300k–$1.5M

- Hyde Park and University District: $200–$450 per sq ft, single-family homes $300k–$1M Price segmentation by property type:

- Apartments / Condos: $250–$1,500+ per sq ft depending on location and luxury level

- Townhouses: $400k–$3M depending on neighborhood and lot size

- Single-family homes in-city: $300k–$4M with upper tiers in North Side enclaves

- Commercial units and retail: widely variable; storefronts on Michigan Avenue and River North command premium rents and sale prices Recent price dynamics show moderate appreciation in established neighborhoods and faster gains where large employers and transit projects stimulate demand. Average rental yields in central neighborhoods commonly range from 4–6% gross, with higher yields of 6–8% in student and outer-city rental pockets.

🚆 Transport and connectivity in Chicago for real estate buyers

Chicago’s transit network is extensive: the CTA ‘L’ rapid transit, bus system, Metra commuter rail and suburban commuter services link neighborhoods to downtown and airports. The Blue Line connects O’Hare International Airport directly to the Loop; the Red Line is the city’s north-south spine through dense residential corridors. Major highways include I-90/94 (Kennedy/Dan Ryan), I-55 (Stevenson) and Lake Shore Drive (US-41), which runs along the lakefront. Typical travel times illustrate convenience: downtown to O’Hare by Blue Line takes about 35–45 minutes, Midway Airport to Loop about 25–35 minutes, and average peak commute within the city often ranges 30–45 minutes by public transport. Metra services provide rapid suburban connections to the Loop with express runs from many lines during peak hours. Connectivity affects both rental demand and resale value: proximity to CTA L stops, Metra stations and major arterial highways increases appeal for commuters and reduces vacancy risk for investment property in Chicago. Buyers seeking value often prioritize neighborhoods with direct Red or Blue Line access or quick driving distance to highways.

🏥 Urban infrastructure and amenities in Chicago affecting property value

Chicago’s infrastructure includes world-class hospitals, top-ranked universities, extensive park systems and a dense retail environment. Major medical anchors are Northwestern Memorial Hospital, Rush University Medical Center, and University of Chicago Medical Center, all of which drive demand for nearby housing from professionals and visiting families. Educational institutions include University of Chicago (Hyde Park), Northwestern University (Evanston) for suburban demand, and University of Illinois at Chicago (UIC). Quality public and private K–12 schools in Lincoln Park and Near North boost family demand and stability. Parks and recreational assets such as Grant Park, Millennium Park, the 18-mile Lakefront Trail, and neighborhood green spaces increase livability metrics. Retail, arts and leisure infrastructure also matter: the Magnificent Mile, River North galleries, Fulton Market restaurants and Navy Pier entertainment all support short-term rental and tourist-driven demand. For investors targeting long-term rentals, proximity to hospitals, universities or corporate campuses is a consistent occupancy driver.

📈 Economic environment and real estate investment in Chicago

Chicago’s economy is diversified: finance, professional services, manufacturing, transportation, healthcare and technology each play a major role. The Loop remains the financial core, while Fulton Market and West Loop attract tech firms and creative industries, creating employment clusters that feed rental demand. The Port of Chicago and O’Hare cargo operations support logistics and trade, and the city benefits from several corporate headquarters and regional offices. Tourism is strong thanks to cultural institutions and events; business travel to downtown business districts provides steadier weekday occupancy for short-stay units near convention venues and hotels. Real estate investment in Chicago is supported by stable demand for office-to-residential conversions, infill development opportunities and large master-planned projects such as Lincoln Yards. Investors track metrics such as job growth, leasing absorption in office and industrial sectors, and development pipelines to measure ROI potential for new developments and resale acquisitions.

🏘️ Property formats and new developments in Chicago including new build property in Chicago

Chicago offers a full spectrum of housing formats: high-rise condominiums and rental towers, mid-rise boutique buildings, townhouses, single-family homes and adaptive-reuse lofts. New developments in Chicago emphasize mixed-use programs with ground-floor retail, amenity floors, fitness and co-working spaces. Buyers should differentiate off-plan property or new build property in Chicago from resale property in Chicago: off-plan units often provide lower entry points and installment opportunities but require developer credibility; resale properties offer immediate occupancy and established performance history. Building density varies from the ultra-dense high-rises of Streeterville to tree-lined townhouse blocks in Lincoln Park. Typical unit sizes and product examples:

- Studio to one-bedroom condos: 450–900 sq ft, popular for investors and first-time buyers

- Two- to three-bedroom units: 900–2,200 sq ft, family-oriented in Lincoln Park and Lakeview

- Townhouses: 1,800–3,500 sq ft, concentrated in Bucktown, Wicker Park and Lincoln Park

- New developments can offer larger amenity packages and smart-home features that command a premium.

🏗️ Developers and key residential projects in Chicago

Chicago’s development landscape includes well-known national and regional developers actively delivering projects across the city. Recognized names include Related Midwest, Crescent Heights, Sterling Bay, Magellan Development Group, and Hines. These developers are associated with large-scale, high-quality residential and mixed-use projects. Notable projects and associations:

- NEMA Chicago — a high-profile rental tower by Crescent Heights in Near North

- One Bennett Park — a luxury residential tower developed by Related Midwest in Streeterville/Lake Shore area

- Lincoln Yards — a major mixed-use master plan led by Sterling Bay on the North Branch corridor

- Aqua Tower — an architecturally distinctive mixed-use tower that helped reframe downtown skyline Project features buyers commonly evaluate include developer track record, warranty programs, materials and finishes, building management, and actual rental performance for investment property in Chicago. For off-plan or pre-construction purchases, working with experienced local brokers and legal counsel to verify delivery timelines and escrow protections is essential.

💳 Mortgage, financing, and installment options for Property in Chicago

Financing options in Chicago follow U.S. norms but foreign buyers often face stricter underwriting. Typical mortgage products include fixed-rate loans with 15–30 year terms and adjustable-rate mortgages for certain buyer preferences. Domestic buyers can access conventional mortgages with 20% down for primary residences; foreign buyers should expect larger deposits. For foreign investors: lenders commonly require 25–30% down payment for a mortgage on an investment property; some portfolio lenders may accept 20% for high-credit foreign nationals. Interest rates depend on credit profile, loan-to-value and market conditions. Closing costs typically range 3–5% of purchase price and include title, escrow, transfer taxes and lender fees. Developer installment plans are sometimes available for new developments and off-plan property in Chicago, particularly for large condo launches. Typical plans include an initial deposit (often 5–10%), staged deposits tied to construction milestones, and a final balance at closing. Buyers pursuing a buy property in Chicago with mortgage should secure pre-approval and, for off-plan deals, confirm the developer’s escrow and refund policy.

📝 Property purchase process for buyers to buy property in Chicago

The standard property purchase workflow includes property search, offer and negotiation, contract (often a Chicago real estate purchase agreement), due diligence, inspections, title search, financing and closing through a title company or attorney. Offers are typically accompanied by an earnest money deposit held in escrow. Foreign buyers should prepare documents early: passport, proof of funds, bank statements, and if applying for a mortgage, employment or income documentation and possibly an ITIN. Inspections (structural, pest, mechanical) and title searches are standard; buyers should budget for appraisal requirements from lenders. Payment methods and escrow arrangements include certified funds or wire transfers to escrow accounts at closing. For off-plan transactions, staged payments to the developer’s escrow are common; for resale property in Chicago, funds clear at closing and title transfers upon recording.

⚖️ Legal aspects and ownership rules for Property in Chicago affecting foreign buyers

Foreign nationals may freely purchase and own property in Chicago; there are no restrictions on foreign ownership at the municipal level. Ownership structures commonly include direct individual title, LLCs for privacy and liability management, or corporate entities depending on tax planning goals. Tax considerations include property taxes assessed by Cook County (effective rates typically fall within 1–2% of assessed value depending on exemptions and assessment methods), city transfer taxes, and federal and state capital gains tax upon sale. Non-resident sellers may be subject to FIRPTA-style withholding mechanics for foreign sellers on U.S. real estate transactions; foreign buyers should consult tax counsel. Owning property does not automatically grant a residence permit in the United States. Investors seeking residency should explore visa categories (work visas, family-based visas, or investment-based programs) with immigration counsel. Legal due diligence should include title insurance, review of condominium association bylaws and HOA dues, and verification of permits for renovations.

🎯 Investment property strategies and use cases to buy property in Chicago

Chicago supports multiple investor strategies: long-term rental for steady cash flow, short-term rental near tourist corridors, buy-to-flip in rapidly appreciating neighborhoods, and premium lifestyle purchases for relocation or second homes. Each use case aligns with specific districts and property types:

- Long-term rental: Lincoln Park, Lakeview, Uptown, Near North — one- to three-bedroom condos and small multifamily buildings with 4–6% gross yields

- Short-term rental: River North, Streeterville, Gold Coast — high occupancy near Navy Pier, museums and the Magnificent Mile (local licensing required)

- Capital appreciation: West Loop, Fulton Market, Near West Side — new developments and conversions with potential for strong appreciation

- Family relocation and primary home: Lincoln Park, Bucktown, Lakeview — townhouses and single-family greystones with access to top schools Investors evaluating ROI should model net operating income after property taxes, insurance, HOA fees and management costs, and stress-test for vacancy and regulatory changes affecting short-term rentals. Diversified portfolios mixing new developments in expanding corridors with stable rental stock around universities and hospitals tend to balance yield and capital growth.

Chicago’s market is large, transparent and layered, offering options for conservative buy-and-hold investors and active buyers seeking redevelopment upside. With clear knowledge of neighborhood dynamics, developer credibility, financing constraints for foreign buyers, and local legal and tax implications, acquisition of property in Chicago can match a wide range of goals from stable rental returns to premium lifestyle ownership.

Frequently Asked Questions

Chicago citywide prices vary by type and area. Expect downtown condos from about $300,000–$1,500,000; neighborhood single‑family homes roughly $250,000–$800,000; entry-level condos in outer neighborhoods $150,000–$350,000. Citywide median resales are in the low‑to‑mid $300,000s (USD). Luxury lakefront and Near North properties command much higher premiums.

Yes—non‑US citizens can buy and hold Chicago property with no ownership restriction. Financing is available but often requires larger down payments (20–30%+) and stricter underwriting. Foreign sellers face US tax rules: rental income is taxable and sales may trigger FIRPTA withholding (up to ~15% of sale proceeds). Nonresidents typically need an ITIN and local tax filing when they earn rental or sale gains.

Chicago offers stable, year‑round rental demand from students, hospitals and corporations. Typical gross rental yields: condos ~4–6% and single‑family houses ~5–8% (USD). Liquidity is solid in popular neighborhoods but slower in fringe areas. Expect steady tenant demand with modest capital growth; pick neighborhoods near transit, universities, or employment hubs for best returns.

Buyers should budget closing costs of about 2–5% of purchase price (USD) plus title, recording fees and possible lender fees. Property tax effective rates in Cook County commonly run roughly 1.6–2.3% of market value annually. Factor in HOA fees, homeowner insurance, and higher winter maintenance. Typical resale closing timeline: 30–60 days; plan 3–12+ months for new construction.

Family‑friendly Chicago areas include Lincoln Park, Lakeview, North Center and Beverly for parks, good schools and lower crime. These neighborhoods offer single‑family homes, good transit access and local amenities; prices are higher than city average. Consider close‑in suburbs if you need top‑ranked public schools or larger yards—commute times to downtown vary 20–60 minutes by rail or car.

Yes—Chicago supports remote workers with widespread fiber and cable broadband (100–1,000+ Mbps in many areas), plentiful coworking, cafes and transit. Long‑stay options include month‑to‑month furnished rentals and leases of 30+ days. Winters are cold and can affect lifestyle; international visitors must follow US visa/ESTA rules for length of stay and cannot work for US employers without proper authorization.

Short‑term rentals are regulated in Chicago: hosts must register, collect local occupancy taxes, and meet safety and zoning rules. Some building HOAs and specific neighborhoods restrict short lets. Permits and registration can take weeks to months; noncompliance risks fines and removal. Check local registration requirements and allow for occupancy tax collection when modeling returns (USD revenue projections).

Off‑plan risks include construction delays, cost overruns, quality shortfalls and financing gaps. Down payments and deposits often range 5–20% (USD) and completion can take 12–36 months. Protect yourself with a detailed contract, escrowed deposits, clear completion dates, inspection rights, and independent legal review. Verify permit status and condo association budgets before signing.

Investment purchases prioritize cash flow, yield and tenant demand; expect higher down payments (20–25%+), property management, and different insurance. Living purchases prioritize layout, schools and lifestyle. Investors target transit corridors, universities or hospitals for steady rents; owner‑occupiers care more about neighborhood feel and resale comfort. Taxes, financing terms and HOA rules often differ between the two.

Check the developer's track record of completed projects, review local permit and inspection records, ask for samples of contracts and warranties, and request escrow arrangements for deposits. Order a title search and lien check, have an independent attorney review construction specs and HOA documents, and confirm timelines and remedies for delays. Ensure clear warranty terms and inspect post‑completion with a licensed inspector.

Properties by Region

Services in Chicago

Properties by Country

- Real estate in Bulgaria (11406)

- Real estate in Montenegro (5375)

- Real estate in Indonesia (2423)

- Real estate in Spain (2289)

- Real estate in Portugal (1975)

- Real estate in Italy (1914)

- Real estate in Turkey (1699)

- Real estate in Cyprus (1578)

- Real estate in Thailand (1565)

- Real estate in Croatia (1431)

- Real estate in Greece (1082)

- Real estate in USA (1013)

- Real estate in France (1006)

- Real estate in Georgia (519)

- Real estate in Serbia (329)

- Real estate in Slovenia (123)

- Real estate in Egypt (23)

Get the advice of a real estate expert in Chicago — within 1 hour

Looking for a property in Chicago? Leave a request — we will help you take into account all the nuances, and we will offer objects according to your personal request.

Maria Guven

Head of Direct Sales Department

+90-507-705-8082