Flat in New York

Do you want to buy flat in New York? We'll tell you where to start

Liliya

International Real Estate Consultant

Need help choosing a property?

Leave a request and our manager will contact you.

Our managers will help you choose a property

Liliya

International Real Estate Consultant

Flat in New York

Do you want to buy flat in New York? We'll tell you where to start

Liliya

International Real Estate Consultant

Need help choosing a property?

Leave a request and our manager will contact you.

Our managers will help you choose a property

Liliya

International Real Estate Consultant

Selection flats in New York in 15 minutes

Leave a request and we will select the 3 best options for your budget

Weather in New York

!

!

For sale Flat , Spain 196 531 $

📌 A few apartments for sale in Cala de Finestrat - a cozy place between Benidorm and Vieijahoyosa with a...

!

!

Flat for sale , Cyprus 122 777 $

The new residential complex is located in the foothills of Alsanjak. The complex consists of two two-storey buildings. Block A - 12...

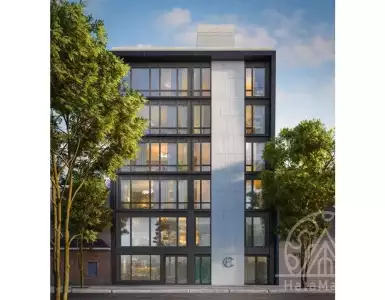

For Sale flat in New York

Flats in Brooklyn

Flats in New York

Do you want to buy flats in New York? We'll tell you where to start

Leave a request and we will select the 3 best options for your budget

Our managers will help you choose a property

Liliya

International Real Estate Consultant

Didnt find the right facility?

Leave a request - we will handle the selection and send the best offers in a short period of time

Irina Nikolaeva

Sales Director, HataMatata

Selection flats in New York in 15 minutes

Leave a request and we will select the 3 best options for your budget

🇺🇸 Buying flats in the New York region: market trends, pricing and neighborhood comparison

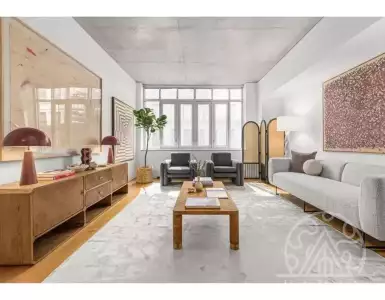

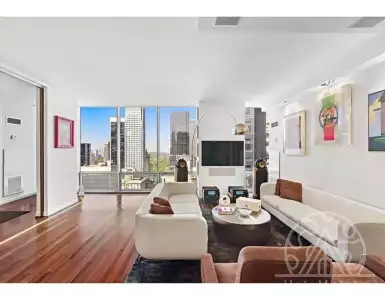

Purchasing a flat in New York offers a unique blend of opportunity and lifestyle that attracts a diverse array of buyers, from young professionals seeking an urban sanctuary to seasoned investors looking to capitalize on a thriving real estate market. Whether you're eyeing a chic studio in the heart of Manhattan or a spacious family flat in Brooklyn, understanding New York's real estate landscape is crucial for making informed decisions. The city's dynamic neighborhoods, robust infrastructure, and vibrant economy combine to create a lucrative environment for flat purchases.

🌍 Characteristics of the New York Region Influencing Flat Purchases

New York is a sprawling metropolis characterized by its rich cultural diversity, iconic architecture, and extensive public infrastructure. The city's geography includes five boroughs—Manhattan, Brooklyn, Queens, the Bronx, and Staten Island—each offering distinct characteristics that influence flat demand. The temperate climate, with mild winters and warm summers, creates year-round desirability for homebuyers and renters alike.

Infrastructure is another key factor shaping the demand for flats. The extensive New York City Subway system, alongside various bus routes and ferries, ensures that residents have easy access to commuting options. Major thoroughfares like the FDR Drive and the Brooklyn-Queens Expressway enhance connectivity for vehicle owners. This robust transportation network means that even neighborhoods further from the city center remain popular among buyers who prioritize affordable living without sacrificing accessibility.

Tourism and business centers are concentrated in areas like Midtown Manhattan and the Financial District, which further increases the demand for flats in these locales. Neighborhoods such as Williamsburg in Brooklyn are emerging as trendy hubs for young professionals, with an influx of cafes, shops, and cultural venues. These features contribute significantly to the high demand for flats, which has only grown over the years.

📈 Economic Factors and Investment Climate in New York

New York's economy is one of the largest and most diversified in the world. The city boasts a staggering GDP of approximately $500 billion, which underscores its status as a global economic powerhouse. Key industries include finance, media, technology, and real estate, all of which contribute to a relatively high income per capita.

The investment climate is bolstered by consistent demand and limited housing supply, which creates a favorable backdrop for investment in flats. With approximately 60 million tourists visiting annually, there is a steady influx of potential renters seeking accommodation, thus increasing the rental yield potential. This demand contributes to a strong rental market characterized by an average rental yield between 3-5%, making it an attractive destination for flat buyers aiming for investment.

While the cost of living is high, particularly in desirable neighborhoods, New York remains resilient in its ability to attract foreign investment. The tax burden, while notable, is mitigated by the potential return on investment (ROI), as the property market shows a consistent appreciation trajectory. International buyers often view purchasing a flat as both a lifestyle enhancement and a prudent investment choice.

💰 Prices for Flats in New York: What to Expect

When considering purchasing a flat in New York, understanding the price range is essential. The average price for flats varies significantly based on location, size, and condition. For instance:

- Manhattan: Average prices range between $1,000 and $2,500 per square foot, with luxury developments in areas such as the Upper East Side often exceeding this range.

- Brooklyn: Pricing can be slightly lower, averaging $700 to $1,300 per square foot. Brownstone flats in areas like Park Slope are particularly coveted.

- The Bronx: More affordable options can be found, with prices averaging around $300 to $600 per square foot. Neighborhoods like Riverdale offer more space for less cost.

The demand for new developments adds complexity to pricing. Many buyers are attracted to luxury high-rises with modern amenities and sustainable features. This concentration on quality leads to premium pricing but often ensures higher appreciation rates.

Price breakdown by areas:

- Flat format and prices:

- Studios: $300,000 - $800,000

- One-bedroom flats: $500,000 - $1.5 million

- Two-bedroom flats: $800,000 - $3 million

In terms of market dynamics, areas like Astoria in Queens are becoming increasingly popular due to their affordability and growing cultural scene, causing prices to rise as demand meets newfound interest.

🏙️ Key Cities and Districts for Purchasing Flats in New York

Choosing the right city or district is pivotal for maximizing the value of your flat purchase. Here’s a closer look at popular areas:

-

Manhattan:

- Known for its vibrant neighborhoods such as Tribeca and SoHo, which feature high-end shopping and nightlife.

- Centrally located, offering unparalleled access to business hubs, making it ideal for professionals.

-

Brooklyn:

- Williamsburg and DUMBO attract a younger demographic thirsty for artistic cultures and innovative living.

- Coney Island adds a seasonal tourist appeal, ideal for those considering rental opportunities.

-

Queens:

- Astoria is gaining traction thanks to its diverse food scene and suburban feel close to the city.

- Flushing boasts major Asian communities and economic growth, presenting lucrative investment options.

-

The Bronx and Staten Island:

- Offer a more local vibe with sweeping parks and more reasonable prices, making them suitable for families.

Understanding the unique benefits of each location empowers buyers to make strategic decisions based on their lifestyle or investment goals.

🏢 Top Developers and Projects Featuring Flats in New York

Several leading developers in New York are known for their high-quality residential projects. Names like Related Companies, Taconic Investment Partners, and Silverstein Properties dominate the market, delivering innovative residential spaces in desirable locations.

- Hudson Yards: A landmark development offering luxury flats, with prices reaching upwards of $5 million, known for its retail and cultural attractions.

- The Edge in Williamsburg: Features contemporary layouts with prices starting at around $860,000 for 1-bedroom units, aimed at young professionals.

- 300 Ashland in Brooklyn: A striking building with eco-friendly designs and pricing starting at $700,000, targeting environmentally conscious buyers.

These projects not only elevate the living experience but also promise excellent investment opportunities through strong resale values.

🏦 Understanding Mortgage and Installment Conditions for Foreign Buyers in New York

Financing options are fundamental for foreign investors and homebuyers looking to buy flat in New York. Mortgage options are generally available to foreigners, with basic requirements that include proof of income, credit history, and a down payment ranging from 20% to 50% depending on the lender and the property type.

- Interest rates typically vary between 3% to 7%, contingent upon market conditions and the borrower’s financial profile.

- Developer installment plans can be attractive, offering flexible payment schedules averaging 3-5 years before full ownership is secured.

Understanding bank requirements and conditions is essential, as some establishments may impose stricter regulations for non-residents. Thus, it's recommended to consult with a local broker or financial advisor well-versed in New York's real estate market.

📋 The Step-by-Step Process of Buying a Flat in New York

Navigating the process of buying a flat in New York requires diligence and understanding. Here is a concise roadmap to follow:

- Property Selection: Start by defining your budget and desired location, followed by narrowing down your search.

- Reservation: Once you find the perfect flat, you may need to make a reservation fee to secure it.

- Due Diligence: Conduct thorough investigations regarding the property's title, involved liens, and required inspections.

- Contract Agreement: Upon satisfactory due diligence, a binding contract is drafted. It's advisable to have a lawyer review it.

- Payment: Payment terms will be outlined; expect to put down your deposit at this stage.

- Registration and Closing: Work with a notary to legally transfer ownership, paying mandatory costs such as recording fees and taxes.

Understanding the legal and technical intricacies can streamline the purchasing process and help you avoid unnecessary pitfalls.

⚖️ Legal Aspects of Owning a Flat in New York

Owning a flat in New York comes with responsibilities and legal prerequisites that buyers must consider. Rental rules dictate that landlords must register with local housing authorities and comply with tenant laws, ensuring fair practices are upheld.

Property taxes on flats in New York can range significantly but typically average around 1.68% of the property's assessed value. Buyers with investment ambitions must familiarize themselves with the short-term rental laws, especially in tourist-heavy neighborhoods where regulations have tightened recently.

Property ownership does not inherently confer a residence permit or citizenship in the USA; thus, investors primarily buy flats for other benefits such as lifestyle or financial returns. Minimum investment amounts may become relevant when considering specific visas tied to property ownership.

🏡 Purpose of Buying a Flat in New York: From Living to Investment

The diverse offerings of flats in New York cater to various buyers' needs. Whether for primary residence, seasonal living, or as an investment property, options abound:

- Residential Use: Many buyers prefer urban flats for daily living due to the convenience and lifestyle amenities available.

- Investment Opportunities: Real estate investment in New York remains a strong consideration, with substantial potential rental income year-round.

- Seasonal Residence: The allure of New York, especially during the holiday season, prompts many to secure a second home flat for leisure.

Flats located near tourist hotspots often yield better short-term rental pricing, making specific areas suitable for generating additional income.

A strategic approach to the flat market in New York can yield significant rewards. As urban landscapes evolve, understanding market dynamics can ensure that your investment not only meets your immediate needs but grows in value over the years ahead. With continued demand from both locals and international buyers alike, the future of New York's flat market holds abundant promise.

Frequently Asked Questions

Prices vary widely: upstate and small towns $75,000–$400,000; suburban/commuter markets $200,000–$800,000; New York City condos and co-ops commonly $300,000–$1,200,000, with prime Manhattan units exceeding $2,000,000. Use these ranges as regional benchmarks in USD.

U.S. residence paths include investor/immigrant options (EB-5: typically $800,000 in a TEA or $1,050,000 standard) and nonimmigrant investor visas for treaty nationals (E-2) or employment-based routes (L-1, H-1B). Owning a flat in New York does not by itself grant residency or citizenship; visa programs have separate investment, job or treaty requirements and timelines.

New York offers top hospitals, diverse schools, extensive public transit, and strong broadband in urban/suburban areas (fiber/100–1000 Mbps common). Costs are high in NYC but suburbs give space and good services. Remote workers find coworking, fast internet and lifestyle options; choose neighborhood by schools, transit and child‑friendly amenities.

Yes, many lenders finance non‑residents but with stricter terms: down payments often 25–50% of price, interest rates higher than local buyers, and shorter or limited product options. Typical mortgage terms available 15–30 years; expect more documentation, proof of foreign income, and 30–60 day processing.

Owners pay annual property tax typically in the 0.5%–2.5% range of assessed value depending on locality, plus homeowner/condo fees, utilities, and state income tax on rental earnings. Sales can trigger transfer taxes and federal/state capital gains taxes. Budget for 1%–3%+ of value annually including fees and upkeep.

Gross rental yields vary: core NYC units often 2%–4% gross, outer boroughs and suburbs 4%–8%, and some upstate markets higher. Net yield depends on taxes, management, vacancy and fees; expect net returns to be several points lower. Short‑term rentals face strict local rules and may reduce yield potential.

Typical closing timing is 30–60 days from contract to closing. Buyer closing costs commonly total about 2%–5% of purchase price (inspections, title, attorney, recording, mortgage fees). Co-op purchases include board approval timelines that can add weeks to the process.

Monthly fees range widely—roughly $300–$2,000+—depending on building size and services. Fees cover building maintenance, common area utilities, insurance, staff, and reserve funds; co‑op fees may also include property tax portions. Higher‑service NYC high‑rises trend toward the top of the range.

Some New York coastal and low‑lying areas are FEMA‑designated flood zones. If your mortgage is from a federally regulated lender and the unit is in a high‑risk zone, flood insurance is required. Annual premiums vary widely—roughly $1,000–$10,000+ depending on location, elevation and coverage.

Arrange a home inspection, structural and pest checks, and, for older buildings, lead/Asbestos reviews. For co‑ops/condos review bylaws, financials and minutes, get a title search and certificate of occupancy, and check liens. Allow a 7–21 day contingency/review window in the contract.

Properties by Region

Properties by Country

- Real estate in Bulgaria (11406)

- Real estate in Montenegro (5362)

- Real estate in Indonesia (2423)

- Real estate in Spain (2289)

- Real estate in Portugal (1975)

- Real estate in Italy (1915)

- Real estate in Turkey (1699)

- Real estate in Cyprus (1578)

- Real estate in Thailand (1565)

- Real estate in Croatia (1429)

- Real estate in Greece (1082)

- Real estate in USA (1013)

- Real estate in France (1006)

- Real estate in Georgia (519)

- Real estate in Serbia (329)

- Real estate in Slovenia (123)

- Real estate in Egypt (23)

Free real estate consultation in New York

Don't know which area to choose in New York? We will tell you in which areas it is better to live or invest, and show you the appropriate options.

Maria Guven

Head of Direct Sales Department

+90-507-705-8082