Flat in New York

Real estate in New York for living, investment and residence permit

- ✓ Verified properties directly from developers

- ✓ No overpayments or commissions

- ✓ Guarantee of transaction purity and post-purchase support

Our managers will help you choose a property

Liliya

International Real Estate Consultant

Need help choosing a property?

Leave a request and our manager will contact you.

Our managers will help you choose a property

Liliya

International Real Estate Consultant

Hot Deals

For Sale flat in New York

63 listings

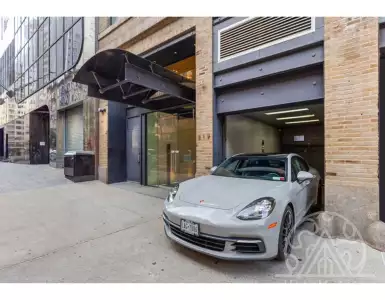

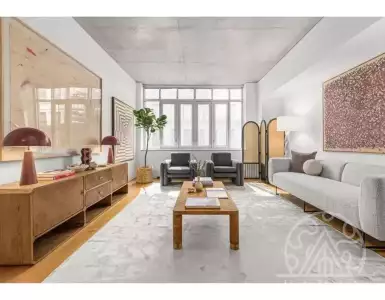

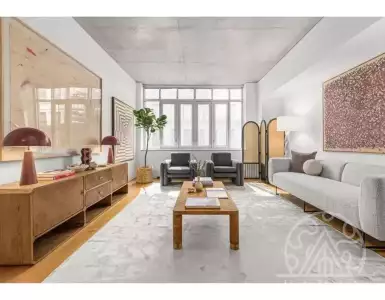

THE CONDOMINIUM, 246 WEST 17th STREET Superbly located in the endlessly thriving, always bustling, and perpetually coveted neighborhood of Chelsea,...

Submit Request

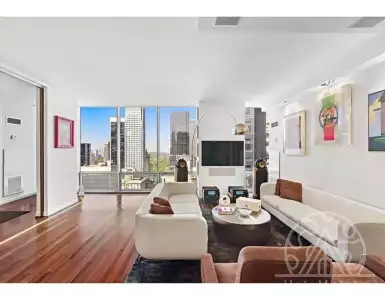

The iconic Olympic Tower building at 641 5th Ave, residence 31C, is one of the most sought after by celebrities,...

Submit Request

Hot Deals

Popular

19 October

19 October

19 October

19 October

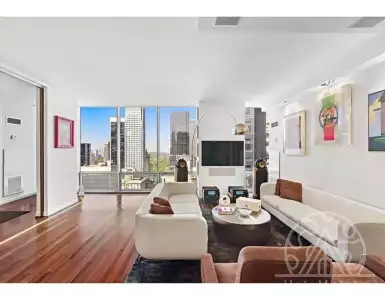

Superb location ~~ New construction ~~ Stunning ~~ Great views ~~ Tax credit. This gorgeous new construction building towers over...

Submit Request

Real estate in New York for living, investment and residence permit

- ✓ Verified properties directly from developers

- ✓ No overpayments or commissions

- ✓ Guarantee of transaction purity and post-purchase support

Our managers will help you choose a property

Liliya

International Real Estate Consultant

NYC - NOMAD (North of Madison Avenue) Calvo Immobiliare is offering for sale an elegant apartment on the 30th floor...

Submit Request

The jewel of Village Green West is a 2,833 square foot duplex apartment with three bedrooms and over 750 square...

Submit Request

Indoor and outdoor living atop a rare penthouse in Chelsea. Scale and tranquility await you in this magnificent duplex with...

Submit Request

Flat in New York

Real estate in New York for living, investment and residence permit

- ✓ Verified properties directly from developers

- ✓ No overpayments or commissions

- ✓ Guarantee of transaction purity and post-purchase support

Our managers will help you choose a property

Liliya

International Real Estate Consultant

Need help choosing a property?

Leave a request and our manager will contact you.

Our managers will help you choose a property

Liliya

International Real Estate Consultant

Need help choosing flats in New York?

Leave a request and we will select the 3 best options for your budget

!

!

Flat for sale in New York, USA 2 683 841 $

THE CONDOMINIUM, 246 WEST 17th STREET Superbly located in the endlessly thriving, always bustling, and perpetually coveted neighborhood of Chelsea,...

!

!

Buy flat in New York, USA 3 230 566 $

The iconic Olympic Tower building at 641 5th Ave, residence 31C, is one of the most sought after by celebrities,...

🇺🇸 New York, NY flats: neighborhood profiles, co-op vs condo, typical closing costs

New York City, often referred to as the Big Apple, is not only a cultural and financial hub but also one of the most sought-after places for real estate investment globally. The dizzying skyline, diverse neighborhoods, and vibrant lifestyle make buying a flat in New York a desirable endeavor for both private buyers and investors. The array of options available appeals to a wide spectrum of buyers, from first-time homeowners to seasoned investors seeking lucrative opportunities in the property market.

🌍 Geography and Infrastructure of New York

New York City is strategically located on the northeast coast of the United States, bordered by the Atlantic Ocean to the southeast. The city comprises five boroughs: Manhattan, Brooklyn, Queens, the Bronx, and Staten Island, each offering unique geographical characteristics and lifestyle options.

The climate features a humid subtropical environment, with four distinct seasons—warm summers, cold winters, and moderate springs and autumns. This variation in climate attracts tenants who enjoy different seasonal activities, from ice skating in Central Park to summer festivals in various neighborhoods.

The infrastructure of New York is well-developed, with a comprehensive transportation system that includes subways, buses, and trains, making commuting seamless for residents. Moreover, proximity to world-class amenities like parks, shops, and cultural institutions enhances the housing demand. This factor significantly influences buyer behavior, as proximity to public transport and commercial zones plays a pivotal role in real estate desirability.

In terms of business and tourist zones, Manhattan stands out as the economic powerhouse. Times Square, Wall Street, and the Theater District are prime areas that attract tourists and businesses alike, thus fostering strong demand for flats in these districts.

💰 Economic Backdrop and Its Impact on Flat Prices in New York

New York’s economy is one of the largest in the world, heavily influenced by finance, technology, and a flourishing tourism industry. The financial district, home to Wall Street, contributes significantly to economic activity, with numerous large corporations headquartered in the area, driving steady demand for residential properties.

Tourist flows are another significant component of New York’s economy, with over 60 million visitors each year. This influx fosters high rental demand, particularly in neighborhoods like Midtown Manhattan and SoHo, which are favored by both tourists and locals, creating a robust market for flat investments.

The tax burden in New York can be substantial, with property taxes averaging around 1.68% of assessed value. However, this is offset by high potential returns on investment, as the city's property market shows promising liquidity. Typically, the average yield on rental properties hovers around 3–5%, showcasing the lucrative potential, especially for buyers looking at long-term investments.

📊 Flat Prices in New York: A Comprehensive Breakdown

Buying a flat in New York requires a clear understanding of the price dynamics across various districts. The average price of a flat in New York can vary significantly:

- Manhattan: Prices can reach $1.8 million for a one-bedroom flat, with luxury developments surpassing $10 million.

- Brooklyn: Average prices tend to be lower, around $900,000, but can spike in neighborhoods like Dumbo and Williamsburg.

- Queens: Representing a more affordable option, flats here average about $650,000, with areas like Astoria gaining popularity.

A breakdown of flat prices by district is as follows:

- Manhattan:

- Times Square – $2 million+

- Upper West Side – $1.5 million+

- Brooklyn:

- Williamsburg – $1.2 million+

- Park Slope – $1.1 million+

- Queens:

- Astoria – $700,000+

- Long Island City – $800,000+

New developments in New York often come with a premium price tag but also offer contemporary amenities and energy-efficient designs. For example, luxury buildings in Hudson Yards or One Manhattan Square reflect the latest in architectural design and attract high-end buyers.

🏙️ Top Districts for Buying a Flat in New York

Understanding the most popular districts for purchasing flats is critical to making the right investment decision. Each area offers unique benefits:

-

Manhattan: Known for its bustling lifestyle and iconic landmarks, Manhattan attracts high-income professionals. The rental demand is exceptionally high, especially in the Financial District and the Upper East Side.

-

Brooklyn: Offering a blend of urban and suburban lifestyles, neighborhoods like Brooklyn Heights and Park Slope are favored by families and young professionals. These areas provide excellent schools and vibrant community events, enhancing their appeal.

-

Queens: This borough is emerging as a cultural melting pot and a hotspot for young families and new immigrants. Neighborhoods like Astoria and Forest Hills are becoming increasingly desirable due to their affordability and community vibe.

🏗️ Leading Developers and Projects in New York

Several reputable developers are pivotal in shaping New York's skyline with innovative projects. Notable names include:

- Related Companies: Known for Hudson Yards, offering luxurious flats and extensive retail spaces.

- Silverstein Properties: Responsible for the new developments around the World Trade Center.

- Tishman Speyer: Focused on high-end residential communities across Manhattan.

Each developer provides different formats, from luxury high-rises to mixed-use buildings, ensuring that potential buyers find flats that suit their preferences. Most projects are completed with modern amenities such as fitness centers, rooftop lounges, and eco-friendly technologies.

📜 Mortgage and Installment Conditions for Foreigners in New York

For foreigners looking to purchase a flat in New York, mortgage options are available, albeit with certain restrictions. Most lenders require:

- A minimum down payment of 20%.

- Rates on mortgages typically range from 3% to 7%, depending on credit history and foreign status.

- Documentation proving income and residency status is essential.

Additionally, some developers offer installment plans which allow potential buyers to pay in several installments over predefined periods. Common practice involves paying a set percentage upfront followed by installments during various phases of construction.

✅ Step-by-Step Process of Buying a Flat in New York

Navigating the process of buying a flat in New York involves several critical steps:

- Selection: Determine your budget and preferred district based on your lifestyle needs.

- Reservation: Contact the seller or real estate agent to express interest and hold the property.

- Due Diligence: Conduct inspections and appraisals to ensure the property meets expectations.

- Contract: Once agreed, a purchase contract is drafted and signed by both parties.

- Payment: Secure financing through a mortgage or by settling on the installment plan terms.

- Registration: Finalize the purchase by registering the property name with the appropriate government office.

Understanding legal aspects such as property taxes and lease agreements is essential to prevent future complications.

🔍 Legal Aspects of Owning a Flat in New York

Owning a flat in New York involves adhering to various legal procedures, including:

- Rental rules: Landlords must comply with tenants' rights and housing regulations.

- Property taxes: Owners are responsible for approximately 1.68% of the property value annually.

- Contracts and registration: All property transfers must go through a title company or lawyer for validity.

For potential buyers interested in securing a residence permit through property purchase or citizenship through real estate investment, it's imperative to meet specific financial thresholds.

👫 Purpose of Purchasing a Flat in New York

Buying a flat in New York serves various purposes. Whether you aim to live permanently, invest, or relocate, the city's diverse offerings cater to different lifestyles:

- Living: A permanent residence in neighborhoods like the Upper East Side ensures proximity to cultural hubs.

- Investment: Areas with high rental yields such as Brooklyn provide steady income streams for investors.

- Seasonal residence: Purchasing in Lower Manhattan or the Bronx offers opportunities for a second home in a vibrant city.

Given the multifaceted nature of New York’s real estate market, understanding these aspects will help you make an informed decision regarding your flat purchase.

As the flat market in New York continues to evolve, it showcases resilience and potential growth, attracting both local and international buyers. The demand for real estate in such a dynamic environment provides significant opportunities, ensuring that New York retains its position as a prime destination for those looking to invest in property.

Frequently Asked Questions

Prices vary by borough and type. Broad NYC benchmarks: studios $200,000–1,000,000; 1BR $300,000–1,500,000; 2BR $500,000–3,500,000. Manhattan is at the high end; Brooklyn/Queens mid-range; Bronx/Staten Island lower. New developments often carry a 20–50% premium over resale. Use these ranges for budgeting and financing.

Rental viability depends on location and unit size. Typical gross rental yields: Manhattan ~3–5%, Brooklyn ~3.5–5.5%, outer boroughs ~4–7%. High demand neighborhoods and short-term rentals can raise income but face regulations. Factor in vacancy, management, taxes and HOA when estimating net return.

Yes. Typical down payments: condos 10–20%, co‑ops 20–25%. Foreign buyers often need 25–40% down. LTVs depend on credit and property type. Mortgage preapproval often takes 1–3 weeks; underwriting and closing 30–60 days. Expect income verification, tax returns and appraisal requirements.

Buyer closing costs commonly run 2–5% of purchase price plus lender fees of ~0.5–1.5%. Expect attorney fees, title, appraisal, inspections and prepaids. Co‑ops have different fees (board processing) and may avoid some title costs. Budget accordingly when making an offer.

Property tax levels vary by borough and assessment method. Effective local rates often range about 0.8–1.7% of assessed value annually. Condos pay property tax directly; co‑ops pass a pro rata share through maintenance charges. Tax assessments and abatements can change a bill, so check local assessment rules.

Co‑ops require board approval, higher down payments (often 20–30%), and maintenance covers taxes; resale can be slower. Condos offer a deed, easier financing (10–20% down), more flexible rentals, and higher closing costs. Choose co‑op for lower prices and stricter governance; choose condo for liquidity and rental flexibility.

Owning property alone does not grant US residency. Certain investment-based visas require substantial business or job-creating investments, often in the hundreds of thousands to millions USD, not just a real estate purchase. Property can support proof of ties or intent but consult an immigration attorney for specific pathways and requirements.

New York offers fast internet (100+ Mbps widely available), coworking spaces, and services, but flats can be small and costly. Expect typical 1BR sizes ~300–900 sq ft; utilities and internet $100–300/month. Consider noise, space for a home office, and neighborhood commute/amenities when choosing a flat for remote work.

Timelines: condo closings commonly 30–60 days from contract; co‑ops add board approval and can take 60–120 days total. Mortgage preapproval: 1–3 weeks. Allow extra time for inspections, board packages, condo or co‑op approvals and any negotiated contingencies.

Expect mortgage payments, property tax, HOA/maintenance, utilities and insurance. Common charges/HOA typically $200–1,500+/month depending on building and services. Property tax equivalent ~0.8–1.7% of assessed value yearly. Home insurance $15–200/month; plan 0.5–1.5% of property value annually for maintenance/repairs.

Properties by Region

Properties by Country

- Real estate in Bulgaria (11403)

- Real estate in Montenegro (5314)

- Real estate in Indonesia (2423)

- Real estate in Spain (2289)

- Real estate in Portugal (1975)

- Real estate in Italy (1918)

- Real estate in Turkey (1699)

- Real estate in Cyprus (1578)

- Real estate in Thailand (1565)

- Real estate in Croatia (1429)

- Real estate in Greece (1082)

- Real estate in USA (1013)

- Real estate in France (1006)

- Real estate in Georgia (519)

- Real estate in Serbia (329)

- Real estate in Slovenia (123)

- Real estate in Egypt (23)

Get the advice of a real estate expert in New York — within 1 hour

Looking for a property in New York? Leave a request — we will help you take into account all the nuances, and we will offer objects according to your personal request.

Maria Guven

Head of Direct Sales Department

+90-507-705-8082