Real Estate in New York

Do you want to buy real estate in New York? We'll tell you where to start

Liliya

International Real Estate Consultant

Need help choosing a property?

Leave a request and our manager will contact you.

Our managers will help you choose a property

Liliya

International Real Estate Consultant

Real Estate in New York

Do you want to buy real estate in New York? We'll tell you where to start

Liliya

International Real Estate Consultant

Need help choosing a property?

Leave a request and our manager will contact you.

Our managers will help you choose a property

Liliya

International Real Estate Consultant

Selection real estate in New York in 15 minutes

Leave a request and we will select the 3 best options for your budget

Weather in New York

!

!

For sale Flat , Spain 196 531 $

📌 A few apartments for sale in Cala de Finestrat - a cozy place between Benidorm and Vieijahoyosa with a...

!

!

Flat for sale , Cyprus 122 777 $

The new residential complex is located in the foothills of Alsanjak. The complex consists of two two-storey buildings. Block A - 12...

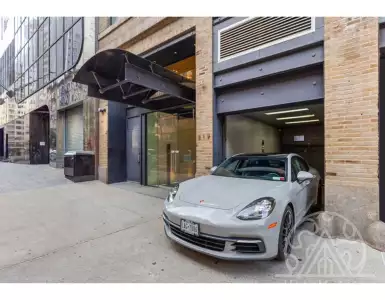

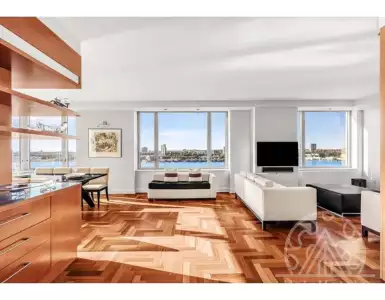

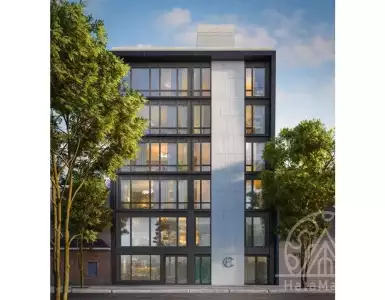

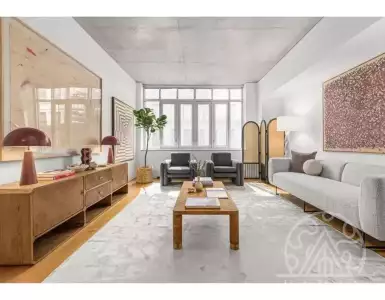

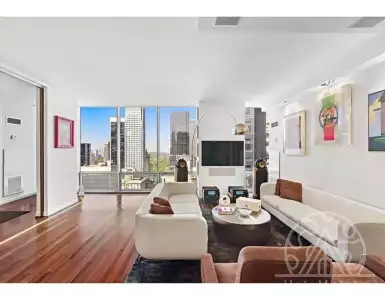

For Sale Real Estate in New York

Other Properties in New York

Flats in Brooklyn

Do you want to buy real estate in New York? We'll tell you where to start

Leave a request and we will select the 3 best options for your budget

Our managers will help you choose a property

Liliya

International Real Estate Consultant

Townhouses in New York

Houses in New York

Houses in Brooklyn

Flats in New York

Selection real estate in New York in 15 minutes

Leave a request and we will select the 3 best options for your budget

🇺🇸 Buy real estate in New York State: market prices, closing costs and neighborhood data

New York is both a global finance hub and a diverse residential market where neighborhoods, infrastructure and legal details matter as much as price per square foot. For buyers from private individuals to institutional investors, understanding transport links, school districts, medical centers and the differences between co-op, condo and townhouse markets is essential to make a safe purchase and capture rental or capital returns. The city population of about 8.5 million within the five boroughs and the larger metropolitan area of around 20 million creates persistent housing demand across segments, while the metropolitan GDP of approximately $1.9 trillion supports high-value employment and long-term price resilience.

🗺️ Geography and climate of New York with transport and infrastructure

New York is organized into five boroughs — Manhattan, Brooklyn, Queens, the Bronx and Staten Island — with transit connectivity that includes the New York City Subway (472 stations), Long Island Rail Road (LIRR), Metro‑North, PATH and commuter bus networks that feed three major airports: JFK, LaGuardia and Newark Liberty. Average travel times to Manhattan vary: from Long Island City or downtown Brooklyn it's typically 15–30 minutes by transit, from Westchester 30–60 minutes by Metro‑North.

New York has a temperate climate with hot, humid summers and cold winters; average temperatures are around 77°F (25°C) in July and 32°F (0°C) in January, with weather patterns that influence seasonal rental demand and heating costs.

New York’s infrastructure includes world‑class hospitals and universities that drive stable demand: NYU Langone, Mount Sinai, Columbia University, New York University, Cornell Tech on Roosevelt Island, and major public hospital networks. Quality schools and medical centres are concentrated near Manhattan and parts of Brooklyn and Westchester, affecting property desirability and pricing.

💶 Property prices in New York by type and district

Property values in New York vary sharply by borough, housing type and finishing. Average price indicators to expect when you research property in New York:

- Manhattan condos: average price per square foot $1,200–$2,000, median sale prices for many buildings $1.0M–$4.0M, luxury penthouses $10M+.

- Brooklyn condos and brownstones: price per sq ft $700–$1,200; brownstones and townhouses often $1.5M–$6M depending on neighborhood.

- Queens (Long Island City, Astoria): condos $600–$900 per sq ft, with many new‑build listings from $600k for one‑bedrooms.

- Outer borough single‑family homes and Westchester suburbs: $500k–$2.5M, depending on lot size and commute.

Buyers should compare new build property in New York (pre‑war conversions to high‑rise towers) and secondary market property in New York where closing costs, maintenance and co‑op board rules affect net affordability.

🎯 Best areas in New York to buy property for residence and investment

Manhattan neighborhoods remain core for capital preservation: Upper East Side, Upper West Side, Midtown, Chelsea, Tribeca, Financial District (FiDi) attract both renters and wealthy owner‑occupiers.

Brooklyn offers balanced yield and lifestyle: Williamsburg, DUMBO, Brooklyn Heights, Park Slope are strong for long‑term rental demand and family purchases, while Bushwick and Crown Heights provide lower entry prices and upside.

Queens and the north Bronx are attractive for price‑sensitive investors: Long Island City, Astoria, Flushing offer transit access and new developments aimed at renters and first‑time buyers. Suburban markets in Westchester, Long Island and Northern New Jersey serve buyers seeking single‑family homes with school districts and shorter commutes.

🏗️ Major developers and projects shaping real estate in New York

Developers who shape the skyline and new‑build pipeline include Related Companies (Hudson Yards), Extell, Tishman Speyer, Silverstein Properties, Brookfield, Hines, JDS Development Group. These developers run both luxury condominium towers and large mixed‑use projects that influence local comparables and resale values.

Notable projects that define pricing benchmarks: Hudson Yards (Related/Oxford), 30 Hudson Yards, One World Trade Center (Silverstein), 432 Park Avenue (CIM/MPA), 111 West 57th (JDS/PM Group), Manhattan West (Brookfield/Related) and VIA 57 West (TF Cornerstone/BIG).

New developments often include amenity packages (concierge, fitness, co‑working) that justify higher common charges and asking prices, while presales and completion timelines are common purchase structures for investors buying new build property in New York.

🏦 Mortgages and installment plans for property in New York

Foreigners can obtain mortgage financing in USA, but typical expectations differ from resident buyers. Most lenders require a down payment of 25–30% for non‑resident buyers; permanent residents or citizens may obtain 20% down on conventional loans. Typical mortgage products are 30‑year fixed and 15‑year fixed, and prevailing mortgage rates for buyers without full US credit history often range around 6–7% depending on loan size and credit.

Developers frequently offer staged deposits or interest‑free installment plans during construction, commonly structured as 10% at contract, 10–20% during construction milestones, balance at closing, which is useful for buyers seeking property in New York with installment plan options.

Mortgage in USA for foreigners can require additional documentation: passport, foreign tax returns, bank statements, proof of income, and sometimes an ITIN; buyers should also consider currency transfer logistics and mortgage insurance or reserve requirements.

📋 Property purchase process in New York step‑by‑step

Start with budgeting and mortgage pre‑approval or proof of funds to strengthen offers when you buy property in New York. Engage a licensed buyer’s agent and an attorney early; for co‑ops you will need to prepare a detailed financial package for board review, often including tax returns, bank statements, and references.

Offer and contract phases: buyers typically submit a purchase offer with an initial deposit (earnest money commonly 1–5%) followed by attorney review and a larger contract deposit that becomes non‑refundable if the buyer withdraws outside contingencies. Closing timelines vary: condos often close in 30–60 days, co‑ops may require additional time for board approvals.

Final steps include title search, property inspection, securing mortgage commitment, and closing at a title company where deeds are recorded and transfer taxes settled. When purchasing new build property in New York, expect staged closings and final occupant turnover tied to certificate of occupancy.

⚖️ Legal aspects, taxes, residence permits and citizenship by real estate

Buying property in New York does not itself provide immigration status: property for residence permit in New York or citizenship by real estate investment in New York are not available routes. Buyers seeking immigration benefits should explore federal programs such as the EB‑5 immigrant investor program where qualifying investments in job‑creating projects start at $800,000 in targeted employment areas or $1,050,000 otherwise; EB‑5 investments are into business projects rather than direct home purchases.

Tax and transfer costs buyers must budget for include New York State transfer tax (0.4% of sale price), New York City Real Property Transfer Tax (1% for sales $0–$500k; 1.425% for sales over $500k), and the mansion tax at 1% for purchases over $1,000,000. Foreign sellers and buyers should be aware of FIRPTA withholding rules which can require up to 15% withholding on gross sale proceeds if the seller is a foreign person.

Investors also need to plan for annual property taxes (varies by property class), local income or rental taxes, and capital gains tax implications at federal and state levels; proper tax counsel and local attorney involvement are indispensable steps in the purchase process.

📊 Economy, market dynamics and investment potential in New York

New York’s diversified economy — finance, tech, media, healthcare, education — creates robust employment hubs such as Wall Street, Midtown Manhattan, Hudson Yards and Brooklyn Tech Triangle, supporting strong rental demand and corporate leasing. Visitor flows to the city regularly exceed 50 million tourists annually, fueling short‑term demand in hospitality‑adjacent neighborhoods and retail corridors.

Market dynamics show a split between luxury product absorption in central Manhattan and higher‑yield opportunities in outer boroughs where rents relative to purchase price can be stronger. Historically foreign buyers have represented a meaningful share of dollar volume — typically around 10–15% in peak cycles — and institutional capital continues to target large multifamily and logistics assets.

Investors should monitor vacancy and rent growth trends: central Manhattan yields are lower but more stable for capital appreciation, while Brooklyn, Queens and renovation‑led secondary market property in New York can deliver higher gross rental yields in the 4–6% range, subject to local regulations and operating costs.

🔍 Investment advantages and buyer scenarios for real estate in New York

Buyers seeking a primary residence should target neighborhoods with schools, transit and local services: Upper West Side, Park Slope, Riverdale suit families; proximity to Columbia, NYU or Cornell Tech is valuable for parents and investors targeting student housing.

For rental income and buy‑to‑rent strategies, consider Long Island City, Williamsburg, and Bedford‑Stuyvesant where younger professionals cluster and yields are relatively attractive. Short‑term rental strategies face strict New York regulations limiting whole‑unit short rentals in many areas, so expect compliance costs if targeting vacation rental income.

For long‑term capital growth and premium segment investment, trophy assets in Tribeca, Soho and Hudson Yards preserve value; suburban single‑family homes in Westchester and Long Island are better for buyers prioritizing space, schools and seasonal living while retaining access to Manhattan employment.

New York’s property market is complex but navigable with the right local advisors: agents versed in co‑op rules, attorneys experienced in transfer taxes and FIRPTA, mortgage brokers who work with foreign buyers and developers offering staged payments. Whether you plan to buy property in New York for residence, rental income, or long‑term appreciation, the decisions you make about neighborhood, product type and financing will determine yield, liquidity and the ease of ownership.

Frequently Asked Questions

Prices vary widely by market. In NYC core, Manhattan condos/co‑ops often range from high six‑figures to multi‑million USD; typical price per sq ft ~1,200–2,000+/sqft. Brooklyn ~700–1,400/sqft; Queens ~400–800/sqft. Suburbs/Long Island commonly $300–700/sqft. Upstate single‑family medians often fall in the $350,000–500,000 range. Local neighborhood, building class and taxes drive large variation.

Yes. Non‑US citizens can buy and hold title with no residency requirement. Financing is tougher: expect 25–40% down for nonresident mortgages; many pay cash. Foreign owners pay local property tax and US tax on rental income and sales; filing obligations apply. Withholding rules on sales may apply—consult a US tax advisor and get an ITIN for transactions and financing.

Gross rental yields: Manhattan often 2–4%, Brooklyn/Queens 3–6%, suburbs/upstate 5–9%, depending on property type. Demand is strong in job and university hubs; vacancy rates in core metro areas commonly 3–7%. Liquidity: prime urban condos can sell in weeks–months; suburban and upstate properties may take longer. Factor management, maintenance and local rent‑stabilization rules into net returns.

Yes for urban amenities: extensive public transit (subway, commuter rails), dense healthcare network and many school options public and private. Commutes in metro areas often 20–60+ minutes. Cost of living and housing is above US average. Utility/setup times are generally 1–7 days; access to services, groceries and emergency care is broad in the metro area.

Metro New York has widespread high‑speed internet—100–1,000+ Mbps in most neighborhoods—and many coworking spaces and cafes. Mobile coverage is reliable in urban areas. Long stays require appropriate US visa (tourist status does not authorize local employment). Rural/upstate areas may have slower broadband; budget for higher housing costs in the city.

The US has no residency or 'golden visa' purely for buying property. Investor immigration route EB‑5 can lead to residency: typical investment thresholds are about $800,000 in targeted employment areas or ~$1,050,000 otherwise, plus job‑creation requirements and multi‑year processing. Other pathways are employment, family sponsorship or study—consult an immigration attorney.

Buyer's closing costs commonly 2–5% of purchase price (varies by state/municipality); sellers often pay broker commissions ~5–6%. Annual property tax rates vary but often 0.5–2% of assessed value. Capital gains face federal long‑term rates up to 20% (plus 3.8% NIIT if applicable) and NY state tax up to roughly 10% (top brackets). Typical closing timeline: 30–60 days; co‑ops add time.

Co‑ops are share ownership with strict board approval, financial disclosures and often higher down payments (20–50%) plus larger reserve requirements; monthly maintenance includes building debt and taxes. Condos are fee‑simple ownership with fewer approval hurdles and easier financing; rentals and resale tend to be simpler. Co‑op closings often take longer due to board review.

Typical timeline: pre‑approval and search 1–12+ weeks; accepted offer to closing usually 30–60 days for condos/houses. Co‑op purchases add board interview and approval—expect an extra 4–8 weeks. Mortgage underwriting, appraisal and inspections commonly take 2–4 weeks. Delays come from financing, title issues or co‑op board processes.

If your property sits in a FEMA‑designated flood zone and you have a federally backed mortgage, lenders will require flood insurance. Premiums vary widely—roughly $500 to several thousand USD per year—depending on elevation, zone and claims history; coastal/high‑risk properties can be much higher. Private flood policies supplement or replace NFIP coverage; check FEMA maps and get elevation data.

Property by cities

- Real estate in New York (124)

Properties by Region

Properties by Country

- Real estate in Bulgaria (11406)

- Real estate in Montenegro (5371)

- Real estate in Indonesia (2423)

- Real estate in Spain (2289)

- Real estate in Portugal (1975)

- Real estate in Italy (1925)

- Real estate in Turkey (1699)

- Real estate in Cyprus (1573)

- Real estate in Thailand (1565)

- Real estate in Croatia (1431)

- Real estate in Greece (1082)

- Real estate in USA (1013)

- Real estate in France (1006)

- Real estate in Georgia (519)

- Real estate in Serbia (329)

- Real estate in Slovenia (123)

- Real estate in Egypt (23)

Free real estate consultation in New York

Don't know which area to choose in New York? We will tell you in which areas it is better to live or invest, and show you the appropriate options.

Maria Guven

Head of Direct Sales Department

+90-507-705-8082