Real Estate in New York

Real estate in New York for living, investment and residence permit

- ✓ Verified properties directly from developers

- ✓ No overpayments or commissions

- ✓ Guarantee of transaction purity and post-purchase support

Our managers will help you choose a property

Liliya

International Real Estate Consultant

Need help choosing a property?

Leave a request and our manager will contact you.

Our managers will help you choose a property

Liliya

International Real Estate Consultant

Hot Deals

For Sale Real Estate in New York

124 listings

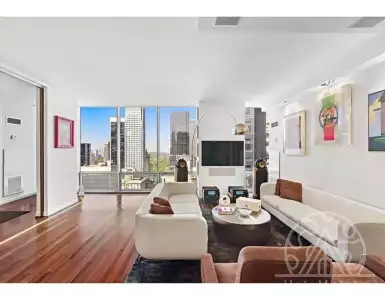

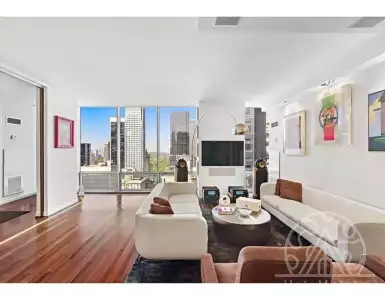

This turnkey apartment is on a high floor in a corner building on the B line with great light and...

Submit Request

The iconic Olympic Tower building at 641 5th Ave, residence 31C, is one of the most sought after by celebrities,...

Submit Request

Hot Deals

Popular

19 October

19 October

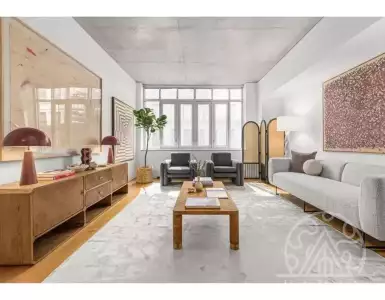

$732 PSF Prime NoMAD. Bring your architect and imagination to this colossal 4,438 +-- SF canvas located in one of...

Submit Request

Real estate in New York for living, investment and residence permit

- ✓ Verified properties directly from developers

- ✓ No overpayments or commissions

- ✓ Guarantee of transaction purity and post-purchase support

Our managers will help you choose a property

Liliya

International Real Estate Consultant

Welcome to 9C at 480 Park Avenue. This turnkey home meets all the standards of a classic Park Avenue condo....

Submit Request

A wonderful opportunity to live on Billionaires Row Welcome to this beautiful, bright classic six bedroom, three and a half...

Submit Request

Real Estate in New York

Real estate in New York for living, investment and residence permit

- ✓ Verified properties directly from developers

- ✓ No overpayments or commissions

- ✓ Guarantee of transaction purity and post-purchase support

Our managers will help you choose a property

Liliya

International Real Estate Consultant

Need help choosing a property?

Leave a request and our manager will contact you.

Our managers will help you choose a property

Liliya

International Real Estate Consultant

Need help choosing real estate in New York?

Leave a request and we will select the 3 best options for your budget

!

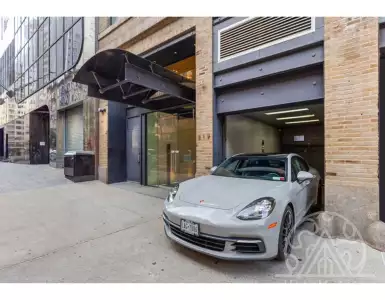

!Flat for sale in New York, USA 2 683 841 $

THE CONDOMINIUM, 246 WEST 17th STREET Superbly located in the endlessly thriving, always bustling, and perpetually coveted neighborhood of Chelsea,...

!

!Buy flat in New York, USA 3 230 566 $

The iconic Olympic Tower building at 641 5th Ave, residence 31C, is one of the most sought after by celebrities,...

🇺🇸 New York City real estate market: condo and co-op prices by borough and neighborhood

New York is not just a city — it is a global market where property in New York intersects lifestyle, commerce and long-term investment. Whether you are a private buyer looking for a family apartment, an investor seeking stable rental income, or a developer evaluating off-plan opportunities, this guide explains how real estate in New York works, where values concentrate, and which neighbourhoods match distinct strategies. Read on for clear facts, concrete price ranges, developer names, transport and legal notes you can act on.

💫 City overview and lifestyle in New York for property buyers

New York City spans five boroughs — Manhattan, Brooklyn, Queens, the Bronx and Staten Island — and combines dense urban cores with waterfront neighborhoods and suburban-feeling enclaves. The climate is temperate continental to humid subtropical: winters are cold with snow in many years, summers are hot and humid, and coastal neighborhoods like Coney Island and Rockaway Beach provide summer leisure within city limits.

New York’s character is mixed: Manhattan delivers high-rise convenience and corporate hubs; Brooklyn offers brownstones and creative clusters; Queens and Staten Island bring more single-family housing and commuter options. Residents choose New York for jobs, culture, world-class healthcare and education.

Foreign buyers are attracted by a liquid luxury market, steady tourism, and transparent legal frameworks for foreign ownership. Property in New York can be bought outright or financed, with strong secondary-market liquidity in core districts and clear roles for agents, attorneys and title companies.

🏙️ Which district of New York to choose for buying property

Manhattan remains the global address for premium real estate and is the primary target for luxury buyers and corporate relocations. Neighborhoods such as Upper East Side, Upper West Side, Midtown, Chelsea, Tribeca and SoHo host high-rise condos, luxury co-ops and landmark brownstones. Accessibility to finance, professional services and corporate headquarters makes Manhattan ideal for investors seeking stable capital appreciation.

Brooklyn neighborhoods like DUMBO, Brooklyn Heights, Williamsburg and Park Slope provide a mix of brownstones, boutique condos and new developments aimed at families and creatives. These areas combine lower-density streets with waterfront views and often higher rental yields than prime Manhattan.

Queens and Staten Island cater to buyers looking for value and commuter convenience. Long Island City and Astoria in Queens have seen significant new developments and attract technology and media workers. Staten Island offers single-family homes and ferry links to Manhattan for a suburban lifestyle within the city.

🗺️ Differences between New York neighborhoods by lifestyle and investment profile

Manhattan — core business and luxury residential market with high liquidity and lower gross yields; best for capital preservation and trophy assets.

Brooklyn — medium–high growth neighbourhoods, attractive for family buyers and mid-term investors seeking rental demand from young professionals.

Queens and Staten Island — better entry prices per square foot and higher potential gross yields for buy-to-let investors willing to accept longer commutes.

Neighborhood bullet list with quick attributes:

- Manhattan (Upper East Side, Midtown, Tribeca, SoHo): high density, premium price per sq ft, co-ops & condos, low gross yields

- Brooklyn (DUMBO, Williamsburg, Brooklyn Heights, Park Slope): brownstones, conversions, strong rental demand

- Queens (Long Island City, Astoria): new developments, transit-oriented, developer activity

- Staten Island (St. George, Tottenville): family homes, ferry access, lower price point

💶 Property prices and market overview for New York

Prices vary greatly by borough and product. Typical price bands in the city:

- Manhattan condos/co-ops: $1,200–$2,500 per sq ft (approx. $12,900–$26,900 per m²) in prime corridors such as Central Park South, Midtown and Tribeca.

- Brooklyn condos and brownstones: $600–$1,400 per sq ft depending on neighborhood and renovation.

- Long Island City and parts of Queens: $700–$1,100 per sq ft for new developments close to transit.

- Townhouses in Manhattan can range from $3 million to over $50 million, while Brooklyn townhouses typically trade between $1 million and $10 million.

Price segmentation by market level: - Luxury (top-tier Manhattan and trophy Brooklyn): ultra-high price per sq ft, limited stock, prestige locations

- Mid-market (Brooklyn, LIC, parts of Midtown South): new builds and resale with steady demand

- Affordable/entry (outer boroughs and older buildings): lower price per sq ft, higher yield potentialRecent dynamics show resilient demand for new developments in transit-connected locations and greater price pressure in boroughs with active tech and corporate leasing.

🚇 Transport and connectivity around New York

New York’s transport system underpins its property market. The MTA subway covers over 470 stations, making most neighborhoods transit-accessible. Long Island Rail Road (LIRR), Metro-North and NJ Transit bring suburban commuters into Manhattan’s hubs.

Air access includes three major airports: JFK, LaGuardia and Newark Liberty, each within reasonable driving distance to Manhattan (distances roughly 8–25 miles depending on origin). Major highways and bridges — FDR, West Side Highway, BQE and I‑95 via the George Washington Bridge — provide road connectivity but are subject to peak congestion.

Average door-to-door commute times in the city typically fall in the 30–45 minute range for many central-to-suburban commutes. Ferries — NYC Ferry and Staten Island Ferry — offer congestion-free options and are catalysts for waterfront premiums in neighborhoods like DUMBO and St. George.

🏥 Urban infrastructure and amenities affecting property in New York

Healthcare and education are key attractors: major hospitals include NewYork‑Presbyterian, NYU Langone, Mount Sinai and Bellevue, all within easy reach of Manhattan neighborhoods. Universities such as Columbia, NYU, Fordham and Cornell Tech generate sustained rental demand.

Parks, retail and cultural assets enhance livability: Central Park, Hudson River Park, Prospect Park, Chelsea Market, Brookfield Place and Westfield World Trade Center are neighborhood anchors that sustain premium pricing. Sports and leisure venues such as Yankee Stadium, Citi Field and Coney Island add local lifestyle value.

Infrastructure bullet list:

- Top hospitals: NewYork‑Presbyterian, NYU Langone, Mount Sinai

- Universities: Columbia, NYU, Cornell Tech, Pratt

- Major retail/entertainment: Hudson Yards, Chelsea Market, Brookfield Place

- Beaches and leisure: Coney Island, Rockaway Beach, Hudson River waterfront parks

🏗️ Economic environment and development drivers for real estate investment in New York

New York’s economy is diversified: finance, media, technology, healthcare and tourism are leading sectors. Core business districts include Midtown, the Financial District and Hudson Yards, where corporate leasing drives demand for high-end housing.

The Port of New York and New Jersey is one of the nation’s busiest, supporting logistics and trade-related employment. Growth in tech and creative industries across Brooklyn and Long Island City has translated into demand for new developments and conversions.

Tourism delivers steady short- and medium-term rental demand from business travelers and leisure visitors, supporting investment property in New York geared to corporate leases and relocation tenancies. Rental yield patterns tend to be stronger outside the most expensive Manhattan micro‑markets.

🏠 Property formats and housing types available in New York

New build property in New York ranges from high-rise glass towers in Hudson Yards and Midtown to boutique condominium conversions in SoHo and brownstone restorations in Brooklyn. Resale property in New York includes co-ops (prevalent on the Upper East/West Sides), condos and single-family houses in outer boroughs.

Off-plan property in New York commonly appears in large master-planned developments or tower launches; buyers can access developer installment plans with staged deposits during construction. Resale properties often require quick closings and can be subject to co-op board approvals where applicable.

Architectural and planning differences:

- High-rise luxury condos (Manhattan, Hudson Yards): full-service amenities, higher HOA fees

- Brownstones and low-rise condos (Brooklyn): character properties, renovation potential

- Converted industrial lofts (SoHo, DUMBO): large floorplates, creative market appeal

🏢 Developers and key residential projects shaping real estate in New York

Established developers active in the city include Related Companies (Hudson Yards, 15 Hudson Yards), Extell Development (Central Park Tower, One Manhattan Square), Tishman Speyer (The Spiral), Silverstein Properties (World Trade Center complex), TF Cornerstone and Two Trees Management (DUMBO and Williamsburg development). These developers run large-scale projects and offer off-plan and new build property in New York.

Representative projects and features:

- Hudson Yards (Related): mixed-use towers, retail hub, large-scale new developments

- Central Park Tower (Extell): trophy condominium with super-prime pricing

- One Manhattan Square (Extell): large residential complex on Lower East Side with amenities

Developers vary in construction quality and buyer protections; major names typically provide standardized contracts, transparent deposit schedules and accessible amenity packages.

🏦 Mortgage, financing and installment options for buying property in New York

Mortgages for foreigners are available but typically require larger down payments and additional documentation. Typical down payment requirements:

- US residents: 20%–25% down common for conventional loans

- Foreign buyers: 30%–50% down depending on lender and buyer profile

Interest rate environments fluctuate; lenders offer fixed and adjustable-rate mortgages with terms up to 30 years. International banks with US operations and local lenders routinely structure loans for foreign nationals who can provide credit history, tax returns and, in some cases, an ITIN or US bank relationship.

Developer financing and installment plans: - Off-plan purchase deposit schedules often begin with 10%–20% at contract, followed by staged payments during construction and balance at closing.

- Some developers accept larger staged deposits or provide interest-bearing escrow accounts for foreign buyers seeking a property in New York with installment plan.

📑 Property purchase process in New York for foreign buyers

Initial steps include property selection with an agent, signing a purchase contract contingent on attorney review, and paying an initial deposit (often 10%). Attorney review, title search and financing approvals follow before a final closing.

Co-op purchases require board package submissions, interviews and board approval; many foreign buyers prefer condos to avoid restrictive co-op board rules. Closing costs include attorney fees, title insurance and transfer taxes — purchases above certain thresholds may trigger a mansion tax and city transfer taxes.

Payment methods and escrow:

- Deposits are typically held in escrow accounts administered by attorneys or title companies.

- Final payments at closing are wired to the title company and secured by title insurance and recording of the deed.

⚖️ Legal aspects, taxes and residence options when buying property in New York

Foreign nationals may own property in New York without residency restrictions; ownership does not confer immigration status or a residence permit. Taxes to consider include federal and state income taxation on rental income, local property taxes, and transfer taxes at purchase.

Selling property as a foreign owner triggers specific withholding requirements under US tax rules; buyers and sellers should plan for capital gains taxes and potential withholding unless exemptions apply. Estate tax planning is important for non-resident owners, as US situs assets can be subject to US estate taxes.

Residence and investment visas:

- Purchasing property in New York does not automatically grant a visa or green card. Investor visa routes such as EB‑5 require qualifying capital investment and job-creation requirements, and can provide lawful permanent residency under specific conditions.

🔍 Property use cases and investment strategies for New York

New York supports multiple use cases for property buyers:

- Permanent residence: Upper East Side, Upper West Side, Battery Park City — condos and family-sized apartments with proximity to schools and hospitals.

- Long-term rental investment: Midtown, Financial District, Long Island City, Williamsburg — condos and multi‑unit assets near employers and transit.

- Short-term rental and holiday use: note that the city restricts short-term rentals under 30 days when the owner is not present; compliance is essential — consider corporate leases or serviced apartments in hospitality zones.

- Capital growth and premium lifestyle purchase: Tribeca, SoHo, Central Park South — trophy condos and penthouses that preserve wealth and status.

Quick match list: - Buy-to-let: LIC, Midtown South, Brooklyn Heights

- Family home: Park Slope, Upper West Side

- Trophy investment: Tribeca, Central Park South

- Value entry and higher yields: Queens (Astoria, LIC), Staten Island

New York property decisions benefit from specialist advisors: a local real estate attorney, a tax advisor experienced with nonresident issues, a lender familiar with foreign mortgage underwriting, and an agent who understands neighborhood micro‑markets. With precise planning — from deposit schedules on off-plan property in New York to structuring financing for buy property in New York with mortgage or installments — buyers can match their objectives to neighborhoods, developers and legal structures that work for them.

Frequently Asked Questions

Prices vary widely by borough and property type. Typical condo/co-op ranges: Manhattan $800,000–$3,500,000+, Brooklyn $500,000–$1,500,000, Queens $350,000–$900,000, Bronx $250,000–$600,000, Staten Island $300,000–$700,000. Studio rentals often list $2,000–$3,500/month in central neighborhoods; family-sized apartments rise substantially. Use neighborhood-level comps when budgeting.

Yes—non‑US citizens can buy and hold property in New York without ownership limits. Expect to register tax requirements (obtain an ITIN), pay US federal and state tax on rental income, and file returns. Nonresident sellers may face withholding and post-sale tax obligations. Work with a US real‑estate attorney and tax advisor before purchase.

Strong rental demand citywide, but yields vary: gross rental yields often 2.5%–5% in Manhattan, 3.5%–6% in parts of Brooklyn/Queens. Liquidity is high in prime neighborhoods but slower for niche units. Short‑term demand spikes downtown and near universities, but regulatory limits affect STR income. Expect lower yields but greater capital-liquidity than many secondary markets.

Typical timeline: 2–6 weeks to get mortgage pre‑approval, 2–8 weeks to negotiate and exchange, then 30–90 days to closing (can be faster for cash). Co‑op approvals add 2–6 weeks for board interviews. Off‑plan buys follow construction schedules and can take 12–36+ months to close. Include time for inspections, title work and financing contingencies.

Buyers should budget transaction costs around 2%–5% of purchase price (closing fees, title, attorney, recording). Annual property tax bills vary by borough and building type—expect roughly 0.5%–1.5% of market value as a starting point. Additional taxes include local/state transfer and possible mortgage recording fees. Factor in HOA/maintenance fees and higher NYC living costs.

New York City restricts short‑term rentals: renting an entire apartment for fewer than 30 days is generally prohibited unless the host resides in the unit. Many buildings require registration and hosts must comply with local rules; fines for violations can be substantial. Always check local ordinances, building rules, and licensing before listing for short stays.

For long‑term living: Upper West/East Manhattan, Park Slope (Brooklyn), Astoria (Queens) for schools/transit. For rental yield: parts of Long Island City, northern Brooklyn, and near universities show stronger demand. For capital growth: prime Manhattan corridors and emerging Brooklyn submarkets. Match goals: family amenities and schools for living; transit and job centers for renting.

Yes for infrastructure: widespread high‑speed internet (100–500+ Mbps in many buildings), abundant coworking and cafés, excellent transit. Monthly long‑stay rents typically range $2,000+ outside Manhattan and $3,500–6,000+ in central Manhattan. No special US digital‑nomad visa—stay limits depend on nationality (ESTA/visa rules). Check immigration rules before long stays.

Watch co‑op vs condo differences (co‑ops require board approval and often larger down payments), high maintenance/HOA fees ($200–$2,500+/month), unexpected assessments, building violations, flood zones and construction delays. Verify title, property condition, outstanding liens, and resale comps. Use inspections, review offering plans and condo docs, and get legal counsel.

Off‑plan (pre‑construction) can offer price entry but carries risks: developer financial stress, delays and changing market conditions. Typical initial deposits are 5%–20% of purchase price, often staged. Mitigate risks by reviewing the offering plan, escrow protections, sponsor financials, condominium documents and including financing contingencies where possible. Use an attorney experienced in New York new‑builds.

Property by cities

Properties by Region

Services in New York

Properties by Country

- Real estate in Bulgaria (11382)

- Real estate in Montenegro (5342)

- Real estate in Indonesia (2423)

- Real estate in Spain (2289)

- Real estate in Portugal (2051)

- Real estate in Italy (1923)

- Real estate in Turkey (1618)

- Real estate in Cyprus (1591)

- Real estate in Thailand (1564)

- Real estate in Croatia (1382)

- Real estate in Greece (1082)

- Real estate in USA (1013)

- Real estate in France (1006)

- Real estate in Georgia (519)

- Real estate in Serbia (329)

- Real estate in Slovenia (122)

- Real estate in Egypt (23)

Get the advice of a real estate expert in New York — within 1 hour

Looking for a property in New York? Leave a request — we will help you take into account all the nuances, and we will offer objects according to your personal request.

Maria Guven

Head of Direct Sales Department

+90-507-705-8082